Oregon Monthly Tax Report for Nonexempt Cigarettes for Cigarette Manufacturers Form

What is the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers

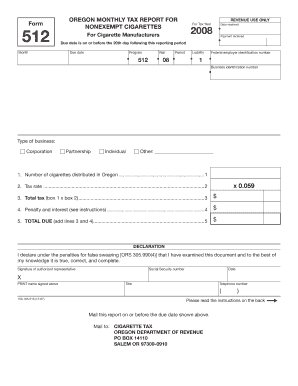

The Oregon Monthly Tax Report for Nonexempt Cigarettes for Cigarette Manufacturers is a crucial document that cigarette manufacturers in Oregon must submit to report the sales and tax obligations related to nonexempt cigarettes. This report helps the state track tobacco sales and ensures compliance with tax regulations. It includes essential information such as the quantity of cigarettes sold, the applicable tax rates, and the total tax due. Understanding this report is vital for manufacturers to maintain compliance and avoid penalties.

Steps to complete the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers

Completing the Oregon Monthly Tax Report involves several key steps:

- Gather sales data for the reporting month, including the total number of nonexempt cigarettes sold.

- Calculate the total tax based on the applicable tax rate for nonexempt cigarettes.

- Fill out the report form accurately, ensuring all required fields are completed.

- Review the report for any errors or omissions before submission.

- Submit the report by the deadline through the designated submission method, which may include online filing or mailing a physical copy.

Key elements of the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers

Several key elements must be included in the Oregon Monthly Tax Report:

- Manufacturer Information: Name, address, and contact details of the cigarette manufacturer.

- Sales Data: Total quantity of nonexempt cigarettes sold during the reporting period.

- Tax Calculation: Detailed breakdown of the tax rate applied and the total tax due.

- Signature: An authorized representative must sign the report to certify its accuracy.

Filing Deadlines / Important Dates

Timely filing of the Oregon Monthly Tax Report is essential to avoid penalties. The report is typically due on the last day of the month following the reporting period. For example, the report for sales in January would be due by February 28. It is important for manufacturers to stay informed about any changes in deadlines that may occur due to state regulations.

Legal use of the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers

The Oregon Monthly Tax Report is legally required for all cigarette manufacturers operating in the state. Failure to submit this report can result in significant penalties, including fines and potential legal action. Manufacturers should ensure that they understand the legal implications of their reporting obligations and maintain accurate records to support their submissions.

Who Issues the Form

The Oregon Department of Revenue is the agency responsible for issuing the Oregon Monthly Tax Report for Nonexempt Cigarettes. This department oversees tax compliance and collection for various tax types, including tobacco taxes. Manufacturers can contact the department for guidance on completing the report and understanding their obligations under state law.

Quick guide on how to complete oregon monthly tax report for nonexempt cigarettes for cigarette manufacturers

Complete [SKS] smoothly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or cover sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon monthly tax report for nonexempt cigarettes for cigarette manufacturers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers?

The Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers is a mandatory document that cigarette manufacturers must file to report their tax obligations. This report details the quantity of nonexempt cigarettes sold and ensures compliance with state tax regulations. Understanding this report is crucial for maintaining legal operations in Oregon.

-

How can airSlate SignNow help with the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers?

airSlate SignNow provides an efficient platform for cigarette manufacturers to prepare and eSign the Oregon Monthly Tax Report For Nonexempt Cigarettes. Our user-friendly interface simplifies document management and ensures that all necessary information is accurately captured. This streamlines the filing process, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing tax reports?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers. These features enhance efficiency and ensure that all documents are compliant with state regulations. Additionally, users can collaborate in real-time, making the process seamless.

-

Is there a cost associated with using airSlate SignNow for tax reporting?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Our pricing plans are flexible and cater to different needs, ensuring that you can manage the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers without breaking the bank. You can choose a plan that fits your business size and requirements.

-

Can airSlate SignNow integrate with other accounting software for tax reporting?

Absolutely! airSlate SignNow can integrate with various accounting software, making it easier to manage the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers. This integration allows for seamless data transfer, reducing the need for manual entry and minimizing errors. You can connect with popular platforms to streamline your tax reporting process.

-

What are the benefits of using airSlate SignNow for cigarette manufacturers?

Using airSlate SignNow offers numerous benefits for cigarette manufacturers, including enhanced efficiency, improved compliance, and reduced paperwork. By simplifying the process of preparing the Oregon Monthly Tax Report For Nonexempt Cigarettes, businesses can focus on their core operations. Additionally, our secure platform ensures that sensitive information is protected.

-

How secure is airSlate SignNow for handling tax documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect all documents, including the Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers. Users can trust that their sensitive information is safe and secure while using our services.

Get more for Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers

- Notice of election to make voluntary plan applicable to all employees de2520cv edd ca form

- Sdi request for information form de 2541

- Unemployment insurance application federal employee de 1101ibd form

- Unemployment insurance application federal employee de 1101ibd 445885800 form

- Ausgrid nosw form online

- 2019 2021 form nz inz 1015 fill online printable

- Inz 1198 partnership based temporary visa application form

- Under the circumstances specified in w form

Find out other Oregon Monthly Tax Report For Nonexempt Cigarettes For Cigarette Manufacturers

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement