Estate Excise Tax Affidavit Form 2022

What is the Washington Real Estate Excise Tax Affidavit Form

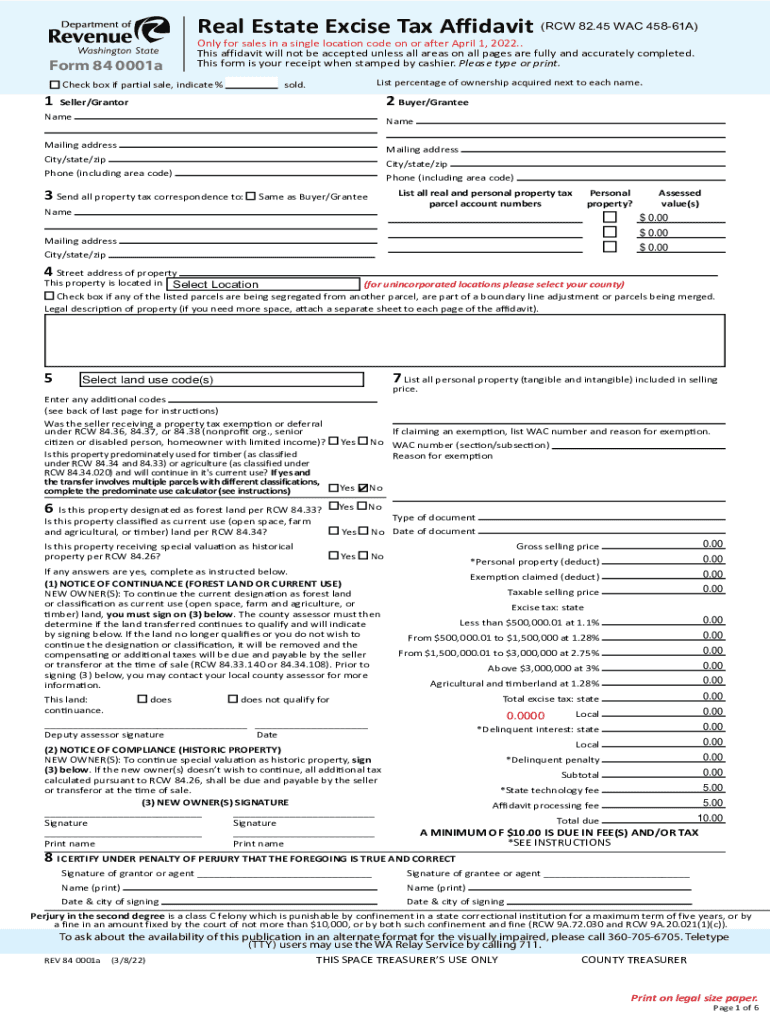

The Washington real estate excise tax affidavit form is a document required for the sale of real property in the state of Washington. This form serves to report the sale and calculate the excise tax owed on the transaction. The excise tax is a percentage of the selling price and is typically paid by the seller at the time of sale. The affidavit includes essential details such as the names of the parties involved, the property address, and the sale price. Proper completion of this form is crucial for compliance with state tax regulations.

Steps to Complete the Washington Real Estate Excise Tax Affidavit Form

Completing the Washington real estate excise tax affidavit form involves several important steps:

- Gather necessary information, including the property address, sale price, and details of the buyer and seller.

- Obtain the correct version of the form, which can be found through state resources or local government offices.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate county office along with any required payment for the excise tax.

Legal Use of the Washington Real Estate Excise Tax Affidavit Form

The Washington real estate excise tax affidavit form is legally binding once it is duly completed and submitted. It is essential for documenting the sale of real property and ensuring compliance with state tax laws. Failure to file the affidavit can result in penalties, including fines and interest on unpaid taxes. The form must be signed by both the buyer and seller, confirming the accuracy of the information provided. Additionally, the form serves as a record for future reference in case of audits or disputes.

Required Documents for the Washington Real Estate Excise Tax Affidavit Form

When completing the Washington real estate excise tax affidavit form, several documents may be required to support the information provided:

- Proof of identity for both the buyer and seller, such as a driver's license or passport.

- A copy of the purchase and sale agreement detailing the terms of the transaction.

- Any prior tax statements or assessments related to the property.

- Documentation of any exemptions or deductions that may apply to the transaction.

Form Submission Methods for the Washington Real Estate Excise Tax Affidavit Form

The Washington real estate excise tax affidavit form can be submitted through various methods to accommodate different preferences:

- Online Submission: Many counties in Washington offer online portals for submitting the affidavit electronically.

- Mail: The completed form can be mailed to the appropriate county office, along with any required payments.

- In-Person: Individuals may choose to submit the form in person at their local county office, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance with the Washington Real Estate Excise Tax Affidavit Form

Non-compliance with the filing requirements of the Washington real estate excise tax affidavit form can lead to significant penalties. These may include:

- Fines for late submission of the affidavit.

- Interest on unpaid excise taxes, which can accumulate over time.

- Potential legal action for failure to comply with state tax regulations.

Quick guide on how to complete estate excise tax affidavit form

Prepare Estate Excise Tax Affidavit Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Estate Excise Tax Affidavit Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Estate Excise Tax Affidavit Form with ease

- Locate Estate Excise Tax Affidavit Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Estate Excise Tax Affidavit Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct estate excise tax affidavit form

Create this form in 5 minutes!

People also ask

-

What is the Washington real estate excise tax?

The Washington real estate excise tax is a tax imposed on the sale of real estate properties in Washington State. It is typically calculated based on the selling price of the property, impacting both buyers and sellers. Understanding this tax is crucial when engaging in real estate transactions in Washington.

-

How does the Washington real estate excise tax affect property sales?

The Washington real estate excise tax directly impacts the net proceeds from property sales. Sellers must consider this tax when pricing their properties, as it can affect potential buyers’ willingness to purchase. Being informed about the excise tax helps all parties make better financial decisions during a sale.

-

What percentage is the Washington real estate excise tax?

The Washington real estate excise tax rate is generally 1.28% for the first $500,000 of the sale price, with incremental increases on higher amounts. Recent legislation may affect these rates, so it's important to check current rates when planning a transaction. Calculating this tax accurately can save sellers and buyers from unexpected costs.

-

How can I calculate my Washington real estate excise tax?

To calculate the Washington real estate excise tax, multiply the sale price of the property by the applicable tax rate. For more complicated transactions or higher sale prices, it may be wise to consult with a tax professional. Accurate calculations help ensure compliance and avoid penalties.

-

Are there exemptions for the Washington real estate excise tax?

Certain exemptions exist for the Washington real estate excise tax, particularly for specific types of transactions, such as transfers between family members or for certain schools and government entities. It's crucial to review these exemptions to determine eligibility. Understanding these can lead to signNow savings during real estate transactions.

-

How can airSlate SignNow help with handling Washington real estate excise tax documents?

airSlate SignNow streamlines the process of preparing and signing documents related to the Washington real estate excise tax. Our easy-to-use platform ensures that all necessary tax forms are completed accurately and efficiently. This eliminates errors and minimizes the time spent on paperwork.

-

What payment options are available for airSlate SignNow related to Washington real estate excise tax services?

airSlate SignNow offers a variety of payment options, making it easy to access our platform for handling Washington real estate excise tax documents. Customers can choose from monthly subscriptions or pay-per-use plans that fit their needs. This flexibility ensures you can manage your documents without breaking your budget.

Get more for Estate Excise Tax Affidavit Form

- Solved assignment below is a sample of a software licensing form

- Investment letterintrastate offering form

- Notice to lessor of decision not to exercise option to purchase form

- Notice to lessorexercise of option to purchase form

- Agreement by lessor to assign lease agreementus legal forms

- Pwcsaomnibus deed 00782889 2docx prince william form

- As a novice salesperson to the sales team i wanted to thank you for your time form

- Checklist of matters to be considered in drafting a lease of a commercial building form

Find out other Estate Excise Tax Affidavit Form

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe