Fidelity Retirement Plan401k Salary Reduction Agreement 2016

What is the Fidelity Retirement Plan 401(k) Salary Reduction Agreement

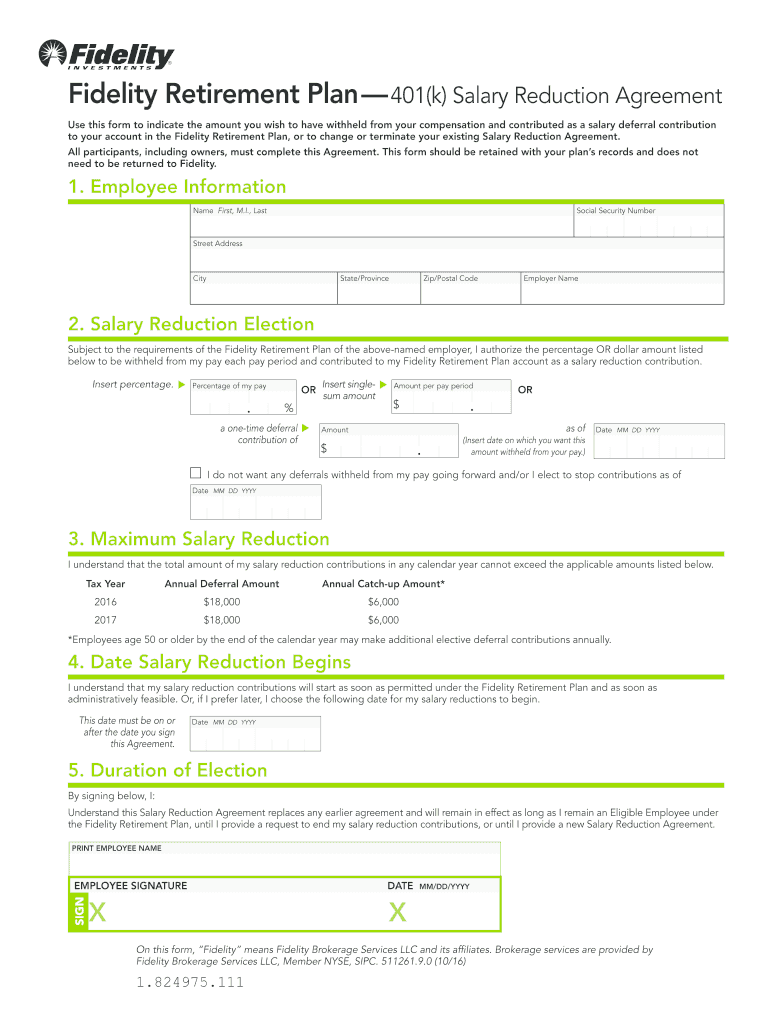

The Fidelity Retirement Plan 401(k) Salary Reduction Agreement is a crucial document that allows employees to designate a portion of their salary to be contributed to their 401(k) retirement plan. This agreement outlines the terms under which the salary deductions will occur, ensuring compliance with federal regulations while providing employees with the opportunity to save for retirement. By participating in this plan, employees can benefit from tax-deferred growth on their investments, which can significantly enhance their retirement savings over time.

How to Use the Fidelity Retirement Plan 401(k) Salary Reduction Agreement

Using the Fidelity Retirement Plan 401(k) Salary Reduction Agreement involves several steps. First, employees must review the plan details provided by their employer, including contribution limits and matching options. Next, they need to fill out the agreement form, specifying the percentage or amount of salary they wish to contribute. Once completed, the form should be submitted to the HR or payroll department for processing. It is important to keep a copy of the signed agreement for personal records and future reference.

Steps to Complete the Fidelity Retirement Plan 401(k) Salary Reduction Agreement

Completing the Fidelity Retirement Plan 401(k) Salary Reduction Agreement requires careful attention to detail. Here are the steps to follow:

- Obtain the agreement form from your employer or the Fidelity website.

- Review the plan’s contribution limits and employer matching policies.

- Decide on the percentage or fixed amount of salary to contribute.

- Fill out the form with accurate personal and employment information.

- Sign and date the agreement.

- Submit the completed form to your HR or payroll department.

Key Elements of the Fidelity Retirement Plan 401(k) Salary Reduction Agreement

Several key elements are essential in the Fidelity Retirement Plan 401(k) Salary Reduction Agreement. These include:

- Employee Information: Personal details such as name, address, and Social Security number.

- Contribution Amount: The specified percentage or dollar amount to be deducted from the salary.

- Effective Date: The date when the salary reduction will begin.

- Employer Matching Contributions: Information regarding any matching contributions offered by the employer.

- Withdrawal Rules: Guidelines on how and when funds can be accessed.

Legal Use of the Fidelity Retirement Plan 401(k) Salary Reduction Agreement

The legal use of the Fidelity Retirement Plan 401(k) Salary Reduction Agreement is governed by federal laws, including the Employee Retirement Income Security Act (ERISA). This agreement must comply with IRS regulations regarding contribution limits and tax implications. Employers are required to maintain accurate records of contributions and ensure that employees are informed of their rights under the plan. Non-compliance with these regulations can lead to penalties for both the employer and the employee.

Eligibility Criteria for the Fidelity Retirement Plan 401(k) Salary Reduction Agreement

Eligibility to participate in the Fidelity Retirement Plan 401(k) Salary Reduction Agreement typically depends on several factors, including:

- Employment status: Employees must be full-time or part-time workers as defined by their employer.

- Age: Some plans may have minimum age requirements.

- Length of service: Employers may require employees to complete a specific period of service before becoming eligible.

It is essential for employees to check with their HR department to understand their specific eligibility requirements.

Quick guide on how to complete fidelity retirement plan401k salary reduction agreement

Complete Fidelity Retirement Plan401k Salary Reduction Agreement seamlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers a superb eco-friendly option to conventional printed and signed documents, as you can easily obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any holdups. Manage Fidelity Retirement Plan401k Salary Reduction Agreement on any platform with airSlate SignNow apps available for Android or iOS and simplify any document-related task today.

How to modify and eSign Fidelity Retirement Plan401k Salary Reduction Agreement effortlessly

- Locate Fidelity Retirement Plan401k Salary Reduction Agreement and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow meets your needs in document management with just a few clicks from any device you choose. Edit and eSign Fidelity Retirement Plan401k Salary Reduction Agreement while ensuring smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fidelity retirement plan401k salary reduction agreement

Create this form in 5 minutes!

How to create an eSignature for the fidelity retirement plan401k salary reduction agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fidelity Retirement Plan401k Salary Reduction Agreement?

A Fidelity Retirement Plan401k Salary Reduction Agreement is a document that allows employees to allocate a portion of their salary to their 401(k) retirement plan. This agreement is essential for setting up contributions and ensuring compliance with IRS regulations. By using airSlate SignNow, you can easily create and manage these agreements digitally.

-

How does airSlate SignNow simplify the process of creating a Fidelity Retirement Plan401k Salary Reduction Agreement?

airSlate SignNow streamlines the creation of a Fidelity Retirement Plan401k Salary Reduction Agreement by providing customizable templates and an intuitive interface. Users can quickly fill in necessary details and send the document for eSignature, reducing the time spent on paperwork. This efficiency helps businesses focus on their core operations.

-

What are the benefits of using airSlate SignNow for my Fidelity Retirement Plan401k Salary Reduction Agreement?

Using airSlate SignNow for your Fidelity Retirement Plan401k Salary Reduction Agreement offers numerous benefits, including enhanced security, faster processing times, and reduced paper usage. The platform ensures that all documents are securely stored and easily accessible, which is crucial for compliance and record-keeping. Additionally, eSigning eliminates the need for physical signatures, making the process more efficient.

-

Is there a cost associated with using airSlate SignNow for Fidelity Retirement Plan401k Salary Reduction Agreements?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost depends on the features and number of users required. However, the investment is often justified by the time and resources saved through streamlined document management, including Fidelity Retirement Plan401k Salary Reduction Agreements.

-

Can I integrate airSlate SignNow with other software for managing my Fidelity Retirement Plan401k Salary Reduction Agreement?

Absolutely! airSlate SignNow offers integrations with various software applications, including HR and payroll systems. This allows for seamless data transfer and management of your Fidelity Retirement Plan401k Salary Reduction Agreement, ensuring that all employee contributions are accurately tracked and reported.

-

How secure is the information in my Fidelity Retirement Plan401k Salary Reduction Agreement when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information in your Fidelity Retirement Plan401k Salary Reduction Agreement. This ensures that your documents are safe from unauthorized access and comply with industry standards.

-

What features does airSlate SignNow offer for managing Fidelity Retirement Plan401k Salary Reduction Agreements?

airSlate SignNow provides a range of features for managing Fidelity Retirement Plan401k Salary Reduction Agreements, including customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency and ensure that all parties are informed throughout the signing process, making it easier to manage agreements.

Get more for Fidelity Retirement Plan401k Salary Reduction Agreement

- Dt 1 form

- If known claimant carrier case no wcb ny form

- Doh molst form

- Oc 923 workersamp39 compensation board new york state wcb ny form

- Ny state human rights form

- Ny sick leave to form

- Summary of reporting cycle workersamp39 compensation board wcb ny form

- Annual reporting memo workersamp39 compensation board wcb ny form

Find out other Fidelity Retirement Plan401k Salary Reduction Agreement

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF