Instructions for 593 E Form RS Login 2024

Understanding the 2025 Form 593 V

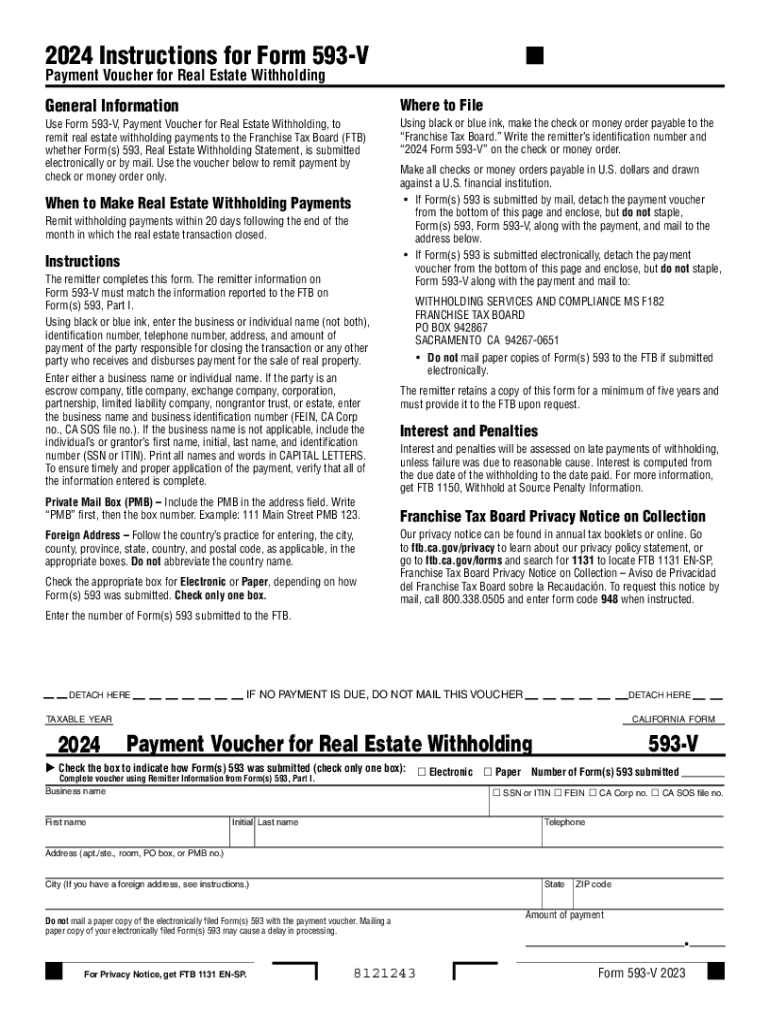

The 2025 Form 593 V is a critical document used in California for reporting withholding on the sale of real estate. This form is primarily utilized by buyers and sellers to ensure compliance with state tax regulations. It is essential for individuals involved in real estate transactions to understand the requirements and implications of this form.

Form 593 V is specifically designed for use by the Franchise Tax Board (FTB) in California, which oversees the collection of taxes related to real estate sales. The form captures the necessary information about the transaction, including the amounts withheld, and is crucial for both parties to fulfill their tax obligations.

Key Elements of the 2025 Form 593 V

Understanding the key elements of the 2025 Form 593 V is vital for accurate completion. The form includes sections for:

- Seller Information: Details about the seller, including their name, address, and taxpayer identification number.

- Buyer Information: Information regarding the buyer, similar to that of the seller.

- Transaction Details: Specifics about the property being sold, including the sale price and date of transaction.

- Withholding Amount: The total amount withheld from the sale for tax purposes, which must be reported accurately.

Each section must be filled out completely and accurately to avoid penalties or issues with the FTB.

Steps to Complete the 2025 Form 593 V

Completing the 2025 Form 593 V involves several straightforward steps:

- Gather Required Information: Collect all necessary details about the transaction, including seller and buyer information.

- Fill Out the Form: Carefully enter the information into the appropriate sections of the form, ensuring accuracy.

- Calculate Withholding: Determine the correct amount to withhold based on the sale price and applicable tax rates.

- Review for Accuracy: Double-check all entries for completeness and correctness before submission.

- Submit the Form: File the completed form with the FTB as part of the real estate transaction process.

Following these steps can help ensure compliance and prevent potential issues with tax reporting.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for compliance with the 2025 Form 593 V. Generally, the form must be submitted by the date of the real estate transaction. Failure to file on time can result in penalties imposed by the FTB. It is advisable to keep track of any changes in deadlines or regulations that may affect filing requirements.

Form Submission Methods

The 2025 Form 593 V can be submitted through various methods, providing flexibility for users. The available submission options include:

- Online Submission: Many users prefer to file electronically through the FTB's online portal, which can streamline the process.

- Mail Submission: The form can also be printed and mailed to the appropriate FTB address, though this method may take longer for processing.

- In-Person Submission: For those who prefer direct interaction, submitting the form in person at a local FTB office is an option.

Choosing the right submission method can depend on personal preference and the urgency of the transaction.

Penalties for Non-Compliance

Failure to comply with the requirements of the 2025 Form 593 V can lead to significant penalties. The FTB may impose fines for late submissions or incorrect information. It is essential for both buyers and sellers to understand these potential penalties to avoid unnecessary financial burdens. Ensuring timely and accurate filing is the best way to mitigate risks associated with non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct instructions for 593 e form rs login

Create this form in 5 minutes!

How to create an eSignature for the instructions for 593 e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2025 form 593 v and why is it important?

The 2025 form 593 v is a crucial document for reporting California source income. It helps businesses comply with state tax regulations and ensures accurate reporting. Understanding its requirements can streamline your tax processes and avoid potential penalties.

-

How can airSlate SignNow assist with the 2025 form 593 v?

airSlate SignNow provides an efficient platform for electronically signing and sending the 2025 form 593 v. Our solution simplifies the document management process, allowing you to focus on your business while ensuring compliance with state regulations.

-

What are the pricing options for using airSlate SignNow for the 2025 form 593 v?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while ensuring you can manage the 2025 form 593 v effectively.

-

What features does airSlate SignNow offer for managing the 2025 form 593 v?

Our platform includes features like customizable templates, secure eSigning, and real-time tracking for the 2025 form 593 v. These tools enhance your workflow efficiency and ensure that your documents are handled securely and promptly.

-

Can I integrate airSlate SignNow with other software for the 2025 form 593 v?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage the 2025 form 593 v. This integration allows for a smoother workflow, connecting your document management with other essential business tools.

-

What are the benefits of using airSlate SignNow for the 2025 form 593 v?

Using airSlate SignNow for the 2025 form 593 v offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are processed quickly and securely, allowing you to focus on your core business activities.

-

Is airSlate SignNow user-friendly for completing the 2025 form 593 v?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 2025 form 593 v. Our intuitive interface guides you through the process, ensuring that you can manage your documents without any hassle.

Get more for Instructions For 593 E Form RS Login

- Wheelers atlas of tooth form pdf

- Medical receipt generator form

- Paytm indemnity form

- Uba account upgrade form

- Truck dispatch spreadsheet template form

- Milady standard cosmetology 13th edition pdf download form

- Nrci lto 02 e california energy commission form

- Behavioral health ampampamp substance abuse services form

Find out other Instructions For 593 E Form RS Login

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online