Form N 100A, Rev , Application for Additional Extension of Time to File Hawaii Return for a Partnership, Trust, or REMIC Forms

What is the Form N-100A?

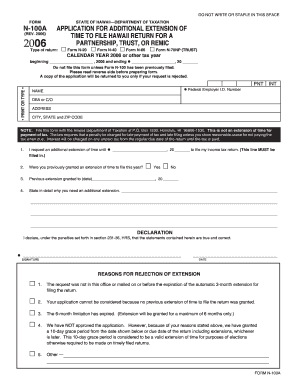

The Form N-100A, also known as the Application for Additional Extension of Time to File Hawaii Return for a Partnership, Trust, or REMIC, is a crucial document for partnerships, trusts, and Real Estate Mortgage Investment Conduits (REMICs) operating in Hawaii. This form allows entities to request an extension of time to file their Hawaii tax returns, ensuring compliance with state tax regulations. It is specifically designed for those who may need additional time beyond the standard filing deadlines.

How to Use the Form N-100A

Using the Form N-100A involves a few straightforward steps. First, ensure that you have the correct version of the form, as revisions may occur. Next, fill out the required information accurately, including details about the entity requesting the extension. After completing the form, submit it to the appropriate state tax authority by the designated deadline. This form is essential for maintaining good standing and avoiding potential penalties associated with late filings.

Steps to Complete the Form N-100A

Completing the Form N-100A requires careful attention to detail. Begin by entering the entity's name, address, and tax identification number. Next, indicate the type of entity—whether it is a partnership, trust, or REMIC. Provide the original due date of the tax return and the requested extension period. Finally, review all entries for accuracy before signing and dating the form. Ensuring that all information is correct can help prevent delays in processing your request.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines associated with the Form N-100A. Generally, the form must be submitted before the original due date of the tax return for which an extension is being requested. Keep in mind that extensions granted through this form do not extend the time for payment of taxes due. Therefore, it is advisable to estimate and pay any taxes owed by the original due date to avoid penalties and interest.

Legal Use of the Form N-100A

The Form N-100A is legally recognized as a valid request for an extension of time to file Hawaii tax returns for eligible entities. It is important to use this form correctly to ensure compliance with Hawaii tax laws. Failure to submit the form on time or providing inaccurate information may result in penalties or denial of the extension request. Therefore, understanding the legal implications and requirements of this form is essential for all partnerships, trusts, and REMICs operating in Hawaii.

Required Documents

When submitting the Form N-100A, certain documents may be required to support your application. Typically, you will need to provide a copy of the original tax return or a draft if it is not yet completed. Additionally, any documentation that verifies the entity's tax identification number and other relevant information may be necessary. Ensuring that all required documents are included can facilitate a smoother processing of your extension request.

Quick guide on how to complete form n 100a rev application for additional extension of time to file hawaii return for a partnership trust or remic forms

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your paperwork quickly and without complications. Handle [SKS] across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Modify and eSign [SKS] Seamlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents to highlight or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms

Create this form in 5 minutes!

How to create an eSignature for the form n 100a rev application for additional extension of time to file hawaii return for a partnership trust or remic forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms?

Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms is a document used by partnerships, trusts, or REMICs to request an extension for filing their Hawaii tax returns. This form allows entities to ensure compliance with state tax regulations while providing additional time to prepare their returns accurately.

-

How can airSlate SignNow help with Form N 100A, Rev?

airSlate SignNow streamlines the process of completing and submitting Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms. Our platform allows users to easily fill out the form, eSign it, and send it securely, ensuring a hassle-free experience.

-

What are the pricing options for using airSlate SignNow for Form N 100A, Rev?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when handling Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms. Our plans are designed to be cost-effective, ensuring that you get the best value for your document management and eSigning needs.

-

Is airSlate SignNow compliant with Hawaii state regulations for Form N 100A, Rev?

Yes, airSlate SignNow is fully compliant with Hawaii state regulations regarding Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms. Our platform adheres to all legal requirements, ensuring that your documents are processed securely and in accordance with state laws.

-

What features does airSlate SignNow offer for managing Form N 100A, Rev?

airSlate SignNow provides a range of features for managing Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms, including customizable templates, secure eSigning, and document tracking. These features enhance efficiency and ensure that your forms are completed and submitted on time.

-

Can I integrate airSlate SignNow with other software for Form N 100A, Rev?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms alongside your existing tools. This integration capability enhances workflow efficiency and simplifies document management.

-

What are the benefits of using airSlate SignNow for Form N 100A, Rev?

Using airSlate SignNow for Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring compliance with tax regulations.

Get more for Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms

- Part 1201 mspb practice ampamp procedure form

- Division of workers compensation central office form

- Filing a lawsuit washington state department of labor form

- Get and sign ps form 3602 r fill out and sign printable

- Itemized statement of charges for travel north carolina form

- Withholding certificate for pension or annuity payments edd form

- Oshas form 300 log of work related injuries and illnesses

- The above named employee claims additional medical compensation as a result of an injury by accident or an form

Find out other Form N 100A, Rev , Application For Additional Extension Of Time To File Hawaii Return For A Partnership, Trust, Or REMIC Forms

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online