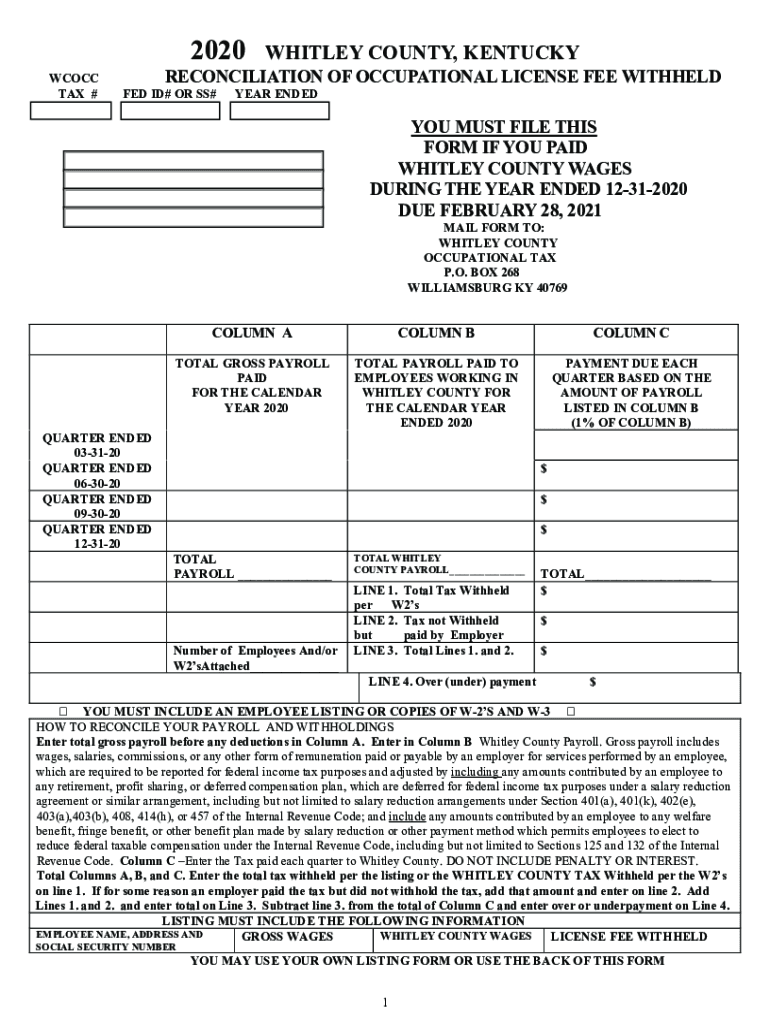

Occupational Tax Reconciliation Form Whitley County 2020

Understanding the Laurel County Occupational Tax

The Laurel County occupational tax is a tax imposed on individuals and businesses operating within the county. This tax is typically based on the income earned by the taxpayer while working in Laurel County. It is important for residents and businesses to understand their obligations regarding this tax to ensure compliance with local regulations. The tax rate may vary depending on the specific circumstances of the taxpayer, including their residency status and the nature of their business operations.

Steps to Complete the Laurel County Occupational Tax Form

Completing the Laurel County occupational tax form involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Obtain the Laurel County occupational tax form from the appropriate local authority.

- Fill out the form accurately, ensuring all income sources are reported.

- Calculate the total tax owed based on the provided guidelines.

- Review the completed form for accuracy before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal Use of the Laurel County Occupational Tax Form

The Laurel County occupational tax form serves a legal purpose in documenting the income earned by individuals and businesses in the county. It is essential that the form is filled out correctly and submitted on time to avoid potential penalties. The form must comply with local tax laws, and any discrepancies may lead to audits or legal issues. Utilizing a reliable electronic signature solution can enhance the legal standing of the submission, ensuring that it meets all necessary requirements.

Filing Deadlines for the Laurel County Occupational Tax

Timely filing of the Laurel County occupational tax form is crucial to avoid penalties. The typical deadline for submission is April 15 each year, coinciding with the federal tax filing deadline. However, it is advisable to check for any local variations or extensions that may apply. Keeping track of these deadlines ensures that taxpayers remain compliant and can avoid unnecessary fines.

Required Documents for the Laurel County Occupational Tax

When preparing to file the Laurel County occupational tax form, certain documents are essential:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or contract work.

- Income statements from self-employment or business operations.

- Previous year’s tax returns for reference.

- Any additional documentation that supports income claims.

Penalties for Non-Compliance with the Laurel County Occupational Tax

Failure to comply with the Laurel County occupational tax requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for both individuals and businesses to understand the importance of timely and accurate submissions to avoid these consequences. Regularly reviewing tax obligations and maintaining proper records can help mitigate these risks.

Quick guide on how to complete 2020 occupational tax reconciliation form whitley county

Easily Prepare Occupational Tax Reconciliation Form Whitley County on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the required forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without any delays. Manage Occupational Tax Reconciliation Form Whitley County on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Most Efficient Way to Edit and Electronically Sign Occupational Tax Reconciliation Form Whitley County

- Obtain Occupational Tax Reconciliation Form Whitley County and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important sections of the documents or redact sensitive details using features provided by airSlate SignNow designed specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new printed copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Occupational Tax Reconciliation Form Whitley County to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 occupational tax reconciliation form whitley county

Create this form in 5 minutes!

How to create an eSignature for the 2020 occupational tax reconciliation form whitley county

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the Laurel County occupational tax?

The Laurel County occupational tax is a tax levied on individuals and businesses operating within Laurel County. This tax helps fund local services and infrastructure. Understanding this tax is crucial for compliance and can affect your overall business operations in the area.

-

How can airSlate SignNow help with Laurel County occupational tax documents?

airSlate SignNow streamlines the process of managing documents related to the Laurel County occupational tax. With our eSigning solution, you can easily send, sign, and store important tax documents. This ensures that you stay compliant and organized as you tackle your tax responsibilities.

-

What features does airSlate SignNow offer for handling occupational tax forms?

airSlate SignNow provides features like customizable templates, automatic reminders, and secure storage for Laurel County occupational tax forms. Our platform allows you to automate your document workflows, making the submission of tax forms more efficient. This saves you time and reduces the possibility of errors.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax management software. This capability allows for seamless data transfer in relation to Laurel County occupational tax documentation. By integrating these tools, you can enhance your productivity and ensure that all your financial records are consistent.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to different business needs, including features essential for managing the Laurel County occupational tax. Our plans are designed to accommodate businesses of all sizes, ensuring you only pay for what you use. You can choose from monthly or annual subscriptions based on your needs.

-

Is airSlate SignNow compliant with occupational tax regulations?

Yes, airSlate SignNow is designed to comply with regulations surrounding the Laurel County occupational tax and other relevant laws. Our platform employs robust security measures to ensure your documents are protected. This compliance provides peace of mind as you manage your tax-related paperwork.

-

What benefits does airSlate SignNow provide for businesses handling local taxes?

airSlate SignNow offers robust benefits such as enhanced efficiency, reduced paper usage, and improved compliance for businesses managing the Laurel County occupational tax. These advantages help streamline processes and save time, allowing business owners to focus more on their core activities. Additionally, our user-friendly interface simplifies the eSigning experience.

Get more for Occupational Tax Reconciliation Form Whitley County

Find out other Occupational Tax Reconciliation Form Whitley County

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later