Dor Mo GovformsMO 941MO 941 Employer's Return of Income Taxes Withheld 2020-2026

Understanding the M 941 Employer's Return of Income Taxes Withheld

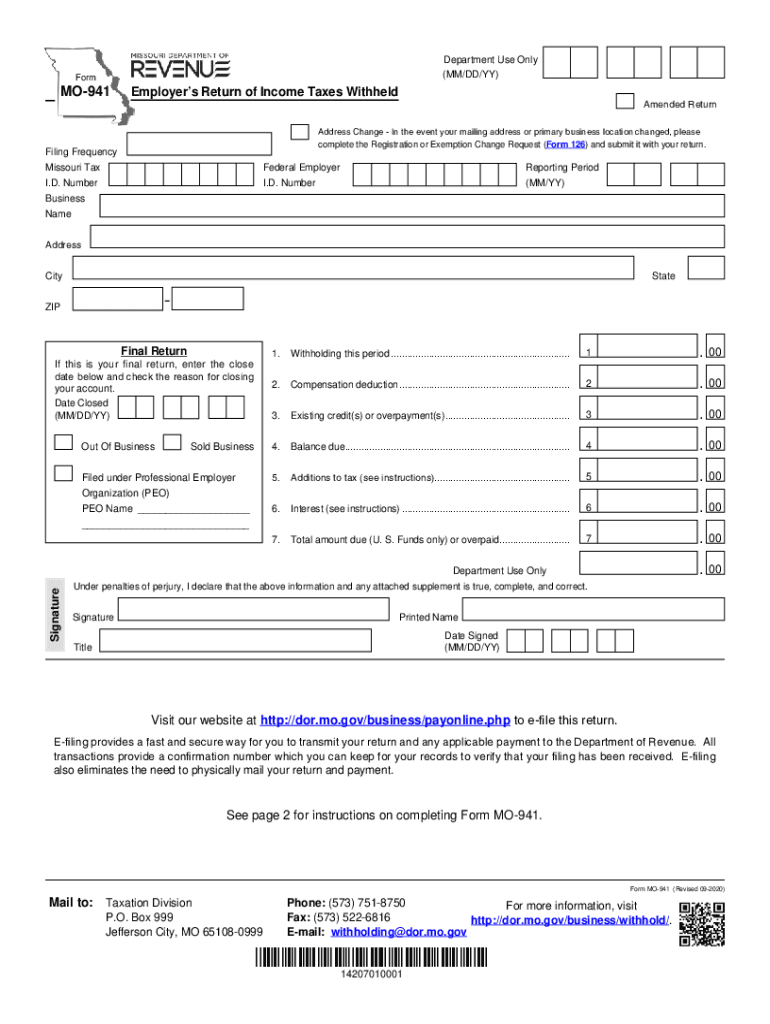

The M 941 form, officially known as the Employer's Return of Income Taxes Withheld, is a vital document for employers in the United States. This form is used to report income taxes that have been withheld from employees' wages. It is essential for ensuring compliance with federal and state tax regulations. Employers must accurately complete this form to reflect the correct amount of taxes withheld, as it directly impacts their tax liabilities and the employees' tax obligations.

Steps to Complete the M 941 Form

Completing the M 941 form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Employee Information: Collect details such as names, Social Security numbers, and wages paid during the reporting period.

- Calculate Withheld Taxes: Determine the total amount of federal income tax withheld from each employee's paycheck.

- Fill Out the Form: Enter the gathered information into the appropriate sections of the M 941 form, ensuring all figures are accurate.

- Review for Accuracy: Double-check all entries for errors or omissions before submission.

- Submit the Form: File the completed form by the designated deadline, either online or by mail.

Filing Deadlines for the M 941 Form

It is crucial for employers to be aware of the filing deadlines for the M 941 form to avoid penalties. The form must be filed quarterly, with specific due dates:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Legal Use of the M 941 Form

The M 941 form serves as a legal document that employers must submit to report withheld income taxes. It is essential for maintaining compliance with tax laws. Failure to file this form or inaccuracies in reporting can lead to significant penalties, including fines and interest on unpaid taxes. Employers should ensure that they understand the legal implications of this form and maintain accurate records to support their filings.

Penalties for Non-Compliance

Employers who fail to file the M 941 form on time or provide inaccurate information may face various penalties. These can include:

- Late Filing Penalties: A percentage of the unpaid tax may be assessed for each month the form is late.

- Accuracy-Related Penalties: If the IRS determines that the form contains substantial errors, additional fines may apply.

- Interest on Unpaid Taxes: Interest accrues on any unpaid taxes from the due date until paid in full.

Digital vs. Paper Version of the M 941 Form

Employers have the option to file the M 941 form either digitally or on paper. The digital version offers several advantages:

- Faster Processing: Electronic submissions are typically processed more quickly than paper forms.

- Immediate Confirmation: Filers receive instant confirmation of submission, providing peace of mind.

- Reduced Errors: Digital forms often include prompts and checks to minimize common mistakes.

Quick guide on how to complete dormogovformsmo 941mo 941 employers return of income taxes withheld

Effortlessly prepare Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to modify and eSign Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld with ease

- Obtain Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors requiring additional printed copies. airSlate SignNow addresses your needs in document management with just a few clicks from your preferred device. Modify and eSign Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dormogovformsmo 941mo 941 employers return of income taxes withheld

Create this form in 5 minutes!

How to create an eSignature for the dormogovformsmo 941mo 941 employers return of income taxes withheld

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an m 941 form and how does airSlate SignNow help with it?

The m 941 form is a crucial document for employers to report quarterly federal income taxes withheld and FICA taxes. airSlate SignNow simplifies the eSigning and sharing process for the m 941 form, ensuring that businesses can quickly gather signatures and submit their forms on time.

-

What features does airSlate SignNow offer for managing m 941 forms?

airSlate SignNow offers features that enhance the management of m 941 forms such as templates, automated workflows, and detailed tracking. These features ensure that your m 941 forms are processed efficiently, saving time and reducing errors in the submission.

-

How does pricing for airSlate SignNow compare when handling m 941 forms?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes, making it cost-effective for managing m 941 forms. Plans start at a competitive rate and increase based on features needed, ensuring you can find an option that fits your budget while effectively managing your m 941 submissions.

-

Can I integrate airSlate SignNow with other tools while handling m 941 forms?

Yes, airSlate SignNow integrates seamlessly with a variety of tools and applications including CRM and accounting software. This integration support enables easy management of m 941 forms within your existing workflows, contributing to overall efficiency.

-

What are the benefits of using airSlate SignNow for m 941 forms?

By using airSlate SignNow for m 941 forms, businesses benefit from enhanced security, quicker turnaround times, and a user-friendly interface. These advantages ensure that your m 941 forms are processed accurately and promptly, reducing stress during tax season.

-

Is airSlate SignNow suitable for all business sizes for m 941 form handling?

Absolutely! airSlate SignNow is designed to be scalable, making it suitable for businesses of any size needing to manage m 941 forms. Whether you are a small business or a large enterprise, the solution can adapt to your specific needs.

-

How secure is airSlate SignNow when dealing with m 941 forms?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and complies with industry standards to protect sensitive information, including that contained in m 941 forms, ensuring that your data remains safe and confidential.

Get more for Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld

- Living trust for husband and wife with no children new jersey form

- New jersey trust 497319400 form

- New jersey trust 497319401 form

- Living trust for husband and wife with one child new jersey form

- Living trust for husband and wife with minor and or adult children new jersey form

- Amendment to living trust new jersey form

- Living trust property record new jersey form

- Financial account transfer to living trust new jersey form

Find out other Dor mo govformsMO 941MO 941 Employer's Return Of Income Taxes Withheld

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF