Bisbee, Arizona REDEMPTION AFFIDAVIT 2019-2026

What is the Bisbee, Arizona Redemption Affidavit

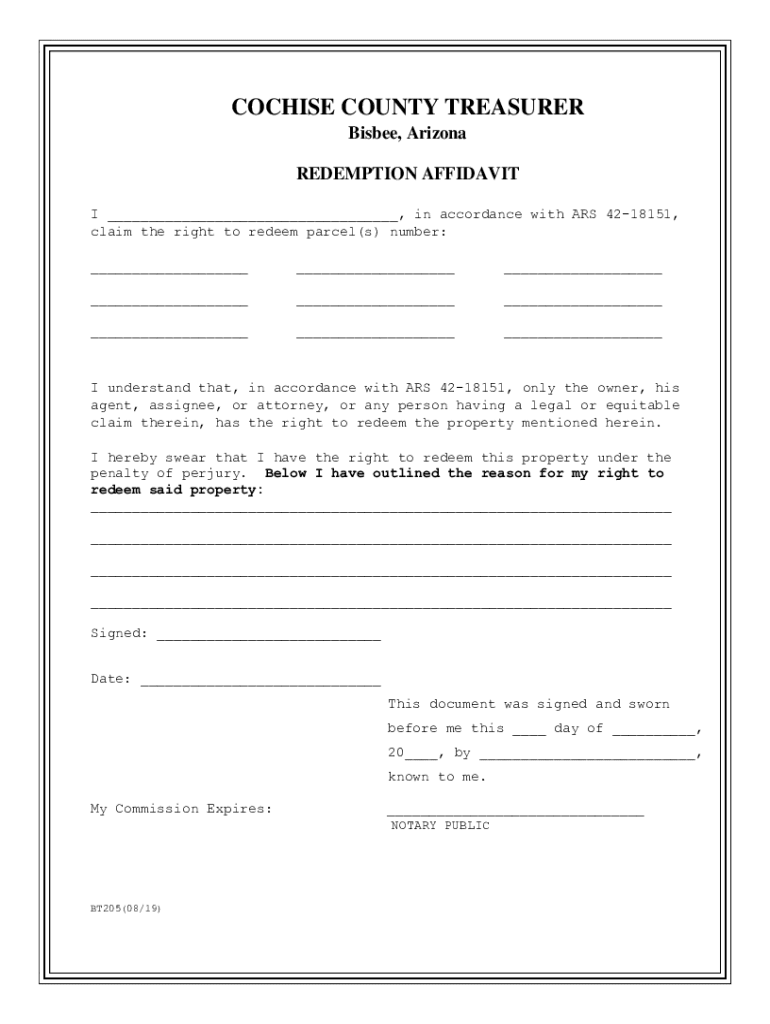

The Bisbee, Arizona Redemption Affidavit is a legal document utilized in Cochise County for the purpose of reclaiming property that may have been sold due to tax delinquency. This affidavit serves as a formal declaration by the property owner, affirming their intent to redeem the property and outlining the necessary details for the redemption process. It is an essential tool for individuals who wish to recover their property rights following a tax sale.

How to Use the Bisbee, Arizona Redemption Affidavit

Using the Bisbee Redemption Affidavit involves several key steps. First, the property owner must complete the affidavit with accurate information regarding the property and the circumstances of the tax sale. Once completed, the affidavit should be submitted to the Cochise County Treasurer's Office, along with any required documentation and payment of outstanding taxes. It is important to ensure that all information is correct to avoid delays in the redemption process.

Steps to Complete the Bisbee, Arizona Redemption Affidavit

Completing the Bisbee Redemption Affidavit requires attention to detail. Here are the steps to follow:

- Gather all necessary documents, including proof of ownership and tax payment records.

- Fill out the affidavit form with accurate property details and personal information.

- Review the completed affidavit for any errors or omissions.

- Submit the affidavit to the Cochise County Treasurer's Office, ensuring all required fees are included.

Legal Use of the Bisbee, Arizona Redemption Affidavit

The legal use of the Bisbee Redemption Affidavit is crucial for property owners seeking to reclaim their property after a tax sale. This affidavit must be filed within a specific timeframe set by state law to ensure that the property owner retains their rights. Failure to file the affidavit correctly or within the designated period may result in the loss of the property. Therefore, understanding the legal implications and requirements is essential for a successful redemption.

Key Elements of the Bisbee, Arizona Redemption Affidavit

The key elements of the Bisbee Redemption Affidavit include:

- The property owner's name and contact information.

- A detailed description of the property being redeemed.

- The tax parcel number associated with the property.

- The date of the tax sale and the amount owed.

- Signature of the property owner, affirming the accuracy of the information provided.

Eligibility Criteria for the Bisbee, Arizona Redemption Affidavit

Eligibility to file the Bisbee Redemption Affidavit typically requires that the individual is the rightful owner of the property in question. Additionally, the property must have been sold at a tax sale due to unpaid taxes. It is also important for the owner to be aware of any outstanding balances that must be settled before the redemption can be processed. Understanding these criteria helps ensure that the redemption process can proceed smoothly.

Quick guide on how to complete bisbee arizona redemption affidavit

Effortlessly prepare Bisbee, Arizona REDEMPTION AFFIDAVIT on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Manage Bisbee, Arizona REDEMPTION AFFIDAVIT on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to edit and eSign Bisbee, Arizona REDEMPTION AFFIDAVIT effortlessly

- Find Bisbee, Arizona REDEMPTION AFFIDAVIT and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Modify and eSign Bisbee, Arizona REDEMPTION AFFIDAVIT and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bisbee arizona redemption affidavit

Create this form in 5 minutes!

How to create an eSignature for the bisbee arizona redemption affidavit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does the Cochise County Treasurer provide?

The Cochise County Treasurer is responsible for managing the collection and distribution of property taxes, as well as overseeing the county's investment portfolio. They ensure that funds are allocated properly to support local services and infrastructure. Understanding these services can help residents effectively manage their financial obligations.

-

How can I pay my property taxes to the Cochise County Treasurer?

You can pay your property taxes to the Cochise County Treasurer online, by mail, or in person at their office. Online payments are convenient and secure, allowing you to manage your payments from anywhere. Make sure to check the official website for specific payment options and deadlines.

-

What are the benefits of using airSlate SignNow for document signing related to the Cochise County Treasurer?

Using airSlate SignNow for document signing related to the Cochise County Treasurer streamlines the process of submitting necessary forms and payments. It offers a secure, easy-to-use platform that ensures your documents are signed and sent quickly. This efficiency can save you time and reduce the hassle of paperwork.

-

Are there any fees associated with payments to the Cochise County Treasurer?

Yes, there may be fees associated with certain payment methods when dealing with the Cochise County Treasurer. It's important to review the fee structure on their official website or contact their office for detailed information. Understanding these fees can help you budget accordingly.

-

How does airSlate SignNow integrate with other tools for managing documents related to the Cochise County Treasurer?

airSlate SignNow offers seamless integrations with various tools and platforms, enhancing your ability to manage documents related to the Cochise County Treasurer. Whether you use CRM systems or cloud storage solutions, these integrations simplify the workflow. This ensures that all your documents are organized and easily accessible.

-

What features does airSlate SignNow offer for eSigning documents for the Cochise County Treasurer?

airSlate SignNow provides features such as customizable templates, in-person signing, and real-time tracking for eSigning documents related to the Cochise County Treasurer. These features enhance the signing experience, making it more efficient and user-friendly. You can also store and manage your signed documents securely within the platform.

-

How can I contact the Cochise County Treasurer for assistance?

You can contact the Cochise County Treasurer's office via phone, email, or by visiting their office in person. Their official website provides all the necessary contact information and office hours. If you have specific questions about payments or services, signNowing out directly can provide you with the most accurate information.

Get more for Bisbee, Arizona REDEMPTION AFFIDAVIT

Find out other Bisbee, Arizona REDEMPTION AFFIDAVIT

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract