IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim for Exemption from Payment of Fee and Levy IRBR61 FORM 3 BUSINESS REGISTRA 2016

Understanding the IRBR61 FORM 3 Business Registration Regulations

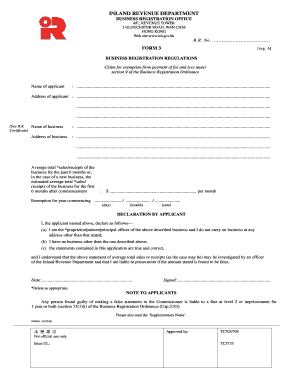

The IRBR61 FORM 3 is a crucial document designed for businesses seeking an exemption from certain fees and levies associated with business registration. This form is particularly relevant for entities that qualify under specific criteria outlined in the regulations. By completing this form, businesses can potentially alleviate some financial burdens related to registration, thus facilitating smoother operations and compliance with local laws.

Steps to Complete the IRBR61 FORM 3

Filling out the IRBR61 FORM 3 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details, tax identification number, and any relevant financial documentation. Next, carefully read the instructions provided with the form to understand the eligibility criteria for exemption. Complete each section of the form accurately, ensuring that all required fields are filled out. Finally, review the form for any errors before submission to avoid delays in processing.

Eligibility Criteria for the IRBR61 FORM 3

To qualify for an exemption using the IRBR61 FORM 3, businesses must meet specific eligibility criteria. These may include being a new startup, operating in certain sectors, or demonstrating financial hardship. It is essential to review the guidelines carefully to determine if your business meets the necessary requirements. Providing accurate and complete information will enhance the likelihood of approval for the exemption.

Required Documents for Submission

When submitting the IRBR61 FORM 3, certain documents may be required to support your claim for exemption. These documents often include proof of business registration, financial statements, and any other relevant paperwork that demonstrates eligibility. Ensuring that all required documents are included with your submission can help expedite the review process and reduce the risk of rejection.

Form Submission Methods

The IRBR61 FORM 3 can be submitted through various methods, including online, by mail, or in person. Each method has its own set of instructions and requirements. For online submissions, ensure that you have a reliable internet connection and access to the necessary digital tools. If submitting by mail, verify the address and any specific mailing instructions to ensure timely delivery. In-person submissions may require an appointment, so check the local office hours and availability.

Potential Penalties for Non-Compliance

Failing to comply with the regulations surrounding the IRBR61 FORM 3 can result in penalties. Businesses that do not submit the form when required or provide inaccurate information may face fines or other legal repercussions. It is vital to adhere to all guidelines and deadlines to avoid these potential issues and maintain good standing with regulatory authorities.

Examples of Using the IRBR61 FORM 3

Understanding how the IRBR61 FORM 3 applies in real-world scenarios can provide valuable insights. For instance, a small business owner launching a new venture may use this form to seek exemption from initial registration fees, thereby easing the financial burden during startup. Similarly, a non-profit organization may qualify for exemption based on its mission and funding structure. Analyzing such examples can help businesses identify their own eligibility and the benefits of submitting the form.

Quick guide on how to complete irbr61 form 3 business registration regulations claim for exemption from payment of fee and levy irbr61 form 3 business

Effortlessly Prepare IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly option to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA with Ease

- Locate IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign option, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irbr61 form 3 business registration regulations claim for exemption from payment of fee and levy irbr61 form 3 business

Create this form in 5 minutes!

How to create an eSignature for the irbr61 form 3 business registration regulations claim for exemption from payment of fee and levy irbr61 form 3 business

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy?

The IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy is a document that allows businesses to apply for an exemption from certain fees and levies associated with business registration. This form is essential for businesses looking to reduce their initial costs while ensuring compliance with local regulations.

-

How can airSlate SignNow help with the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS?

airSlate SignNow provides a streamlined platform for businesses to easily fill out and eSign the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy. Our user-friendly interface simplifies the process, ensuring that you can complete your registration efficiently and without hassle.

-

What are the benefits of using airSlate SignNow for the IRBR61 FORM 3?

Using airSlate SignNow for the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are safely stored and easily accessible, allowing you to focus on growing your business.

-

Is there a cost associated with using airSlate SignNow for the IRBR61 FORM 3?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those needing to complete the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy. We provide a cost-effective solution that can help you save on registration fees while ensuring compliance.

-

Can I integrate airSlate SignNow with other software for the IRBR61 FORM 3?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easier to manage your documents related to the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy. This integration allows for a more efficient workflow and helps keep all your business processes connected.

-

What features does airSlate SignNow offer for managing the IRBR61 FORM 3?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSigning, all tailored to assist with the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy. These features enhance your document management experience and ensure that you stay organized throughout the registration process.

-

How secure is airSlate SignNow when handling the IRBR61 FORM 3?

Security is a top priority at airSlate SignNow. When handling the IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy, we utilize advanced encryption and secure cloud storage to protect your sensitive information, ensuring that your documents remain confidential and secure.

Get more for IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA

Find out other IRBR61 FORM 3 BUSINESS REGISTRATION REGULATIONS Claim For Exemption From Payment Of Fee And Levy IRBR61 FORM 3 BUSINESS REGISTRA

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself