M 941 Form 2018

What is the M-941 Form

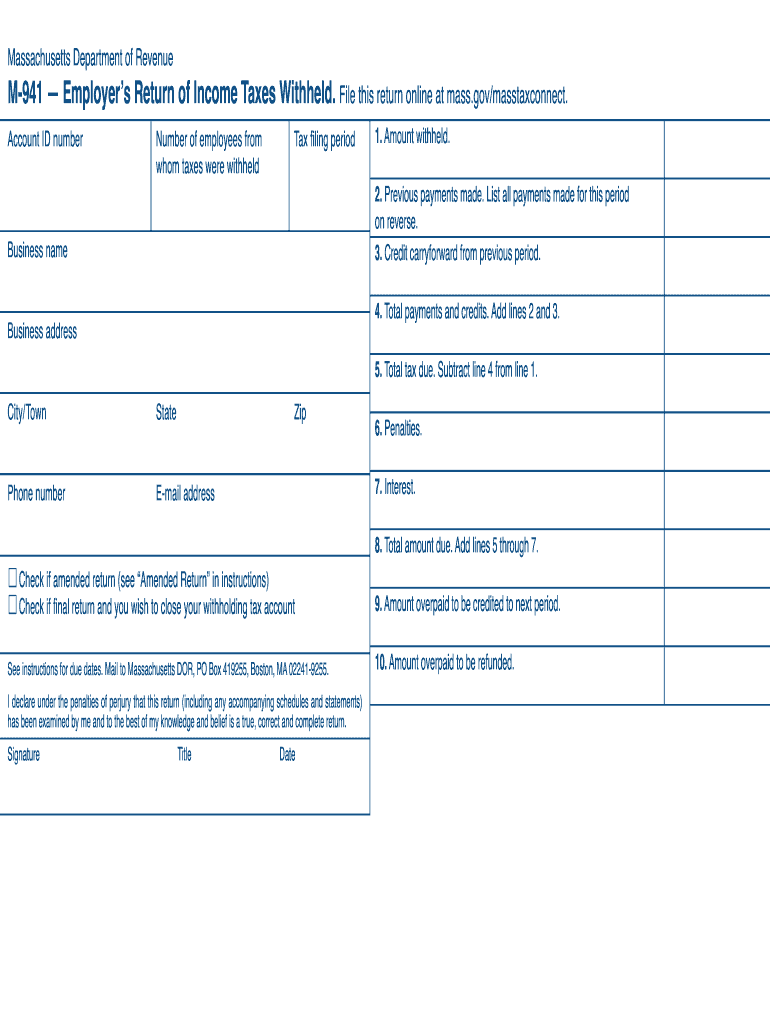

The M-941 form, also known as the Massachusetts Employer's Quarterly Return, is a crucial document for employers in Massachusetts. This form is used to report income tax withheld from employees' wages, along with unemployment insurance contributions. It is essential for maintaining compliance with both state and federal tax regulations. The M-941 form captures important data regarding the employer's payroll activities and ensures that the appropriate taxes are remitted to the Massachusetts Department of Revenue.

Steps to Complete the M-941 Form

Completing the M-941 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including total wages paid, the amount of income tax withheld, and unemployment insurance contributions. Next, accurately fill out each section of the form, ensuring that all figures are correct. After completing the form, review it for any errors before signing and dating it. Finally, submit the form by the due date to avoid penalties. Utilizing a digital platform can streamline this process, allowing for easy completion and submission.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the M-941 form. The form is due on the last day of the month following the end of each quarter. For example, the due dates are January 31 for the fourth quarter, April 30 for the first quarter, July 31 for the second quarter, and October 31 for the third quarter. It is crucial to meet these deadlines to avoid late fees and potential penalties. Marking these dates on your calendar can help ensure timely submission.

Legal Use of the M-941 Form

The M-941 form must be used in accordance with Massachusetts state laws and IRS guidelines. Employers are legally required to report accurate withholding amounts and unemployment contributions. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. Additionally, maintaining proper records of submitted forms is essential for legal compliance and potential audits. Employers should familiarize themselves with the legal obligations associated with the M-941 to ensure adherence to all requirements.

Form Submission Methods

The M-941 form can be submitted through various methods, including online submission, mail, or in-person delivery. Online submission is often the most efficient option, allowing for immediate processing and confirmation. For those opting to submit by mail, it is advisable to use certified mail to ensure delivery and maintain a record. In-person submissions can be made at designated offices of the Massachusetts Department of Revenue. Each method has its advantages, and employers should choose the one that best fits their needs.

Key Elements of the M-941 Form

The M-941 form consists of several key elements that employers must complete accurately. These include the employer's identification information, total wages paid, amount of income tax withheld, and unemployment contributions. Additionally, the form requires the employer's signature and date to validate the information provided. Each element plays a vital role in ensuring that the form meets state and federal requirements, making it essential for employers to pay close attention to detail when completing the form.

Quick guide on how to complete m 941 massachusetts 2018 2019 form

Your assistance manual on how to prepare your M 941 Form

If you’re wondering how to create and submit your M 941 Form, here are a few simple pointers on how to make tax filing less challenging.

To start, you just need to set up your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is a user-friendly and powerful document solution that allows you to modify, draft, and complete your income tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and return to amend responses as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your M 941 Form in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your M 941 Form in our editor.

- Complete the necessary fillable fields with your details (text, figures, check marks).

- Use the Signature Tool to include your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in hard copy can lead to more return errors and delayed refunds. Naturally, before e-filing your taxes, check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct m 941 massachusetts 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the m 941 massachusetts 2018 2019 form

How to make an electronic signature for the M 941 Massachusetts 2018 2019 Form online

How to generate an eSignature for the M 941 Massachusetts 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the M 941 Massachusetts 2018 2019 Form in Gmail

How to create an eSignature for the M 941 Massachusetts 2018 2019 Form straight from your smart phone

How to make an electronic signature for the M 941 Massachusetts 2018 2019 Form on iOS devices

How to generate an eSignature for the M 941 Massachusetts 2018 2019 Form on Android OS

People also ask

-

What is 941 income and how does it relate to airSlate SignNow?

941 income refers to the earnings reported on IRS Form 941, used by employers to report income taxes withheld from employee paychecks. airSlate SignNow enables businesses to efficiently manage the electronic signatures and submissions of documents related to 941 income. With our solution, you can streamline the process of filing tax forms and ensure timely compliance.

-

How does airSlate SignNow help with filing 941 income forms?

airSlate SignNow simplifies the filing of 941 income forms by providing an intuitive platform for signing and sharing documents. Users can easily create, edit, and eSign IRS forms from any device, ensuring that all necessary paperwork is completed and submitted accurately and on time. Our secure features protect sensitive tax information during this critical process.

-

What are the pricing plans for using airSlate SignNow for 941 income documentation?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses managing 941 income documentation. We provide options that cater to individual users and larger teams, with features designed to facilitate seamless eSigning and document management. Sign up for a free trial to explore these plans before committing.

-

Can I integrate airSlate SignNow with my accounting software for 941 income management?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions that can help manage 941 income. This integration allows for an efficient flow of information, ensuring that all financial data is harmonized and easily accessible when preparing your tax documents. Check our integrations page for a complete list.

-

What features does airSlate SignNow offer for handling 941 income documents?

airSlate SignNow offers a variety of features specifically designed for handling 941 income documents. These include customizable templates, in-app document editing, and secure cloud storage options. Our platform also ensures compliance with eSignature laws, making your filing process smooth and reliable.

-

How can airSlate SignNow improve the efficiency of processing 941 income forms?

By using airSlate SignNow, businesses can signNowly enhance the efficiency of processing 941 income forms. The user-friendly interface allows for quick creation and signing of documents, reducing the time traditionally spent on paperwork. Automated reminders and notifications also ensure deadlines are met without the hassle.

-

Is airSlate SignNow suitable for small businesses dealing with 941 income?

Absolutely! airSlate SignNow is an ideal solution for small businesses managing 941 income. Our cost-effective plans and easy-to-use interface enable even the smallest teams to handle their tax documentation efficiently without extensive training or upfront costs.

Get more for M 941 Form

- Change of beneficiary american general life companies form

- Centralized employee registry reporting form 100092101

- Ns umsatz brutto2006 form

- Malaysia bank form

- Oklahoma state medical association observership program form

- Achieving anonymity via clustering gagan aggarwal1 google inc theory stanford form

- Managers contract template form

- Mandate contract template form

Find out other M 941 Form

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure