Pa 8879 2014

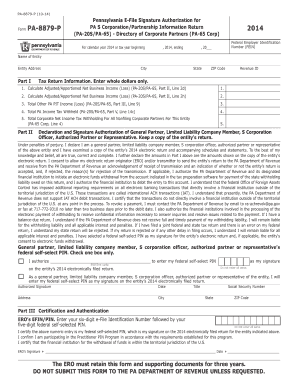

What is the PA-8879?

The PA-8879 is a tax form used in Pennsylvania, specifically designed for taxpayers who wish to electronically sign their tax returns. This form serves as an authorization for tax preparers to file returns on behalf of their clients. It is particularly relevant for individuals and businesses who utilize electronic filing methods to streamline their tax submission process.

How to Use the PA-8879

To use the PA-8879, taxpayers must first ensure they have completed their tax return accurately. Once the return is prepared, the taxpayer must fill out the PA-8879 form, providing essential information such as their name, Social Security number, and the tax preparer's details. After signing the form, it must be submitted to the tax preparer, who will then file the return electronically with the Pennsylvania Department of Revenue.

Steps to Complete the PA-8879

Completing the PA-8879 involves several key steps:

- Gather necessary documents, including your tax return and identification details.

- Fill in your personal information on the PA-8879, ensuring accuracy.

- Sign and date the form, confirming your authorization for electronic filing.

- Provide the completed form to your tax preparer for submission.

Legal Use of the PA-8879

The PA-8879 is legally recognized as a valid authorization for electronic filing of tax returns in Pennsylvania. By signing this form, taxpayers grant their tax preparers permission to submit their returns electronically. It is essential to understand that the form must be signed by the taxpayer, as it serves as a legal document that verifies consent for the electronic filing process.

Filing Deadlines / Important Dates

Filing deadlines for the PA-8879 generally align with the state tax return deadlines. Taxpayers should be aware that the deadline for filing individual income tax returns in Pennsylvania is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is crucial to check the Pennsylvania Department of Revenue's official announcements for any updates regarding specific deadlines.

Required Documents

To complete the PA-8879, taxpayers will need several documents, including:

- Completed tax return (e.g., PA-40 for individuals).

- Identification information, such as Social Security numbers for all filers.

- Any relevant tax documents that support the information included in the return.

Form Submission Methods

The PA-8879 must be submitted to the tax preparer, who will handle the electronic filing of the tax return. While the form itself is not submitted directly to the Pennsylvania Department of Revenue, it is essential for the preparer to have it on file to comply with electronic filing regulations. Taxpayers can provide the form via email, fax, or in person, depending on their agreement with the tax preparer.

Quick guide on how to complete pa 8879

Complete Pa 8879 easily on any device

Online document management has gained popularity among companies and individuals. It provides an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers all the tools required to create, edit, and eSign your documents quickly without interruptions. Handle Pa 8879 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Pa 8879 with minimal effort

- Locate Pa 8879 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Pa 8879 and ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa 8879

Create this form in 5 minutes!

How to create an eSignature for the pa 8879

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 8879 form and how does airSlate SignNow help with it?

The PA 8879 form is a declaration for electronic filing of Pennsylvania personal income tax returns. airSlate SignNow simplifies the process by allowing users to eSign the PA 8879 securely and efficiently, ensuring compliance with state regulations while saving time.

-

How much does it cost to use airSlate SignNow for PA 8879 eSigning?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Users can choose from monthly or annual subscriptions, making it a cost-effective solution for managing PA 8879 eSignatures without hidden fees.

-

What features does airSlate SignNow offer for managing PA 8879 forms?

airSlate SignNow provides a range of features for PA 8879 management, including customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the efficiency of handling tax documents and ensure a smooth eSigning experience.

-

Can I integrate airSlate SignNow with other software for PA 8879 processing?

Yes, airSlate SignNow offers seamless integrations with various software applications, including accounting and tax preparation tools. This allows users to streamline their workflow when handling PA 8879 forms and other related documents.

-

What are the benefits of using airSlate SignNow for PA 8879 eSignatures?

Using airSlate SignNow for PA 8879 eSignatures provides numerous benefits, including enhanced security, reduced turnaround time, and improved document management. This solution empowers businesses to handle tax forms efficiently while ensuring compliance with legal requirements.

-

Is airSlate SignNow user-friendly for eSigning PA 8879?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to eSign the PA 8879 form. The intuitive interface allows users to navigate the signing process effortlessly, even if they are not tech-savvy.

-

How does airSlate SignNow ensure the security of PA 8879 documents?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect PA 8879 documents. This ensures that sensitive information remains confidential and secure throughout the eSigning process.

Get more for Pa 8879

- Non represented party victoria only land title verification of identity form

- Childcare allergy form nswtforgau

- Dla form 2500

- Incorrect payments form

- Employment separation certificate form

- Victoria verification identity form

- Griffith university os help loan application form griffith edu

- Statement environmental effects lake macquarie template form

Find out other Pa 8879

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online