Irbr61 2013

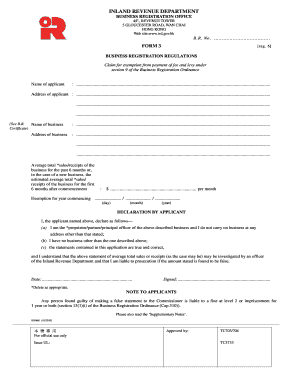

What is the IRBR61?

The IRBR61 is a specific form used in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals or businesses that need to disclose specific income, deductions, or credits as part of their tax filings. Understanding the purpose of the IRBR61 helps ensure compliance with federal tax regulations and facilitates accurate reporting.

How to Use the IRBR61

Using the IRBR61 involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information corresponds to the financial data you have collected. After completing the form, review it for any errors before submission. This careful approach helps prevent delays in processing and potential penalties.

Steps to Complete the IRBR61

Completing the IRBR61 requires attention to detail. Follow these steps:

- Gather relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report your income accurately in the designated sections of the form.

- Include any applicable deductions or credits that you qualify for.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the IRBR61

The IRBR61 must be used in accordance with IRS guidelines to ensure legal compliance. Failing to use the form correctly can lead to penalties or audits. It is crucial to understand the legal implications of the information reported on the form, including the potential consequences of misreporting. Consulting with a tax professional can provide additional guidance on the legal aspects of using the IRBR61.

Required Documents for the IRBR61

When preparing to complete the IRBR61, certain documents are necessary to support the information reported. These documents typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements showing income deposits

- Any other relevant financial records

Filing Deadlines for the IRBR61

It is important to be aware of the filing deadlines associated with the IRBR61 to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, if you are unable to meet this deadline, you may be eligible for an extension. Always verify specific dates each tax year, as they can vary.

Quick guide on how to complete irbr61

Prepare Irbr61 easily on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Irbr61 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Irbr61 effortlessly

- Find Irbr61 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal value as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irbr61 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irbr61

Create this form in 5 minutes!

How to create an eSignature for the irbr61

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is irbr61 and how does it relate to airSlate SignNow?

Irbr61 is a unique identifier for our airSlate SignNow service, which empowers businesses to send and eSign documents efficiently. By utilizing irbr61, users can access a range of features designed to streamline document management and enhance productivity.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs. With irbr61, you can explore our competitive pricing tiers that provide access to essential features, ensuring you find a plan that fits your budget.

-

What features does airSlate SignNow offer?

AirSlate SignNow, identified by irbr61, includes features such as document templates, real-time collaboration, and advanced security measures. These features are designed to simplify the eSigning process and enhance user experience.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, marked by irbr61, businesses can signNowly reduce the time spent on document processing. This solution not only improves efficiency but also enhances customer satisfaction through faster turnaround times.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow, associated with irbr61, offers seamless integrations with various third-party applications. This allows businesses to incorporate eSigning into their existing workflows without disruption.

-

What security measures does airSlate SignNow implement?

AirSlate SignNow, recognized by irbr61, prioritizes security with features like encryption and secure cloud storage. These measures ensure that your documents are protected throughout the signing process.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! AirSlate SignNow, linked to irbr61, is fully optimized for mobile use, allowing users to send and eSign documents on the go. This flexibility ensures that you can manage your documents anytime, anywhere.

Get more for Irbr61

- Ohio dower release form

- Business where applicant was employed form

- Kshitij 2013 17 cummins college of engineering for women pune form

- Eia 861 form

- Mississippi affidavit for reservation indian dormsgov form

- Imm 5620 e form

- Member information for the overseas scheme manager

- Va form 40 1330up claim for commemorative urn or plaque for veterans cremains not interred

Find out other Irbr61

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture