Fixed Term Deposit for Existing CustomersThe Co Operative Bank Form

Understanding Fixed Term Deposit for Existing Customers at The Co-operative Bank

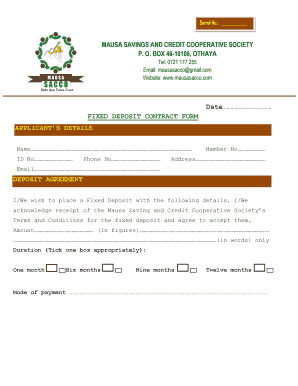

A Fixed Term Deposit is a financial product offered by The Co-operative Bank that allows existing customers to invest their money for a predetermined period at a fixed interest rate. This type of deposit is designed to provide a safe and secure way to grow savings while ensuring that funds are not accessible until the maturity date. Customers can choose from various terms, typically ranging from a few months to several years, depending on their financial goals and needs.

Utilizing the Fixed Term Deposit for Existing Customers

To make the most of a Fixed Term Deposit, existing customers should assess their financial situation and determine how much they can afford to set aside for the duration of the term. It is important to consider factors such as upcoming expenses, interest rates, and personal savings goals. Once a decision is made, customers can proceed to open a deposit account through The Co-operative Bank's online platform or by visiting a local branch.

Steps to Complete the Fixed Term Deposit Application

Completing the application for a Fixed Term Deposit involves several straightforward steps:

- Log in to your online banking account or visit a local branch.

- Select the Fixed Term Deposit option from the available products.

- Choose the desired term length and deposit amount.

- Review the terms and conditions, including interest rates and penalties for early withdrawal.

- Submit the application, providing any necessary identification and account information.

Key Elements of the Fixed Term Deposit

When considering a Fixed Term Deposit, customers should be aware of several key elements:

- Interest Rates: Rates are typically fixed for the duration of the term, providing certainty in returns.

- Maturity Date: Funds are locked in until the end of the term, which can range from one month to several years.

- Minimum Deposit: There may be a minimum amount required to open a Fixed Term Deposit account.

- Early Withdrawal Penalties: Withdrawing funds before the maturity date may incur penalties, reducing overall returns.

Eligibility Criteria for Fixed Term Deposit

To qualify for a Fixed Term Deposit at The Co-operative Bank, customers must meet specific eligibility criteria. Generally, applicants should:

- Be an existing customer of The Co-operative Bank.

- Have a valid identification document.

- Meet any minimum deposit requirements set by the bank.

- Be of legal age to enter into a financial contract.

Application Process and Approval Time

The application process for a Fixed Term Deposit is typically efficient. Once the application is submitted, customers can expect the following timeline:

- Immediate confirmation of application receipt via email or in-person acknowledgment.

- Approval usually occurs within one to two business days, depending on the bank's processing times.

- Funds are deposited into the Fixed Term Deposit account upon approval, and customers will receive a confirmation of the deposit.

Quick guide on how to complete fixed term deposit for existing customersthe co operative bank

Effortlessly Prepare Fixed Term Deposit For Existing CustomersThe Co operative Bank on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fixed Term Deposit For Existing CustomersThe Co operative Bank on any device using the airSlate SignNow applications for Android or iOS, and elevate any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Fixed Term Deposit For Existing CustomersThe Co operative Bank With Minimal Effort

- Locate Fixed Term Deposit For Existing CustomersThe Co operative Bank and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Select important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Fixed Term Deposit For Existing CustomersThe Co operative Bank and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fixed term deposit for existing customersthe co operative bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Fixed Term Deposit For Existing CustomersThe Co operative Bank?

A Fixed Term Deposit For Existing CustomersThe Co operative Bank is a savings product that allows existing customers to deposit funds for a fixed period at a predetermined interest rate. This option provides a secure way to grow your savings while ensuring that your funds are not accessible until the term ends.

-

What are the interest rates for Fixed Term Deposit For Existing CustomersThe Co operative Bank?

Interest rates for the Fixed Term Deposit For Existing CustomersThe Co operative Bank vary based on the term length and the amount deposited. Typically, longer terms offer higher interest rates, allowing you to maximize your returns on savings.

-

How can I open a Fixed Term Deposit For Existing CustomersThe Co operative Bank?

To open a Fixed Term Deposit For Existing CustomersThe Co operative Bank, existing customers can visit their nearest branch or use the online banking platform. The process is straightforward and requires minimal documentation, making it easy to start saving.

-

What are the benefits of a Fixed Term Deposit For Existing CustomersThe Co operative Bank?

The benefits of a Fixed Term Deposit For Existing CustomersThe Co operative Bank include guaranteed returns, security of your principal amount, and the ability to plan your finances effectively. This product is ideal for customers looking to save for specific goals without the risk of market fluctuations.

-

Can I withdraw my funds before the maturity date of my Fixed Term Deposit For Existing CustomersThe Co operative Bank?

Withdrawals before the maturity date of a Fixed Term Deposit For Existing CustomersThe Co operative Bank may incur penalties or reduced interest rates. It is advisable to consider your financial needs carefully before committing to a fixed term.

-

Are there any fees associated with the Fixed Term Deposit For Existing CustomersThe Co operative Bank?

Generally, there are no fees to open a Fixed Term Deposit For Existing CustomersThe Co operative Bank. However, early withdrawal penalties may apply, so it's important to review the terms and conditions before proceeding.

-

How does the Fixed Term Deposit For Existing CustomersThe Co operative Bank compare to other savings options?

The Fixed Term Deposit For Existing CustomersThe Co operative Bank typically offers higher interest rates compared to regular savings accounts, making it a more attractive option for those looking to grow their savings securely. Unlike other investment options, it provides guaranteed returns without market risk.

Get more for Fixed Term Deposit For Existing CustomersThe Co operative Bank

Find out other Fixed Term Deposit For Existing CustomersThe Co operative Bank

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document