Form 593 V Payment Voucher for Real Franchise Tax 2018

What is the Form 593 V Payment Voucher For Real Franchise Tax

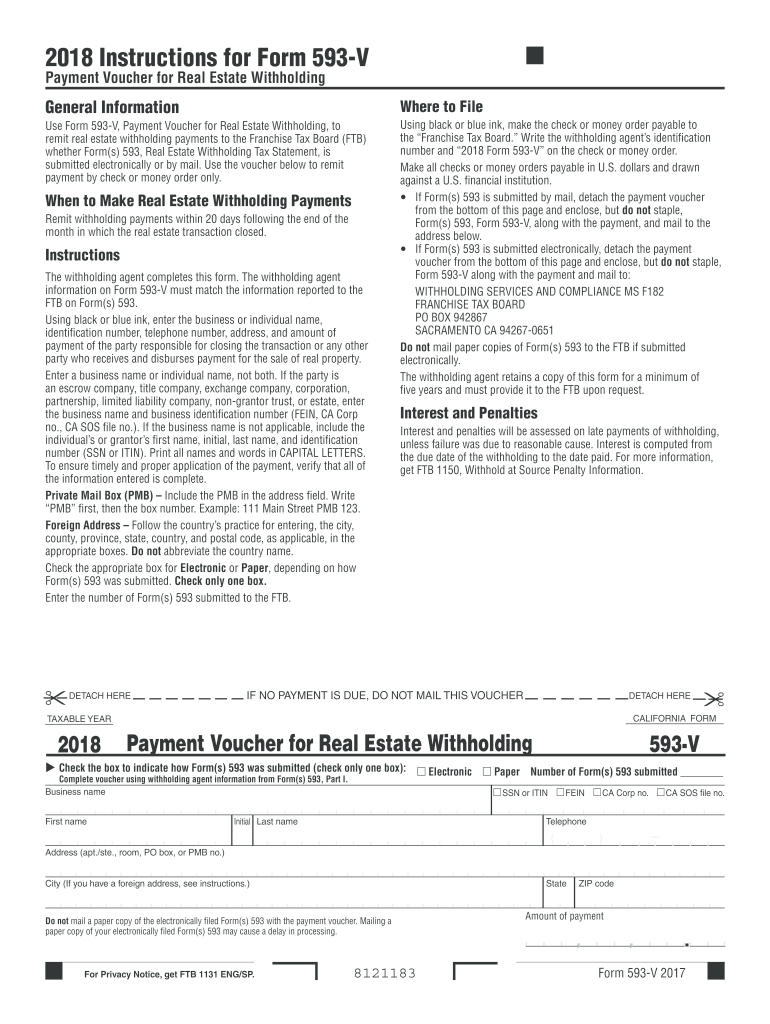

The Form 593 V Payment Voucher for Real Franchise Tax is a document used by businesses in California to remit their franchise tax payments. This form is specifically designed for those who owe taxes based on their income or revenue generated within the state. It serves as a payment voucher that accompanies the tax payment, ensuring that the payment is properly credited to the taxpayer's account. Understanding the purpose of this form is crucial for compliance with California tax laws.

How to use the Form 593 V Payment Voucher For Real Franchise Tax

Using the Form 593 V involves several steps to ensure accurate completion and submission. First, gather all necessary financial information, including your business's income and any applicable deductions. Next, fill out the form with the required details, such as your business name, address, and the amount owed. After completing the form, include it with your payment, whether you choose to submit it by mail or electronically. Proper use of this form helps streamline the tax payment process and ensures compliance with state regulations.

Steps to complete the Form 593 V Payment Voucher For Real Franchise Tax

Completing the Form 593 V requires attention to detail. Follow these steps:

- Begin by entering your business information, including the legal name and address.

- Indicate the tax year for which you are making the payment.

- Calculate the total amount due based on your reported income.

- Double-check all entries for accuracy to avoid delays in processing.

- Sign and date the form to validate your submission.

By following these steps, you can ensure that your payment voucher is filled out correctly and submitted on time.

Legal use of the Form 593 V Payment Voucher For Real Franchise Tax

The legal use of the Form 593 V is essential for compliance with California tax laws. This form is recognized by the California Franchise Tax Board (FTB) as a valid method for submitting franchise tax payments. It is important to ensure that the form is completed accurately and submitted by the appropriate deadlines to avoid penalties. Utilizing this form legally helps maintain good standing with state tax authorities and prevents potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 V are critical for taxpayers to adhere to in order to avoid penalties. Generally, the payment is due on the same date as your business's tax return. For most corporations, this is the 15th day of the fourth month following the end of the fiscal year. It is advisable to check the California Franchise Tax Board’s website for any updates or changes to deadlines, as these can vary based on specific circumstances or legislation.

Form Submission Methods (Online / Mail / In-Person)

The Form 593 V can be submitted through various methods, providing flexibility for taxpayers. You can choose to file the form online through the California Franchise Tax Board's website, which offers a secure and efficient way to submit payments. Alternatively, you can mail the completed form along with your payment to the designated address provided by the FTB. In-person submissions may also be possible at certain FTB offices, but it is advisable to check for availability and any required appointments.

Quick guide on how to complete 2018 form 593 v payment voucher for real franchise tax

Your instructional manual on how to prepare your Form 593 V Payment Voucher For Real Franchise Tax

If you wish to learn how to complete and submit your Form 593 V Payment Voucher For Real Franchise Tax, here are some concise directions on how to simplify tax submission.

First, you just need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that permits you to modify, create, and finalize your income tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revisit to amend responses when necessary. Streamline your tax handling with sophisticated PDF editing, electronic signatures, and easy sharing.

Follow the instructions below to complete your Form 593 V Payment Voucher For Real Franchise Tax in just a few minutes:

- Create your account and start working on PDFs within moments.

- Access our directory to find any IRS tax form; explore different versions and schedules.

- Select Get form to launch your Form 593 V Payment Voucher For Real Franchise Tax in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to e-file your taxes through airSlate SignNow. Keep in mind that submitting on paper may lead to higher error rates and delay refunds. Of course, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 593 v payment voucher for real franchise tax

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

How do I register for the ANTHE 2018? I was registering online. I successfully made the payment, but was unable to fill the form due to connectivity issues. How should I enroll now?

Now look into your email Id. They will send you an email regarding your enrollment. Follow the instructions given there.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 593 v payment voucher for real franchise tax

How to make an electronic signature for your 2018 Form 593 V Payment Voucher For Real Franchise Tax in the online mode

How to generate an electronic signature for your 2018 Form 593 V Payment Voucher For Real Franchise Tax in Google Chrome

How to create an eSignature for putting it on the 2018 Form 593 V Payment Voucher For Real Franchise Tax in Gmail

How to create an electronic signature for the 2018 Form 593 V Payment Voucher For Real Franchise Tax from your smartphone

How to make an eSignature for the 2018 Form 593 V Payment Voucher For Real Franchise Tax on iOS

How to generate an electronic signature for the 2018 Form 593 V Payment Voucher For Real Franchise Tax on Android

People also ask

-

What is the Form 593 V Payment Voucher For Real Franchise Tax?

The Form 593 V Payment Voucher For Real Franchise Tax is a document that individuals and businesses use to submit payments for California real estate franchise tax. Understanding this form is crucial for compliance with state tax regulations and ensuring timely tax payments.

-

How can airSlate SignNow help with the Form 593 V Payment Voucher For Real Franchise Tax?

airSlate SignNow allows users to easily fill out, sign, and send the Form 593 V Payment Voucher For Real Franchise Tax electronically. This streamlined process not only saves time but also enhances accuracy and keeps your tax documents organized.

-

Is there a cost associated with using airSlate SignNow for the Form 593 V Payment Voucher For Real Franchise Tax?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing the Form 593 V Payment Voucher For Real Franchise Tax, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing the Form 593 V Payment Voucher For Real Franchise Tax?

AirSlate SignNow provides features such as electronic signatures, customizable templates, and secure cloud storage specifically for the Form 593 V Payment Voucher For Real Franchise Tax. These features enhance efficiency and compliance in the tax submission process.

-

Can I integrate airSlate SignNow with other applications for the Form 593 V Payment Voucher For Real Franchise Tax?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to seamlessly manage financial workflows related to the Form 593 V Payment Voucher For Real Franchise Tax. These integrations include popular accounting and CRM software.

-

How does airSlate SignNow ensure the security of the Form 593 V Payment Voucher For Real Franchise Tax?

AirSlate SignNow employs industry-standard encryption and secure storage to protect your Form 593 V Payment Voucher For Real Franchise Tax documents. This commitment to security ensures that your sensitive information remains confidential and safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the Form 593 V Payment Voucher For Real Franchise Tax?

Using airSlate SignNow for the Form 593 V Payment Voucher For Real Franchise Tax provides multiple benefits, including increased efficiency, reduced paperwork, and greater compliance with tax regulations. With its intuitive design, even users with minimal technical expertise can navigate the process easily.

Get more for Form 593 V Payment Voucher For Real Franchise Tax

- Driver disciplinary action form

- Proving angles congruent worksheet form

- Application for the working parents assistance program wpa montgomerycountymd form

- Dbs bank deposit slip form

- Hawaii form gp 4

- Completed warranty deed sample form

- Preston county assessors office 106 w main st s form

- Adjusters international client references form

Find out other Form 593 V Payment Voucher For Real Franchise Tax

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple