Instructions for Form 593 V 2025-2026

Understanding Form 593 V

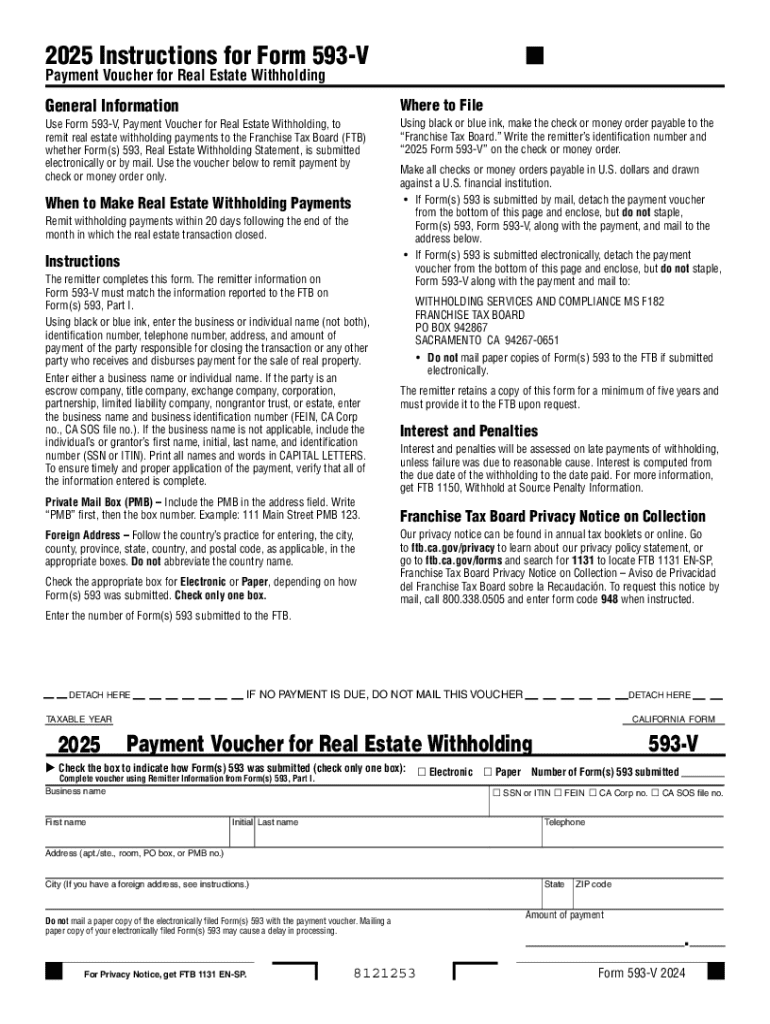

The 2025 CA 593 V is a crucial document used in California for reporting the sale of real estate by nonresidents. This form is specifically designed to help the California Franchise Tax Board (FTB) track the withholding tax obligations associated with such transactions. When a nonresident sells California real estate, the buyer is typically required to withhold a percentage of the sale price to ensure that the seller meets their tax obligations. The instructions for Form 593 V detail the necessary steps and requirements for both buyers and sellers involved in these transactions.

How to Complete the Instructions for Form 593 V

Completing the 2025 CA 593 V requires careful attention to detail. The form includes several key sections that must be filled out accurately. First, the seller's information, including name, address, and taxpayer identification number, must be provided. Next, the buyer's information should be included. The form also requires details about the property being sold, such as the address and sale price. Additionally, the withholding amount must be calculated based on the sale price and entered in the appropriate section. It's important to review all entries for accuracy before submission to avoid potential penalties.

Key Elements of the Instructions for Form 593 V

The instructions for Form 593 V encompass several important elements that ensure compliance with California tax regulations. These include:

- Eligibility Criteria: Understanding who is required to file Form 593 V is essential. Typically, this applies to nonresidents selling real estate in California.

- Filing Deadlines: The form must be submitted within specific timeframes to avoid late penalties.

- Required Documentation: Sellers may need to provide additional documentation, such as proof of identity and ownership.

- Submission Methods: The form can be submitted online, by mail, or in person, depending on the seller's preference.

Steps to File Form 593 V

Filing Form 593 V involves a series of steps that must be followed to ensure compliance with California tax laws:

- Gather all necessary information regarding the property and the parties involved in the transaction.

- Complete the form accurately, ensuring all required fields are filled out.

- Calculate the withholding amount based on the sale price of the property.

- Submit the completed form to the California Franchise Tax Board by the specified deadline.

Legal Use of Form 593 V

The legal implications of Form 593 V are significant. By filing this form, nonresidents comply with California tax laws regarding the sale of real estate. Failure to file or incorrect filing can lead to penalties, including fines and interest on unpaid taxes. It is essential for both buyers and sellers to understand their responsibilities under California law when completing and submitting this form.

Obtaining the Instructions for Form 593 V

The instructions for Form 593 V can be obtained directly from the California Franchise Tax Board's website or through authorized tax professionals. It is advisable to refer to the most current version of the instructions to ensure compliance with any updates or changes in tax law. Additionally, many tax preparation software programs include the necessary forms and instructions, making it easier for users to complete their filings accurately.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 593 v

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 593 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2025 CA 593 instructions?

The 2025 CA 593 instructions provide detailed guidelines for California residents on how to complete the CA 593 form for withholding tax purposes. This form is essential for reporting the sale of real estate and ensuring compliance with state tax regulations. Understanding these instructions can help you avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow assist with the 2025 CA 593 instructions?

airSlate SignNow simplifies the process of completing and submitting the 2025 CA 593 instructions by allowing users to eSign documents securely and efficiently. Our platform provides templates and tools that streamline the form-filling process, ensuring that all necessary information is included. This helps users save time and reduce errors when dealing with tax forms.

-

What features does airSlate SignNow offer for handling tax documents like the 2025 CA 593 instructions?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are particularly useful for handling tax documents like the 2025 CA 593 instructions. These features ensure that your documents are completed accurately and can be easily shared with relevant parties. Additionally, our platform provides a user-friendly interface that makes the process straightforward.

-

Is airSlate SignNow cost-effective for managing the 2025 CA 593 instructions?

Yes, airSlate SignNow is a cost-effective solution for managing the 2025 CA 593 instructions. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you get the best value for your investment. By using our platform, you can reduce administrative costs associated with paper-based processes and improve overall efficiency.

-

Can I integrate airSlate SignNow with other software for the 2025 CA 593 instructions?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the 2025 CA 593 instructions alongside your existing tools. Whether you use CRM systems, accounting software, or document management platforms, our integrations enhance your workflow and ensure that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the 2025 CA 593 instructions?

Using airSlate SignNow for the 2025 CA 593 instructions provides numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows for quick eSigning and document sharing, which speeds up the process of tax reporting. Additionally, our security measures ensure that your sensitive information is protected throughout the process.

-

How does airSlate SignNow ensure compliance with the 2025 CA 593 instructions?

airSlate SignNow is designed to help users maintain compliance with the 2025 CA 593 instructions by providing clear templates and guidance throughout the document preparation process. Our platform also keeps you updated on any changes to tax regulations, ensuring that your submissions are always accurate and compliant. This proactive approach minimizes the risk of errors and penalties.

Get more for Instructions For Form 593 V

- Montoursville youth football and cheer participant application form

- Borang penamaan nomination form mxmcommy

- Dc 313 visitor inquiry form

- Fort mcclellan regulation 350 2 range and training area safety form

- Casas practice test 8384 table of contents bhubbsbbsppsbborgb hubbs spps form

- Application for employment correct health correcthealth form

- Realtors association of new mexico listing agreement form

- Chardon valley derby 2015 form

Find out other Instructions For Form 593 V

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement