FL 196 Income Withholding for Support Instructions 2024-2026

Understanding the FL 196 Income Withholding for Support

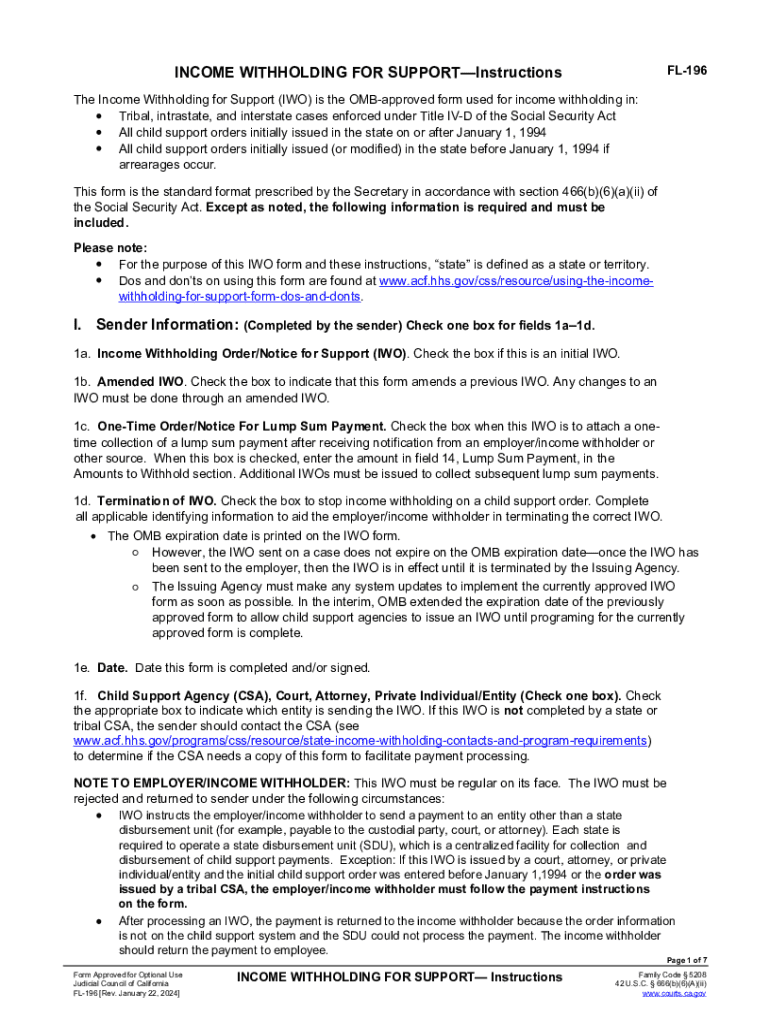

The FL 196 form, also known as the Income Withholding for Support form, is a legal document used in California to facilitate the collection of child support or spousal support payments directly from an employee's wages. This form is crucial for ensuring that support payments are made consistently and on time. It is typically issued by the court or a child support agency and is used to notify the employer of the withholding obligation.

Steps to Complete the FL 196 Income Withholding for Support

Completing the FL 196 form involves several key steps to ensure accuracy and compliance. First, the individual responsible for support must fill out their personal information, including their name, address, and Social Security number. Next, the form requires details about the recipient of the support payments, including their name and address. The individual must also provide information regarding the amount to be withheld from their paycheck. Finally, the form must be signed and dated before submission to the employer.

Obtaining the FL 196 Income Withholding for Support

The FL 196 form can be obtained from various sources. It is available through the California Department of Child Support Services website, where users can download a PDF version of the form. Additionally, local child support agencies may provide physical copies of the form. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Legal Use of the FL 196 Income Withholding for Support

The FL 196 form is legally binding and must be used in accordance with California state laws regarding child and spousal support. Employers are required to comply with the withholding instructions provided in the form. Failure to do so can result in legal penalties for the employer, including fines. It is essential for both the payer and the recipient to understand their rights and obligations under this form to ensure proper enforcement of support payments.

Examples of Using the FL 196 Income Withholding for Support

Practical examples of using the FL 196 form can help clarify its application. For instance, if an individual is ordered to pay child support, the court may issue the FL 196 to their employer, instructing them to withhold a specific amount from each paycheck. This ensures that the child support payments are made directly to the custodial parent without the payer needing to manage the payments manually. Another example could involve spousal support, where the same process applies to ensure timely payments.

Filing Deadlines and Important Dates for the FL 196

When dealing with the FL 196 form, it is crucial to be aware of filing deadlines and important dates. Typically, the form should be submitted to the employer as soon as a support order is issued. Employers are generally required to start withholding payments within a specific timeframe after receiving the FL 196. It is advisable to check with local child support agencies for exact deadlines to ensure compliance and avoid any disruptions in support payments.

Quick guide on how to complete fl 196 income withholding for support instructions

Prepare FL 196 Income Withholding For Support Instructions effortlessly on any device

Digital document management has gained traction with both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage FL 196 Income Withholding For Support Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign FL 196 Income Withholding For Support Instructions without stress

- Locate FL 196 Income Withholding For Support Instructions and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive content with tools that airSlate SignNow provides specifically for that reason.

- Create your eSignature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you prefer to distribute your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing fresh document copies. airSlate SignNow manages all your document administration needs in just a few clicks from a device of your preference. Modify and eSign FL 196 Income Withholding For Support Instructions and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fl 196 income withholding for support instructions

Create this form in 5 minutes!

How to create an eSignature for the fl 196 income withholding for support instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is fl 196 and how does it relate to airSlate SignNow?

FL 196 is a specific form used in various business processes. With airSlate SignNow, you can easily fill out and eSign FL 196 documents, streamlining your workflow and ensuring compliance with legal standards.

-

How much does airSlate SignNow cost for using FL 196?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can choose a plan that fits your budget while efficiently managing FL 196 documents and other essential paperwork.

-

What features does airSlate SignNow provide for FL 196 document management?

airSlate SignNow includes features like customizable templates, secure eSigning, and real-time tracking for FL 196 documents. These tools enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for FL 196 processing?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage FL 196 documents alongside your existing tools. This integration capability enhances your overall workflow and efficiency.

-

What are the benefits of using airSlate SignNow for FL 196?

Using airSlate SignNow for FL 196 provides numerous benefits, including faster document turnaround times, reduced paper usage, and improved accuracy. This solution helps businesses save time and resources while ensuring compliance.

-

Is airSlate SignNow secure for handling FL 196 documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your FL 196 documents. With encryption and secure storage, you can trust that your sensitive information is safe.

-

How can I get started with airSlate SignNow for FL 196?

Getting started with airSlate SignNow for FL 196 is simple. You can sign up for a free trial, explore the features, and begin creating and eSigning your FL 196 documents in no time.

Get more for FL 196 Income Withholding For Support Instructions

- First report of injury form for ri

- Designation of beneficiary form 105 public school teachers ctpf

- Teejay maths book 3a pdf form

- Fullerton college request transcripts form

- Gid 37 c doc gainsurance form

- Wake county inspections permits 336 fayetteville form

- Wake county building inspections workers comp affidavit form

- Supplier buyer agreement template form

Find out other FL 196 Income Withholding For Support Instructions

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF