PA 8879P 2018

What is the PA 8879P

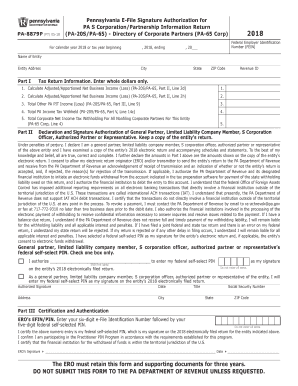

The PA 8879P is a tax form used in Pennsylvania, specifically designed for taxpayers who are filing their state income tax returns. This form serves as a declaration of the taxpayer's intent to electronically file their return and is essential for those who wish to utilize e-filing services. By signing this form, taxpayers authorize the electronic transmission of their tax return, ensuring a quicker and more efficient filing process.

How to use the PA 8879P

To effectively use the PA 8879P, taxpayers must first complete their state income tax return. Once the return is prepared, the PA 8879P must be filled out to indicate the taxpayer's consent for electronic filing. This form requires the taxpayer's signature and may also require the signature of a paid preparer if applicable. After signing, the form should be submitted alongside the electronic return to the state tax authority.

Steps to complete the PA 8879P

Completing the PA 8879P involves several straightforward steps:

- Begin by gathering your completed Pennsylvania state income tax return.

- Fill in the necessary personal information, including your name, address, and Social Security number.

- If applicable, provide the paid preparer's details, including their name and identification number.

- Sign and date the form, confirming your consent for electronic filing.

- Submit the signed form along with your electronic tax return.

Legal use of the PA 8879P

The PA 8879P is legally binding once signed, indicating the taxpayer's agreement to file their return electronically. It is crucial to ensure that the information provided on this form is accurate and complete, as any discrepancies could lead to issues with the tax authority. The form must be retained for your records, as it serves as proof of consent for the electronic filing process.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the PA 8879P. Generally, the deadline for filing Pennsylvania state income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is important to submit the PA 8879P and your tax return on or before this deadline to avoid penalties and interest on any owed taxes.

Required Documents

When preparing to complete the PA 8879P, taxpayers should gather several key documents:

- Your completed Pennsylvania state income tax return.

- Any relevant W-2 forms or 1099 forms that report income.

- Documentation for any deductions or credits claimed.

- Identification details such as your Social Security number.

Examples of using the PA 8879P

Common scenarios for using the PA 8879P include:

- A self-employed individual filing their annual income tax return electronically.

- A family claiming tax credits and deductions through e-filing.

- A taxpayer who has received assistance from a paid preparer to file their return electronically.

Quick guide on how to complete pa 8879p

Complete PA 8879P effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle PA 8879P on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign PA 8879P with ease

- Find PA 8879P and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or obscure confidential information using tools specifically available from airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or errors that necessitate reprinting copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from your chosen device. Edit and electronically sign PA 8879P while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa 8879p

Create this form in 5 minutes!

How to create an eSignature for the pa 8879p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 8879P form?

The PA 8879P form is an electronic signature authorization form used in Pennsylvania for e-filing tax returns. It allows taxpayers to authorize their tax preparers to file their returns electronically on their behalf. Understanding the PA 8879P is crucial for ensuring compliance and streamlining the e-filing process.

-

How does airSlate SignNow facilitate the use of the PA 8879P?

airSlate SignNow simplifies the process of signing the PA 8879P by providing an intuitive platform for electronic signatures. Users can easily upload the form, add necessary signatures, and send it securely to their tax preparers. This efficiency helps reduce paperwork and speeds up the filing process.

-

What are the pricing options for using airSlate SignNow with the PA 8879P?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. The plans are designed to be cost-effective, ensuring that users can manage their PA 8879P forms without breaking the bank. Each plan includes features that enhance document management and e-signing capabilities.

-

What features does airSlate SignNow offer for managing the PA 8879P?

airSlate SignNow provides features such as customizable templates, secure storage, and real-time tracking for the PA 8879P. Users can create templates for repetitive tasks, ensuring consistency and saving time. Additionally, the platform's security measures protect sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling the PA 8879P?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality for managing the PA 8879P. Users can connect it with popular accounting and tax software to streamline their workflow. This integration helps ensure that all documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for the PA 8879P?

Using airSlate SignNow for the PA 8879P provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick and easy signing, which can signNowly speed up the tax filing process. Additionally, it ensures that all documents are securely stored and easily retrievable.

-

Is airSlate SignNow compliant with regulations for the PA 8879P?

Yes, airSlate SignNow is compliant with all necessary regulations for electronic signatures, including those applicable to the PA 8879P. The platform adheres to industry standards to ensure that all signed documents are legally binding. This compliance gives users peace of mind when managing their tax documents.

Get more for PA 8879P

- Laferla healthplans laferla insurance form

- New client health history form lori sharp massage therapy

- Goldberg rubric form

- Single importation form

- Robert f smith school dedicated in inspiring ceremony form

- Letter of last instruction template form

- Rntcp request form for examination of biological specimen for tb

- Samordnet registermelding del 1 hovedblankett form

Find out other PA 8879P

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast