Change Address or Account Status Florida Department of Revenue 2015

What is the Change Address Or Account Status Florida Department Of Revenue

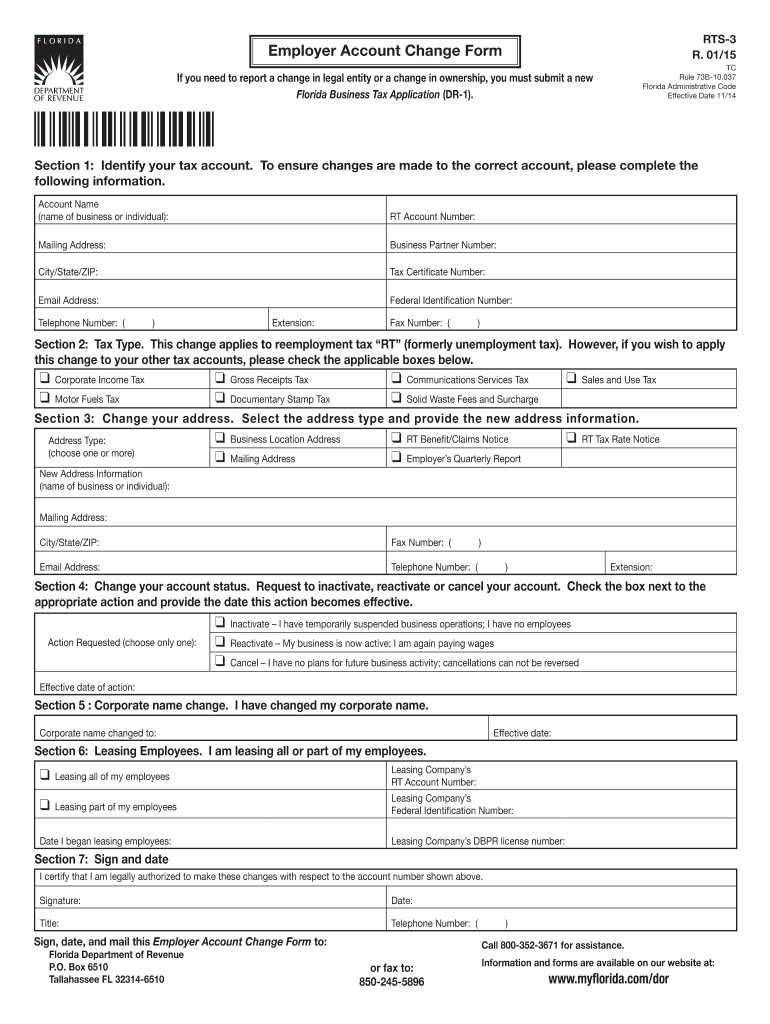

The Change Address Or Account Status form from the Florida Department of Revenue is a crucial document for individuals and businesses wishing to update their address or account information. This form ensures that the Department has the most current information, which is essential for accurate tax reporting and communication. It is commonly used by taxpayers to notify the Department of any changes in residence or business location, allowing for seamless updates to tax records.

Steps to complete the Change Address Or Account Status Florida Department Of Revenue

Completing the Change Address Or Account Status form involves several straightforward steps. First, gather all necessary information, including your current address, new address, and account details. Next, access the form online or obtain a physical copy. Fill in the required fields accurately, ensuring that all information is up to date. After completing the form, review it for any errors. Finally, submit the form either electronically or by mailing it to the appropriate address provided by the Florida Department of Revenue.

Legal use of the Change Address Or Account Status Florida Department Of Revenue

The legal use of the Change Address Or Account Status form is governed by state tax laws. This form is designed to maintain the integrity of tax records and ensure compliance with Florida's tax regulations. By submitting this form, taxpayers fulfill their legal obligation to keep the Department informed of their current address, which is essential for receiving important tax documents and notices. Failure to update this information can lead to delays in processing tax returns and potential penalties.

Form Submission Methods

There are various methods to submit the Change Address Or Account Status form to the Florida Department of Revenue. Taxpayers can choose to file the form online through the Department's official website, which is often the fastest option. Alternatively, the form can be printed and mailed to the designated address. In some cases, individuals may also deliver the form in person at a local Department office. Each submission method has its own processing times, so it is advisable to choose the one that best suits your needs.

Required Documents

When completing the Change Address Or Account Status form, certain documents may be required to verify your identity and support your address change. Typically, you will need to provide a government-issued identification, such as a driver’s license or state ID, along with any relevant account numbers. If you are updating a business address, additional documentation, such as business registration papers, may also be necessary. Ensuring that you have all required documents ready can facilitate a smoother submission process.

IRS Guidelines

While the Change Address Or Account Status form is specific to the Florida Department of Revenue, it is important to be aware of the related IRS guidelines. The IRS requires taxpayers to keep their address updated to ensure they receive important tax information and correspondence. Taxpayers can update their address with the IRS by using Form 8822, which is a separate form from the Florida Department of Revenue. Understanding both state and federal requirements helps ensure compliance and avoid complications during tax filing.

Quick guide on how to complete change address or account status florida department of revenue

Your assistance manual on how to prepare your Change Address Or Account Status Florida Department Of Revenue

If you’re curious about how to generate and dispatch your Change Address Or Account Status Florida Department Of Revenue, here are some brief instructions on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, generate, and finalize your income tax forms seamlessly. Using its editor, you can toggle between text, checkboxes, and eSignatures and revisit to modify details as necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Change Address Or Account Status Florida Department Of Revenue in no time:

- Set up your account and start working on PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Obtain form to access your Change Address Or Account Status Florida Department Of Revenue in our editor.

- Complete the necessary fillable sections with your information (text, numbers, check marks).

- Use the Signature Tool to affix your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can lead to an increase in errors and delays in refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct change address or account status florida department of revenue

FAQs

-

Would change in home address after filling the form of SBI or any other exams turn out to be something wrong?

No it won't be a problem if you have proper justification for that, they are supportive in these things if you have relevant documents for proof.

-

How can I sue someone for not filling out a change of address form and using my address as their business address (moved a year ago, CA)?

I do not think you have a lawsuit just because someone did not file a change of address with USPS. As per the previous answer, you would have to had suffered financial loss or injury due to the situation.As information, it is illegal to file a forwarding request on behalf of another person unless you have a power of attorney or are otherwise authorized to do so.To help stop receiving mail for previous residents write “Not at this address” on any first class mail and place it with outgoing mail. and write the names of those who should be receiving mail at your address on the mailbox (you may place it inside the flap where it is only visible to the carrier).Please note that any mail which has “or current resident”, or similar phrasing, will still be delivered to you even though it may also have the previous residents name. If you don’t want it, toss it into recycling.

-

My wife and I filed a form 1-485 for Adjustment of Status for the USCIS but we haven't received our NOA1 yet. We are moving out of state. Do I change my address through mail or online?

Change your address on the USCIS web site.File an address change mail forwarding request with the post office. Give your new address to the new occupants of your residence and some preload envelopes with your new address.Despite all this it is possible will miss your noa1 and biometrics notice.

-

Has anyone ever filled out a "Change of Address" form for your address, written in a fake address, and turned it in to the Post Office, without your knowledge?

College kids used to do that all the time (except the addresses weren't fake - they were usually the addresses of someone they dislike) - they think it's cute. They also subscribe to magazines for you without your knowledge. Nowdays, in this digital era, however, the post office has checking/confirming mechanisms in place.

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

-

Why do we have to specify our gender every time we fill out some kind of form, admission form, email account, bank account or any place where we explicitly mention our sex?

Thanks Nitish for the reply. I am asking exactly because of the realistic reasons you mentioned above. That, why we have to provide benefits to any specific gender, why we do calculations based on gender just to represent how much progress we have done so far in uplifting women. In world where we live in such arguments are reasonable. But i am imagining of an ideal world where no one see each other based on gender. Think of how our world would have been if we had no gender mentioned anywhere in our society. Just one single gender let just say human being. Everyone would be seen as equal in all terms. I am being too idealistic here but it feels good to see world around you like that. Sadly, it is not the reality.

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

Create this form in 5 minutes!

How to create an eSignature for the change address or account status florida department of revenue

How to create an eSignature for your Change Address Or Account Status Florida Department Of Revenue online

How to generate an electronic signature for the Change Address Or Account Status Florida Department Of Revenue in Chrome

How to create an eSignature for putting it on the Change Address Or Account Status Florida Department Of Revenue in Gmail

How to generate an electronic signature for the Change Address Or Account Status Florida Department Of Revenue right from your smartphone

How to create an electronic signature for the Change Address Or Account Status Florida Department Of Revenue on iOS devices

How to create an eSignature for the Change Address Or Account Status Florida Department Of Revenue on Android

People also ask

-

How can I easily Change Address Or Account Status Florida Department Of Revenue using airSlate SignNow?

You can effortlessly Change Address Or Account Status Florida Department Of Revenue with airSlate SignNow's intuitive platform. Simply upload your document where you mention the new address or status, and send it for eSignature. The secure and user-friendly interface ensures a smooth process from start to finish.

-

What features does airSlate SignNow offer to help Change Address Or Account Status Florida Department Of Revenue?

airSlate SignNow includes features such as document templates, customizable workflows, and real-time tracking to assist you in changing your address or account status with the Florida Department Of Revenue. The platform also allows unlimited document sharing and integrates seamlessly with popular applications to enhance your experience.

-

Is there a cost associated with using airSlate SignNow for Changing Address Or Account Status Florida Department Of Revenue?

Yes, there are various pricing plans available tailored to different business needs. Depending on volume and features, you can choose a plan that allows you to Change Address Or Account Status Florida Department Of Revenue without breaking the bank. Our cost-effective solution ensures you get the most value for your investment.

-

What benefits do I get by using airSlate SignNow to Change Address Or Account Status Florida Department Of Revenue?

Using airSlate SignNow to Change Address Or Account Status Florida Department Of Revenue means enjoying greater efficiency and minimal paperwork. Our electronic signing feature speeds up the process, saving you time and reducing the risk of errors. Additionally, documents are stored securely, giving you peace of mind.

-

Does airSlate SignNow integrate with other tools for managing changes to my address or account status?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, streamlining your process to Change Address Or Account Status Florida Department Of Revenue. Whether you are using CRMs, cloud storages, or productivity tools, you can easily connect and manage your documents within your existing ecosystem.

-

Can I track the status of my documents after I Change Address Or Account Status Florida Department Of Revenue?

Yes, airSlate SignNow provides real-time tracking for all documents. Once you send your documents for signing to Change Address Or Account Status Florida Department Of Revenue, you can monitor their progress and receive notifications when they are completed, ensuring no detail is overlooked.

-

Is airSlate SignNow user-friendly for someone looking to Change Address Or Account Status Florida Department Of Revenue?

Definitely! airSlate SignNow is designed with user experience in mind, making it accessible for everyone, even those who are not tech-savvy. The straightforward interface guides you through each step, allowing you to Change Address Or Account Status Florida Department Of Revenue with confidence.

Get more for Change Address Or Account Status Florida Department Of Revenue

- Md beauty secrets form

- Employee enrollment change form initial group cobra open enrollment benefits administered by umr enrollment services new

- Barry hampe documentory pdf form

- Met reevaluation waiver arizona department of education azed form

- District school board of pasco county fundraiser form

- Sewer overflow response plan form

- Personal property foreclosure fulton county magistrate court of form

- Football contract template 787751794 form

Find out other Change Address Or Account Status Florida Department Of Revenue

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy