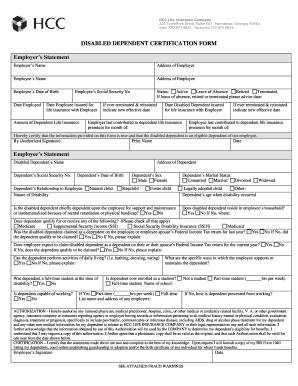

Disabled Dependent Certification Form

What is the Disabled Dependent Certification Form

The Disabled Dependent Certification Form is a document used primarily for tax and benefits purposes in the United States. This form certifies that an individual has a dependent who is disabled, allowing taxpayers to claim certain tax benefits or adjustments. It is essential for individuals who wish to receive deductions or credits related to the care of a disabled dependent, ensuring they meet eligibility criteria established by the Internal Revenue Service (IRS) and other relevant authorities.

How to use the Disabled Dependent Certification Form

To use the Disabled Dependent Certification Form effectively, individuals should first ensure they meet the necessary eligibility criteria for claiming a disabled dependent. After confirming eligibility, the form must be filled out accurately, providing required details about the dependent's disability status and any relevant medical documentation. Once completed, the form should be submitted alongside the taxpayer's annual return or to the appropriate agency as directed. Proper usage of this form can lead to significant tax benefits.

Steps to complete the Disabled Dependent Certification Form

Completing the Disabled Dependent Certification Form involves several key steps:

- Gather necessary documentation, including proof of the dependent's disability.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form along with your tax return or to the designated agency as required.

Taking these steps carefully can help facilitate a smooth certification process.

Legal use of the Disabled Dependent Certification Form

The Disabled Dependent Certification Form is legally recognized and must be used in accordance with IRS guidelines and state regulations. It serves as a formal declaration of a dependent's disability status, which can affect tax filings and eligibility for various benefits. Misuse of the form, such as providing false information, can lead to penalties or legal repercussions. Therefore, it is crucial to ensure that all information provided is truthful and substantiated by appropriate documentation.

Eligibility Criteria

To qualify for the benefits associated with the Disabled Dependent Certification Form, certain eligibility criteria must be met. The dependent must have a documented disability that significantly impairs their ability to perform daily activities. Additionally, the taxpayer must provide evidence of their relationship to the dependent, such as a birth certificate or legal guardianship documents. Understanding these criteria is vital for ensuring compliance and maximizing potential tax benefits.

Required Documents

When completing the Disabled Dependent Certification Form, several documents may be required to support the claim. These typically include:

- Medical records or a letter from a qualified healthcare provider confirming the disability.

- Proof of relationship to the dependent, such as a birth certificate or adoption papers.

- Any previous tax documents that may support the claim for deductions or credits.

Having these documents ready can streamline the certification process and help avoid delays.

Quick guide on how to complete disabled dependent certification form

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained popularity among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documentation, as you can access the necessary form and securely store it online. airSlate SignNow offers you all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

Edit and eSign [SKS] Seamlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Disabled Dependent Certification Form

Create this form in 5 minutes!

How to create an eSignature for the disabled dependent certification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Disabled Dependent Certification Form?

The Disabled Dependent Certification Form is a document used to signNow the eligibility of a dependent who has a disability. This form is essential for businesses and organizations to ensure compliance with various regulations and to provide necessary benefits to eligible dependents.

-

How can airSlate SignNow help with the Disabled Dependent Certification Form?

airSlate SignNow simplifies the process of managing the Disabled Dependent Certification Form by allowing users to create, send, and eSign documents securely. Our platform ensures that all necessary information is captured accurately, making it easier for businesses to handle dependent certifications efficiently.

-

Is there a cost associated with using the Disabled Dependent Certification Form on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for the Disabled Dependent Certification Form, but it is designed to be cost-effective. We offer various pricing plans that cater to different business needs, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for the Disabled Dependent Certification Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for the Disabled Dependent Certification Form. These features enhance the user experience and streamline the certification process, making it more efficient for businesses.

-

Can I integrate airSlate SignNow with other software for the Disabled Dependent Certification Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Disabled Dependent Certification Form alongside your existing tools. This integration capability enhances workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for the Disabled Dependent Certification Form?

Using airSlate SignNow for the Disabled Dependent Certification Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while simplifying the entire certification process.

-

How secure is the Disabled Dependent Certification Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The Disabled Dependent Certification Form is protected with advanced encryption and secure access controls, ensuring that sensitive information remains confidential and compliant with industry standards.

Get more for Disabled Dependent Certification Form

- Fillable online application for licensure as a clinical form

- Ameren income qualified programenergy stars heating form

- Illinois income qualified form

- Chairmans back to school 100 gift card for form

- America against america by wang huning the unz review form

- Ks fa form

- Foreign for profit corporation application i form

- Tate of orth carolina office of state human resources 1331 form

Find out other Disabled Dependent Certification Form

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free