Form 457 2018

What is the Form 457

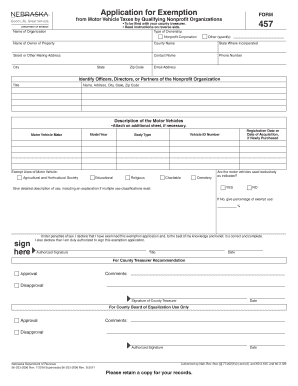

The Form 457, also known as the Nebraska application for exemption, is a crucial document used by taxpayers in Nebraska to apply for specific tax exemptions. This form is typically utilized by individuals and businesses seeking to reduce their tax liability under certain conditions outlined by state law. Understanding the purpose of this form is essential for those looking to navigate the tax system effectively.

How to use the Form 457

Using the Form 457 involves several steps to ensure compliance with state requirements. Taxpayers must accurately fill out the form, providing necessary details such as personal identification information and the specific exemption being requested. Once completed, the form must be submitted to the appropriate state tax authority for review. It is important to follow the guidelines provided by the Nebraska Department of Revenue to avoid delays or rejections.

Steps to complete the Form 457

Completing the Form 457 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including identification and any supporting materials that justify your exemption request.

- Fill out the form with accurate personal and business information.

- Clearly indicate the type of exemption you are applying for and provide any required explanations.

- Review the form for completeness and accuracy to ensure all information is correct.

- Submit the form either online, by mail, or in person, depending on the submission methods allowed by the state.

Eligibility Criteria

To qualify for the exemption outlined in the Form 457, applicants must meet specific eligibility criteria set by Nebraska law. Generally, these criteria include factors such as the type of entity applying, the nature of the exemption sought, and compliance with any relevant state regulations. It is advisable for applicants to review these criteria thoroughly to determine their eligibility before submitting the form.

Form Submission Methods

The Form 457 can be submitted through various methods to accommodate different preferences and situations. Taxpayers may choose to submit the form online via the Nebraska Department of Revenue's website, which often provides a faster processing time. Alternatively, the form can be mailed to the appropriate office or submitted in person at designated locations. Each method has its own set of guidelines, so it is important to follow the instructions specific to your chosen submission method.

Required Documents

When completing the Form 457, applicants must provide certain supporting documents to substantiate their claims for exemption. Commonly required documents may include:

- Proof of identity, such as a driver's license or Social Security number.

- Documentation that supports the exemption request, such as tax returns or financial statements.

- Any additional forms or evidence specified in the instructions for the Form 457.

IRS Guidelines

While the Form 457 is a state-specific document, it is essential to be aware of how it aligns with IRS guidelines. The Internal Revenue Service provides overarching rules that govern tax exemptions at the federal level. Taxpayers should ensure that their application for exemption complies with both state and federal regulations to avoid complications during the review process.

Quick guide on how to complete ne 457 2018 2019 form

Your assistance manual on preparing your Form 457

If you're curious about how to develop and submit your Form 457, here are a few straightforward guidelines on how to streamline tax processing.

To begin, you simply need to create your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify information as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and seamless sharing capabilities.

Follow the instructions below to complete your Form 457 in no time:

- Set up your account and begin processing PDFs in no time.

- Utilize our directory to find any IRS tax form; explore the various versions and schedules available.

- Click Obtain form to bring up your Form 457 in our editor.

- Input the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to append your legally-binding eSignature (if needed).

- Examine your document and rectify any inaccuracies.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to submit your taxes electronically with airSlate SignNow. Please remember that submitting on paper may lead to return discrepancies and delay reimbursements. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ne 457 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the NEET application form for 2018?

For the academic session of 2018-2019, NEET 2018 will be conducted on 6th May 2018.The application form for the same had been released on 8th February 2018.Steps to Fill NEET 2018 Application Form:Registration: Register yourself on the official website before filling the application form.Filling Up The Form: Fill up the application form by providing personal information (like name, father’s name, address, etc.), academic details.Uploading The Images: Upload the scanned images of their photograph, signature and right-hand index finger impression.Payment of The Application Fees: Pay the application fees for NEET 2018 in both online and offline mode. You can pay through credit/debit card/net banking or through e-challan.For details, visit this site: NEET 2018 Application Form Released - Apply Now!

Create this form in 5 minutes!

How to create an eSignature for the ne 457 2018 2019 form

How to make an eSignature for the Ne 457 2018 2019 Form online

How to create an eSignature for the Ne 457 2018 2019 Form in Chrome

How to make an eSignature for putting it on the Ne 457 2018 2019 Form in Gmail

How to generate an electronic signature for the Ne 457 2018 2019 Form from your smartphone

How to make an eSignature for the Ne 457 2018 2019 Form on iOS

How to make an eSignature for the Ne 457 2018 2019 Form on Android devices

People also ask

-

What is an application for exemption and how can it help my business?

An application for exemption is a crucial document that allows businesses to request waivers from certain requirements. By utilizing airSlate SignNow, you can easily create, send, and e-sign your application for exemption, streamlining the process and ensuring compliance with legal requirements.

-

How does airSlate SignNow simplify the application for exemption process?

airSlate SignNow provides an intuitive platform that simplifies the application for exemption process. With user-friendly templates and e-signature capabilities, you can complete your application quickly, ensuring that you meet deadlines and reduce administrative burdens.

-

What are the pricing options for using airSlate SignNow for my application for exemption?

airSlate SignNow offers flexible pricing plans tailored to the needs of your business. Depending on your requirements for the application for exemption, you can choose from various subscription tiers, ensuring that you only pay for the features you need.

-

Can airSlate SignNow integrate with other tools I use for managing applications for exemption?

Yes, airSlate SignNow offers seamless integrations with popular business tools and applications. This means you can easily incorporate your workflow for application for exemption into software that your team already uses, enhancing overall productivity.

-

What features does airSlate SignNow provide that are essential for an application for exemption?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, which are essential for managing your application for exemption. These features ensure that your application process is efficient and that you can track its progress at every stage.

-

How can I ensure my application for exemption is secure with airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and secure data storage for your application for exemption. This means your sensitive information is protected, giving you peace of mind as you send and sign documents electronically.

-

What are the benefits of using airSlate SignNow for e-signing my application for exemption?

Using airSlate SignNow for e-signing your application for exemption offers numerous benefits, including faster processing times and improved accuracy. Digital signatures are legally binding, and by using our platform, you streamline workflows while maintaining compliance with regulatory standards.

Get more for Form 457

- Jefferson d tufts sr scholarship application form

- Sae cover sheet 9 form 36 7 addendum for property subject to manatory membership in a property owners association trec texas

- F0190 vendor performance evaluation form

- Fm 7 22 pdf form

- Inspection notice buyer s election and seller s response form

- Senator mark r warner service academy nomination reference form

- Alachua county noc 566946929 form

- Indemnity form for the trip to the water park

Find out other Form 457

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT