Www Revenue Pa GovFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization for PA S 2021

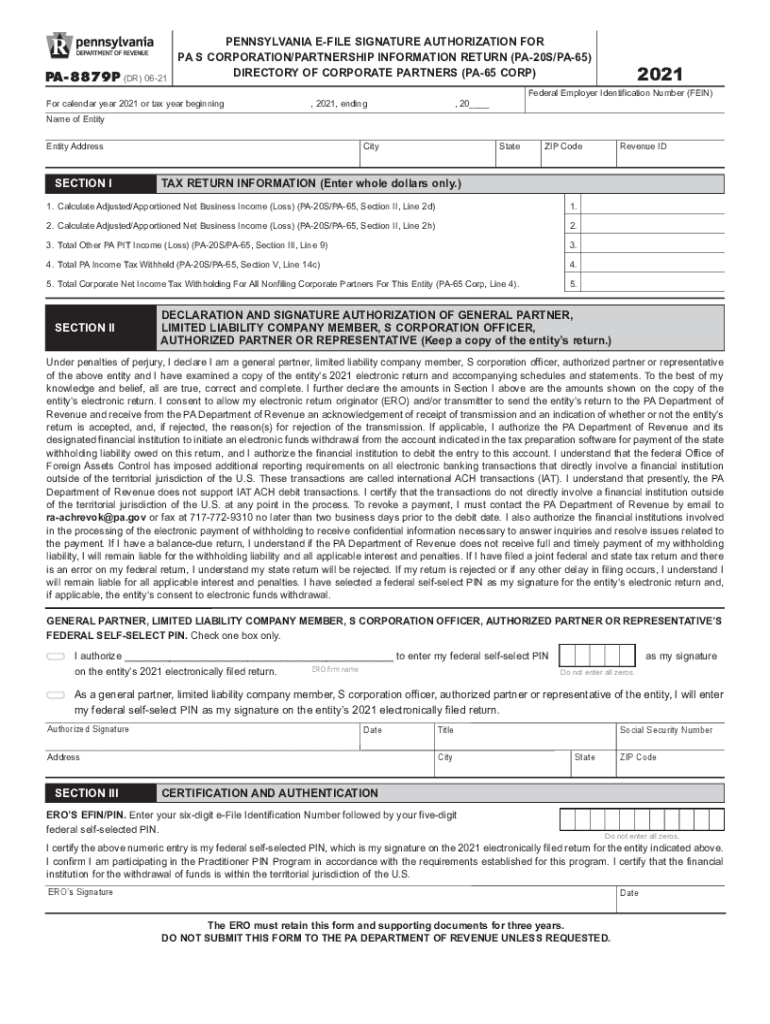

What is the Pennsylvania E-File Signature Authorization Form?

The Pennsylvania E-File Signature Authorization Form is a crucial document for taxpayers in Pennsylvania who wish to electronically file their state tax returns. This form authorizes a tax preparer to submit tax returns on behalf of the taxpayer, ensuring compliance with state regulations. It is particularly important for individuals who use tax preparation software or services to facilitate their filing process. By completing this form, taxpayers grant permission for their chosen preparer to sign and file their returns electronically, streamlining the filing process and reducing the likelihood of errors.

Steps to Complete the Pennsylvania E-File Signature Authorization Form

Completing the Pennsylvania E-File Signature Authorization Form involves several straightforward steps:

- Begin by downloading the form from the official Pennsylvania Department of Revenue website.

- Fill in the required personal information, including your name, address, and Social Security number.

- Provide details about your tax preparer, including their name and contact information.

- Sign and date the form to confirm your authorization.

- Submit the completed form to your tax preparer, who will then file it along with your electronic tax return.

Legal Use of the Pennsylvania E-File Signature Authorization Form

This form serves a legal purpose by ensuring that taxpayers can authorize their tax preparers to file returns on their behalf. It protects both the taxpayer and the preparer by establishing a clear agreement regarding the filing process. The form must be completed accurately and submitted in accordance with Pennsylvania tax laws to avoid any potential legal issues. Taxpayers should retain a copy of the signed form for their records, as it may be required for future reference or in case of an audit.

Required Documents for Filing

When preparing to file your Pennsylvania tax return using the E-File Signature Authorization Form, ensure you have the following documents ready:

- Your previous year’s tax return for reference.

- W-2 forms from your employer(s) and any 1099 forms for additional income.

- Documentation for any deductions or credits you plan to claim.

- Identification information, including your Social Security number.

Filing Deadlines for the Pennsylvania E-File Signature Authorization Form

It is essential to be aware of the filing deadlines associated with the Pennsylvania E-File Signature Authorization Form. Typically, the deadline for submitting your state tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that the E-File Signature Authorization Form is submitted to their tax preparer before this deadline to allow for timely filing of their returns.

Examples of Using the Pennsylvania E-File Signature Authorization Form

There are various scenarios in which the Pennsylvania E-File Signature Authorization Form may be utilized:

- A self-employed individual using a tax preparer to file their annual returns.

- A family with multiple income sources seeking assistance from a professional tax service.

- Taxpayers who have complex financial situations, such as investments or rental properties, requiring expert guidance.

Quick guide on how to complete www revenue pa govformsandpublicationsformsfor2017 pennsylvania e file signature authorization for pa s

Complete Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents promptly without any delays. Handle Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S effortlessly

- Find Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www revenue pa govformsandpublicationsformsfor2017 pennsylvania e file signature authorization for pa s

Create this form in 5 minutes!

How to create an eSignature for the www revenue pa govformsandpublicationsformsfor2017 pennsylvania e file signature authorization for pa s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

The Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S is a form that allows taxpayers in Pennsylvania to authorize electronic filing of their tax returns. This form is essential for ensuring that your e-filed documents are processed correctly and securely.

-

How can airSlate SignNow help with the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

airSlate SignNow provides a seamless platform for signing and sending the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S. With our easy-to-use interface, you can quickly complete and eSign this form, ensuring compliance and efficiency in your tax filing process.

-

What are the pricing options for using airSlate SignNow for the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and provide access to features that simplify the signing process for the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S, making it affordable for both individuals and businesses.

-

What features does airSlate SignNow offer for managing the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

With airSlate SignNow, you can easily create, send, and manage the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S. Key features include customizable templates, real-time tracking, and secure cloud storage, ensuring that your documents are always accessible and organized.

-

Is airSlate SignNow secure for handling the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and security protocols to protect your data while handling the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S, ensuring that your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other applications for the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when dealing with the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S. This means you can connect with your favorite tools and enhance productivity.

-

What are the benefits of using airSlate SignNow for the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S?

Using airSlate SignNow for the Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S offers numerous benefits, including time savings, increased efficiency, and reduced paperwork. Our platform simplifies the signing process, allowing you to focus on what matters most—your business.

Get more for Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S

- Declaration of consent for the receipt of electronic registered messages with incamail form

- Invoicing form for guest lectures and scientific activities fin k2

- Transfer reinstatement request phi beta sigma fraternity inc form

- Planet earth pole to pole worksheet form

- Release of body authorization form

- Roomcommissionsheetdocx form

- Camping health consent and release form young life

- Gaann program us department of education form

Find out other Www revenue pa govFormsandPublicationsFormsfor2017 Pennsylvania E File Signature Authorization For PA S

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation