Whitley Co Ky Occupational Tax Forms 2018

What is the Whitley County KY Occupational Tax Forms

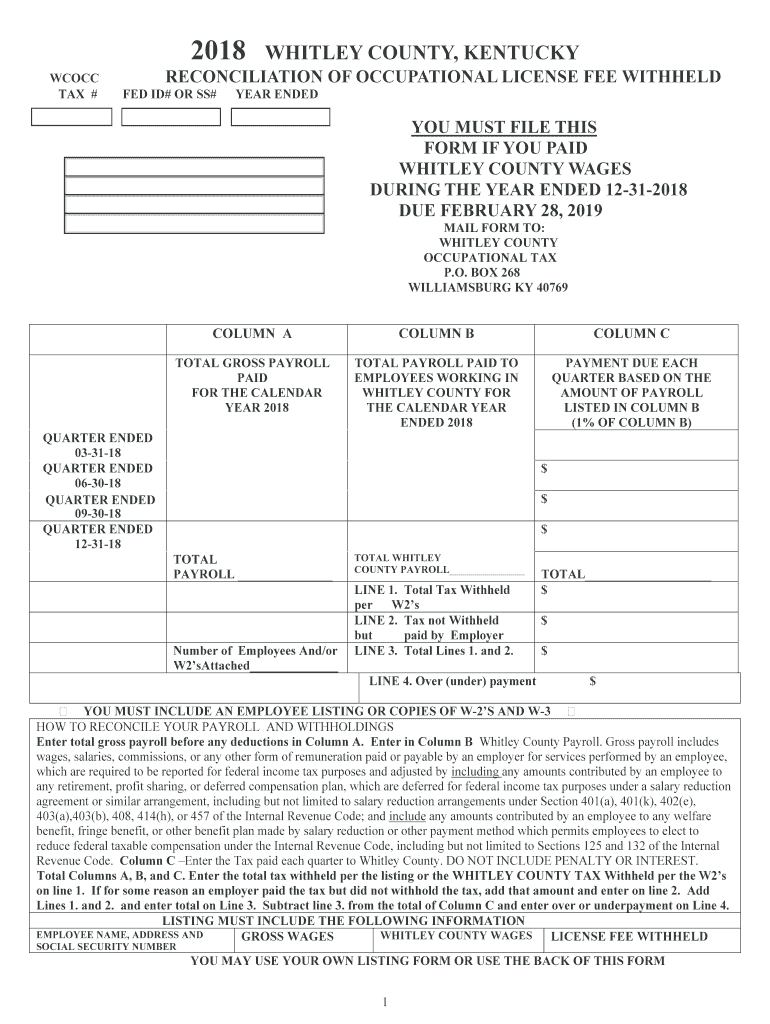

The Whitley County KY occupational tax forms are essential documents used by individuals and businesses to report and pay occupational taxes in Whitley County, Kentucky. These forms are designed to ensure compliance with local tax regulations and help fund various public services. The forms typically require information about the taxpayer’s income, business activities, and other relevant details that determine the tax liability. Completing these forms accurately is crucial for avoiding penalties and ensuring that all tax obligations are met.

How to Use the Whitley County KY Occupational Tax Forms

Using the Whitley County KY occupational tax forms involves several steps. First, you need to obtain the correct form, which can be accessed online or through local government offices. Once you have the form, carefully read the instructions provided to understand the required information. Fill out the form with accurate data regarding your income and business activities. After completing the form, you can eSign it using a secure digital signature solution, ensuring that it is legally binding. Finally, submit the form through the designated method, which may include online submission or mailing it to the appropriate tax authority.

Steps to Complete the Whitley County KY Occupational Tax Forms

Completing the Whitley County KY occupational tax forms involves a systematic approach:

- Gather necessary documents, such as income statements and business records.

- Obtain the correct form from the Whitley County tax office or online.

- Read the instructions carefully to understand what information is required.

- Fill in the form with accurate and complete information.

- Review the form for any errors or omissions before signing.

- Use a digital signature solution to eSign the form for submission.

- Submit the completed form by the specified deadline.

Legal Use of the Whitley County KY Occupational Tax Forms

The legal use of the Whitley County KY occupational tax forms is governed by local tax laws and regulations. These forms must be filled out accurately and submitted on time to avoid penalties. The forms serve as official documentation of your tax obligations and compliance with local laws. Using a secure method for eSigning and submitting these forms enhances their legal standing, ensuring that they are recognized by tax authorities. It is important to keep a copy of the submitted forms for your records, as they may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Whitley County KY occupational tax forms are crucial for taxpayers to note. Typically, these forms are due annually, with specific dates set by the local tax authority. It is essential to check the latest deadlines to avoid late fees or penalties. Additionally, some taxpayers may have quarterly filing requirements based on their income levels or business activities. Staying informed about these dates ensures timely compliance and helps maintain good standing with tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Whitley County KY occupational tax forms can be submitted through various methods, providing flexibility for taxpayers. You can choose to submit the forms online, which is often the quickest and most efficient method. Alternatively, you may mail the completed forms to the designated tax office or deliver them in person. Each submission method has its own requirements, so it is important to follow the instructions carefully to ensure that your forms are processed correctly and on time.

Quick guide on how to complete tax

Your assistance manual on how to prepare your Whitley Co Ky Occupational Tax Forms

If you’re pondering how to finalize and submit your Whitley Co Ky Occupational Tax Forms, here are some concise instructions on how to simplify tax filing.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and robust document tool that enables you to alter, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, allowing you to revisit and modify information as necessary. Streamline your tax organization with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Whitley Co Ky Occupational Tax Forms in just a few minutes:

- Set up your account and begin working on PDFs within a few minutes.

- Utilize our directory to acquire any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Whitley Co Ky Occupational Tax Forms in our editor.

- Populate the mandatory fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to include your legally-recognized eSignature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to increased return errors and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for filing rules in your region.

Create this form in 5 minutes or less

Find and fill out the correct tax

FAQs

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

In the UK, how do I complete or exempt myself from filling out tax returns when self-employment has ceased? All information would be zero.

If they send you a tax return you have to fill it in.Fortunately, if you are only employed or on benefits it’s really, really quick. There’s about 6 boxes to do, and you can get all the info from your P60.You can also tell them you no longer need to file a self assessment due to a change in circumstances. This will stop it for future tax years, but not the current one, so you might have to do two more - one for last year, one for this.I think you can do this through your account online.

-

Is it illegal for my boss to fill out the tax papers to tell them how much to take out?

It would be illegal for an employer to fill out a W-4 form for you.However, if you have not signed a W-4 form and given it to your employer, the employer is still required to withhold taxes. If I remember correctly they must do as if you'd filled out the form as single with 0 exemptions.If you want to change what your employer is withholding, you should be able to go to Internal Revenue Service, print out a W-4 form, fill it out and give it to your employer.If after that your withholding doesn't change in a reasonable time (I think they're allowed a couple of weeks), then talk to the IRS.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the tax

How to make an electronic signature for your Tax in the online mode

How to make an eSignature for your Tax in Google Chrome

How to create an electronic signature for signing the Tax in Gmail

How to make an electronic signature for the Tax right from your mobile device

How to generate an electronic signature for the Tax on iOS

How to generate an electronic signature for the Tax on Android

People also ask

-

What are Whitley Co Ky Occupational Tax Forms?

Whitley Co Ky Occupational Tax Forms are official documents required for individuals and businesses operating in Whitley County, Kentucky, to report and pay occupational taxes. These forms ensure compliance with local tax regulations and are essential for accurate tax filing.

-

How can airSlate SignNow help with Whitley Co Ky Occupational Tax Forms?

airSlate SignNow streamlines the process of filling out and eSigning Whitley Co Ky Occupational Tax Forms. Our easy-to-use platform allows you to create, send, and sign these forms electronically, saving you time and ensuring accuracy in your tax submissions.

-

What features does airSlate SignNow offer for managing Whitley Co Ky Occupational Tax Forms?

With airSlate SignNow, you gain access to features like customizable templates for Whitley Co Ky Occupational Tax Forms, real-time collaboration, and secure cloud storage. These features enhance efficiency and ensure that your documents are always accessible and up-to-date.

-

Is airSlate SignNow cost-effective for handling Whitley Co Ky Occupational Tax Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Whitley Co Ky Occupational Tax Forms. Our pricing plans are designed to fit various budgets, allowing businesses of all sizes to efficiently handle their tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with my existing software for Whitley Co Ky Occupational Tax Forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software platforms, enabling you to manage Whitley Co Ky Occupational Tax Forms alongside your existing tools. This integration helps streamline your workflow and improves overall productivity.

-

What benefits do I gain by using airSlate SignNow for Whitley Co Ky Occupational Tax Forms?

Using airSlate SignNow for Whitley Co Ky Occupational Tax Forms offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security for your sensitive information. Our platform helps ensure compliance while simplifying the entire tax filing process.

-

How secure is airSlate SignNow for handling Whitley Co Ky Occupational Tax Forms?

airSlate SignNow prioritizes security, utilizing advanced encryption and authentication measures to protect your Whitley Co Ky Occupational Tax Forms. You can trust that your data is safe while you eSign and manage your documents on our platform.

Get more for Whitley Co Ky Occupational Tax Forms

Find out other Whitley Co Ky Occupational Tax Forms

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter