Hmrc Capital Gains Summary 2022-2026

Understanding the HMRC Capital Gains Summary

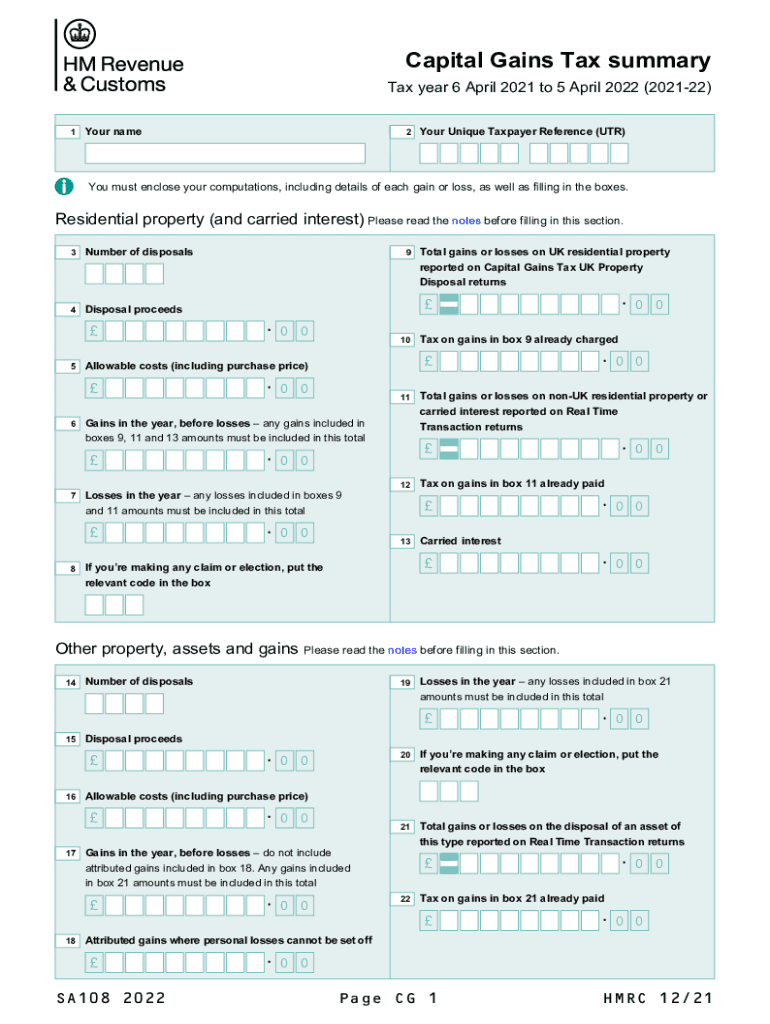

The HMRC Capital Gains Summary is a crucial document for individuals and businesses in the United Kingdom who need to report capital gains for tax purposes. This summary outlines the gains made from the sale of assets such as property, stocks, and other investments. It is essential for accurately calculating the amount of tax owed on these gains, as it provides a clear breakdown of the transactions involved.

For U.S. taxpayers, understanding similar forms and guidelines, like the SA108 Capital Gains Summary form, can help ensure compliance with local tax laws. While the HMRC summary is specific to the UK, the concepts of reporting capital gains are relevant across different jurisdictions.

Steps to Complete the HMRC Capital Gains Summary

Completing the HMRC Capital Gains Summary involves several key steps. First, gather all relevant documentation regarding the assets sold, including purchase and sale dates, costs, and any associated expenses. Next, calculate the total capital gains by subtracting the total costs from the sale price.

Once the gains are calculated, fill out the SA108 form with the necessary details, including the asset descriptions and the amounts gained. Review the form for accuracy before submission to ensure compliance with tax regulations.

Required Documents for the HMRC Capital Gains Summary

To accurately complete the HMRC Capital Gains Summary, certain documents are required. These include:

- Purchase and sale agreements for the assets sold

- Records of any improvements made to the assets

- Documentation of any costs associated with the sale, such as agent fees or legal costs

- Previous ownership records if the asset was inherited or gifted

Having these documents readily available will facilitate a smoother completion process and help ensure that all necessary information is included.

Filing Deadlines and Important Dates

Filing deadlines for the HMRC Capital Gains Summary are critical to avoid penalties. Typically, individuals must report their capital gains by January 31 of the year following the tax year in which the gains were realized. For instance, gains made in the tax year ending April 5 must be reported by the following January 31.

It is important to keep track of these dates and prepare the necessary documentation in advance to ensure timely submission.

Legal Use of the HMRC Capital Gains Summary

The HMRC Capital Gains Summary is legally required for individuals and businesses that have realized capital gains exceeding the annual exempt amount. Failure to report these gains can result in penalties and interest on unpaid taxes. Understanding the legal implications of this form is essential for compliance with tax laws.

Moreover, accurate reporting can help taxpayers avoid audits and ensure that they are not subject to additional scrutiny from tax authorities.

IRS Guidelines on Capital Gains Reporting

For U.S. taxpayers, the IRS provides guidelines on reporting capital gains through various forms, including Schedule D and Form 8949. Understanding these guidelines is essential for ensuring compliance with U.S. tax laws. Taxpayers should familiarize themselves with the specific requirements for reporting capital gains and losses, including the need to maintain accurate records of all transactions.

By adhering to IRS guidelines, taxpayers can effectively manage their tax obligations and avoid potential issues with the IRS.

Quick guide on how to complete hmrc capital gains summary

Complete Hmrc Capital Gains Summary effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Hmrc Capital Gains Summary on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest method to alter and eSign Hmrc Capital Gains Summary with ease

- Obtain Hmrc Capital Gains Summary and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that aim.

- Create your signature using the Sign tool, which requires mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Hmrc Capital Gains Summary and guarantee exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hmrc capital gains summary

Create this form in 5 minutes!

How to create an eSignature for the hmrc capital gains summary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SA108 capital gains summary?

The SA108 capital gains summary is a tax form used in the UK to report capital gains and losses for individuals. It is essential for accurately calculating your tax obligations on profits from the sale of assets. Understanding how to fill out the SA108 capital gains summary can help ensure compliance with tax regulations.

-

How can airSlate SignNow assist with the SA108 capital gains summary?

airSlate SignNow provides a streamlined solution for electronically signing and sending documents, including the SA108 capital gains summary. With its user-friendly interface, you can easily prepare and share your tax documents securely, ensuring that your submissions are timely and accurate.

-

Is there a cost associated with using airSlate SignNow for the SA108 capital gains summary?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans are designed to be cost-effective, allowing you to manage your documents, including the SA108 capital gains summary, without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the SA108 capital gains summary?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, which are beneficial for managing the SA108 capital gains summary. These features simplify the process of preparing and signing your tax documents, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for my SA108 capital gains summary?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing the SA108 capital gains summary. Whether you use accounting software or document management systems, these integrations can help streamline your processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for tax documents like the SA108 capital gains summary?

Using airSlate SignNow for tax documents, including the SA108 capital gains summary, provides numerous benefits such as increased efficiency, enhanced security, and ease of use. You can quickly send, sign, and store your documents, reducing the time spent on administrative tasks and minimizing the risk of errors.

-

Is airSlate SignNow suitable for individuals filing the SA108 capital gains summary?

Absolutely! airSlate SignNow is designed for both individuals and businesses, making it an excellent choice for anyone needing to file the SA108 capital gains summary. Its intuitive platform allows users of all skill levels to manage their documents effectively and securely.

Get more for Hmrc Capital Gains Summary

Find out other Hmrc Capital Gains Summary

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself