Ca Income Withholding 2020

What is the California Income Withholding Form?

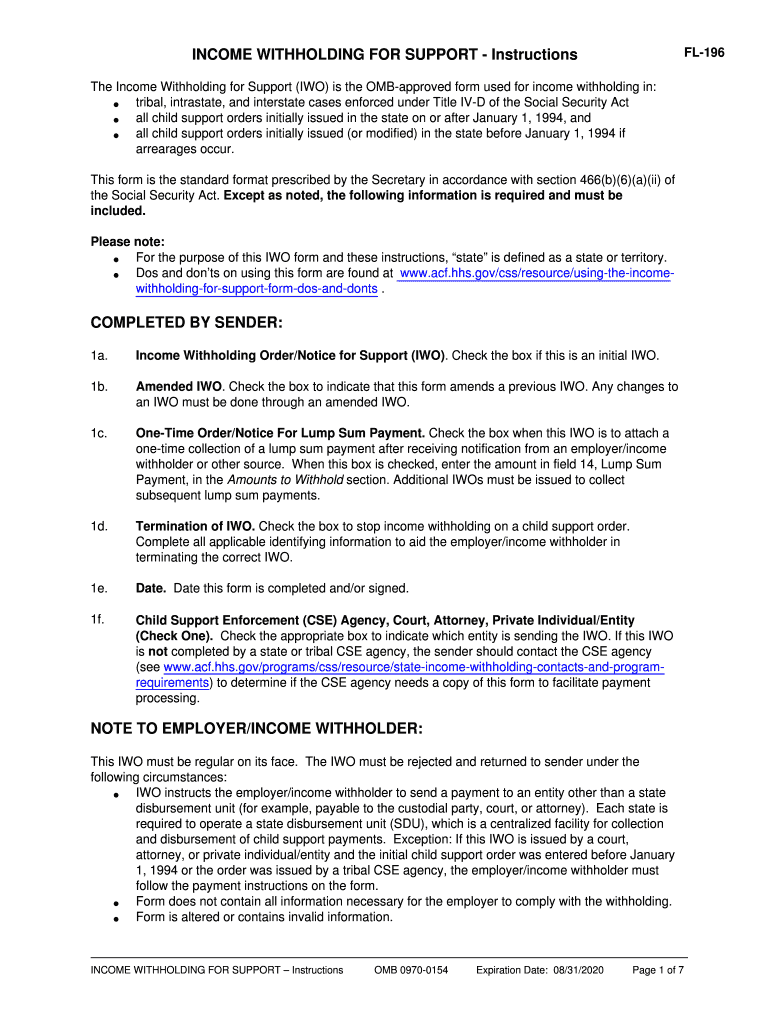

The California income withholding form, often referred to as the FL-196, is a legal document used to direct an employer to withhold a specific amount of an employee's wages for child support or spousal support. This form is essential for ensuring that financial obligations are met in a timely manner, particularly in cases of divorce or separation. It provides clear instructions on how much should be withheld and outlines the responsibilities of both the employer and the employee.

Steps to Complete the California Income Withholding Form

Completing the California income withholding form involves several key steps:

- Gather necessary information, including the employee's personal details and the amount to be withheld.

- Fill out the FL-196 accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the employer, who is responsible for processing the withholding.

It is important to ensure that all information is current and accurate to avoid delays in processing.

Legal Use of the California Income Withholding Form

The California income withholding form is legally binding when completed correctly. It complies with state laws regarding child and spousal support, ensuring that the withholding amount is enforced by the employer. Both the employer and the employee must adhere to the stipulations outlined in the form. Failure to comply with the withholding instructions can result in legal penalties for the employer.

Key Elements of the California Income Withholding Form

Several key elements must be included in the California income withholding form to ensure its validity:

- Employee Information: Full name, address, and Social Security number.

- Withholding Amount: The specific dollar amount or percentage to be withheld from wages.

- Employer Information: Name and address of the employer responsible for the withholding.

- Signature: The form must be signed by the appropriate parties to validate the instructions.

Form Submission Methods

The California income withholding form can be submitted through various methods, ensuring flexibility for both employers and employees. The options include:

- Online Submission: Many employers have systems in place for electronic submission of withholding forms.

- Mail: The completed form can be mailed directly to the employer's payroll department.

- In-Person: Employees may also choose to deliver the form in person to ensure it is received.

Who Issues the California Income Withholding Form?

The California income withholding form is typically issued by the court or the local child support agency. It is important for individuals to obtain the form from an official source to ensure it meets all legal requirements. This helps to avoid any complications during the withholding process.

Quick guide on how to complete ca income withholding

Complete Ca Income Withholding effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Handle Ca Income Withholding on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Ca Income Withholding smoothly

- Locate Ca Income Withholding and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Edit and eSign Ca Income Withholding and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ca income withholding

Create this form in 5 minutes!

How to create an eSignature for the ca income withholding

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the California income withholding form and why is it important?

The California income withholding form is a critical document used by employers to withhold state income taxes from employees' paychecks. It ensures compliance with state tax laws and helps employees avoid tax penalties. Properly managing this form can enhance payroll accuracy and simplify tax reporting.

-

How can airSlate SignNow help me manage my California income withholding form?

airSlate SignNow offers a streamlined platform that allows you to create, send, and eSign your California income withholding form quickly and efficiently. With its user-friendly interface, you can ensure that all necessary information is filled out correctly. This saves both time and reduces the risk of errors, so your payroll stays compliant.

-

Is there a cost associated with using airSlate SignNow for the California income withholding form?

Yes, airSlate SignNow provides a cost-effective solution for managing your California income withholding form. Our pricing plans are designed to meet the needs of businesses of all sizes, offering flexibility without sacrificing features. You can choose from various subscription options based on your organizational requirements, ensuring you get the best value.

-

Can I integrate airSlate SignNow with my current payroll software?

Absolutely! airSlate SignNow supports seamless integration with multiple payroll systems, making it easier to handle your California income withholding form. This integration allows for automatic data transfers, reducing manual entry errors and improving overall efficiency. Your team can enjoy a cohesive workflow, allowing them to focus on other critical tasks.

-

What security measures does airSlate SignNow implement for eSigning documents like the California income withholding form?

airSlate SignNow prioritizes user security by employing advanced encryption protocols and multi-factor authentication for all eSignatures. This ensures that your California income withholding form is safe from unauthorized access. Our commitment to security means you can confidently send and sign sensitive documents without worry.

-

How does using airSlate SignNow improve the signing process for the California income withholding form?

Using airSlate SignNow signNowly enhances the signing process for your California income withholding form by providing a quick, accessible platform. Users can eSign documents anytime, anywhere, using any device. This flexibility reduces turnaround times and accelerates the compliance process, ensuring you meet deadlines effortlessly.

-

What happens if I make a mistake on my California income withholding form?

If you make a mistake on your California income withholding form, airSlate SignNow allows you to quickly correct and resend the document for eSignature. Our system maintains a comprehensive audit trail, so you can track changes and ensure compliance. This feature minimizes errors and keeps your payroll processes smooth and efficient.

Get more for Ca Income Withholding

- Request for extension of time to earn eagle scout rank no 512 077 philmontscoutranch form

- Bcia 4084 form

- Prior authorization request form celticare health

- Planet fitness cancellation form pdf 432110405

- Pennzoil rebate form

- Prometheus order form pdf

- Artisan timesheet form

- Recorded at the request of and mail to form

Find out other Ca Income Withholding

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online