Form 1040C Fill in Version U S Departing Alien Income Tax Return

What is the Form 1040C Fill in Version U S Departing Alien Income Tax Return

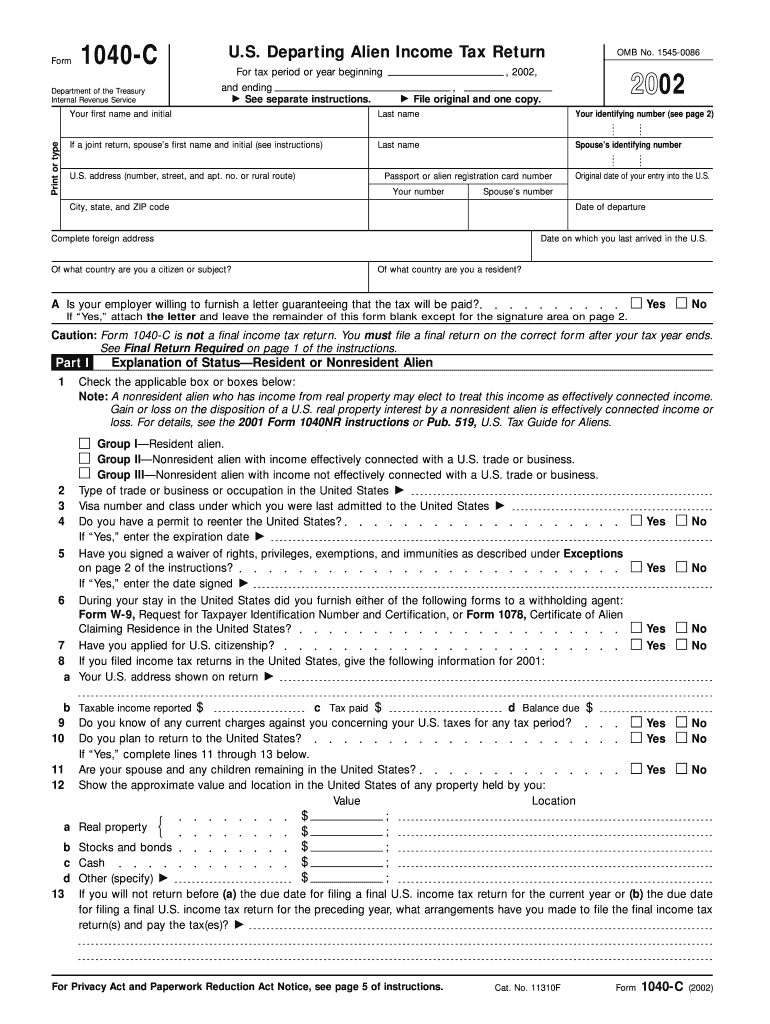

The Form 1040C Fill in Version U S Departing Alien Income Tax Return is a tax form specifically designed for non-resident aliens who are leaving the United States. This form allows these individuals to report their income and calculate their tax liability for the year in which they depart. It is essential for ensuring compliance with U.S. tax laws and for determining any potential refunds or outstanding tax obligations. Non-resident aliens must use this form to settle their tax affairs before leaving the country, as it provides a clear record of their income and tax status during their time in the U.S.

How to use the Form 1040C Fill in Version U S Departing Alien Income Tax Return

Using the Form 1040C involves several steps to ensure accurate reporting of income and taxes owed. First, individuals should gather all necessary documentation, including W-2 forms, 1099 forms, and any other relevant income statements. Next, the form should be filled out with personal information, including name, address, and taxpayer identification number. It is important to report all income earned while in the U.S. and to apply any applicable deductions. After completing the form, individuals should review it for accuracy before submitting it to the IRS.

Steps to complete the Form 1040C Fill in Version U S Departing Alien Income Tax Return

Completing the Form 1040C requires careful attention to detail. Follow these steps:

- Gather all income documentation, such as W-2s and 1099s.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Report all income earned in the U.S. for the tax year.

- Apply any eligible deductions and credits.

- Calculate your total tax liability based on the reported income.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the appropriate deadline.

Key elements of the Form 1040C Fill in Version U S Departing Alien Income Tax Return

The Form 1040C includes several key elements that must be accurately completed. These elements include:

- Personal Information: Name, address, and taxpayer identification number.

- Income Reporting: Detailed sections for reporting various types of income.

- Deductions and Credits: Sections to apply any applicable deductions or credits.

- Tax Calculation: A summary section for calculating total tax liability.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040C are crucial to avoid penalties. Generally, the form must be submitted by the tax deadline for the year in which you are departing. For most individuals, this deadline falls on April fifteenth of the following year. However, if you are leaving the U.S. before this date, it is advisable to file the form as soon as your tax situation is clear. Keeping track of these dates helps ensure compliance with U.S. tax regulations.

Required Documents

To complete the Form 1040C, several documents are necessary. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income received while in the U.S.

- Documentation for any deductions or credits you plan to claim.

Quick guide on how to complete form 1040c fill in version u s departing alien income tax return

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling users to access the necessary form and securely store it online. airSlate SignNow furnishes all the resources required to create, modify, and electronically sign your documents promptly and without hold-ups. Oversee [SKS] across any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information utilizing the tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for the form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate worries about misplaced or lost documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040C Fill in Version U S Departing Alien Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 1040c fill in version u s departing alien income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040C Fill in Version U S Departing Alien Income Tax Return?

The Form 1040C Fill in Version U S Departing Alien Income Tax Return is a tax form specifically designed for non-resident aliens who are departing the United States. This form allows them to report their income and calculate any taxes owed before leaving the country. Using this form ensures compliance with U.S. tax laws for departing aliens.

-

How can airSlate SignNow help with the Form 1040C Fill in Version U S Departing Alien Income Tax Return?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the Form 1040C Fill in Version U S Departing Alien Income Tax Return. Our solution streamlines the document preparation process, allowing users to complete their tax forms quickly and efficiently. With our platform, you can ensure that your tax documents are accurate and submitted on time.

-

What are the pricing options for using airSlate SignNow for Form 1040C Fill in Version U S Departing Alien Income Tax Return?

airSlate SignNow offers flexible pricing plans to accommodate various needs, including options for individuals and businesses. You can choose a monthly or annual subscription based on your usage requirements. Our pricing is competitive, making it a cost-effective solution for managing the Form 1040C Fill in Version U S Departing Alien Income Tax Return.

-

Are there any features specifically designed for the Form 1040C Fill in Version U S Departing Alien Income Tax Return?

Yes, airSlate SignNow includes features tailored for the Form 1040C Fill in Version U S Departing Alien Income Tax Return, such as customizable templates and guided workflows. These features help users navigate the complexities of tax filing, ensuring that all necessary information is included. Additionally, our platform supports document storage and retrieval for easy access.

-

Can I integrate airSlate SignNow with other software for filing the Form 1040C Fill in Version U S Departing Alien Income Tax Return?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage the Form 1040C Fill in Version U S Departing Alien Income Tax Return alongside your other financial documents. This seamless integration helps streamline your workflow and reduces the risk of errors during the filing process.

-

What are the benefits of using airSlate SignNow for my Form 1040C Fill in Version U S Departing Alien Income Tax Return?

Using airSlate SignNow for your Form 1040C Fill in Version U S Departing Alien Income Tax Return provides numerous benefits, including enhanced efficiency, accuracy, and security. Our platform allows you to complete and eSign documents from anywhere, saving you time and effort. Additionally, our secure storage ensures that your sensitive information is protected.

-

Is airSlate SignNow user-friendly for completing the Form 1040C Fill in Version U S Departing Alien Income Tax Return?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the Form 1040C Fill in Version U S Departing Alien Income Tax Return. Our intuitive interface guides users through each step of the process, ensuring that even those with limited technical skills can navigate the platform with ease. Support resources are also available for additional assistance.

Get more for Form 1040C Fill in Version U S Departing Alien Income Tax Return

- Corporation e file signature form form va virginia tax

- Va 8879 form

- Registrationtaxtitle application vermont department of form

- 8821 vt department of taxes tax vermont form

- Vermont department of taxes form

- Vt form pvr 4404a 2011 2021 fill out tax template online

- Mail towashington state multi purpose combined excise tax return form

- Combined excise tax return form

Find out other Form 1040C Fill in Version U S Departing Alien Income Tax Return

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will