Not Ready to File Your Taxes? Extension Form Forbes 2020-2026

Understanding the Form 457 Application for Motor Vehicle

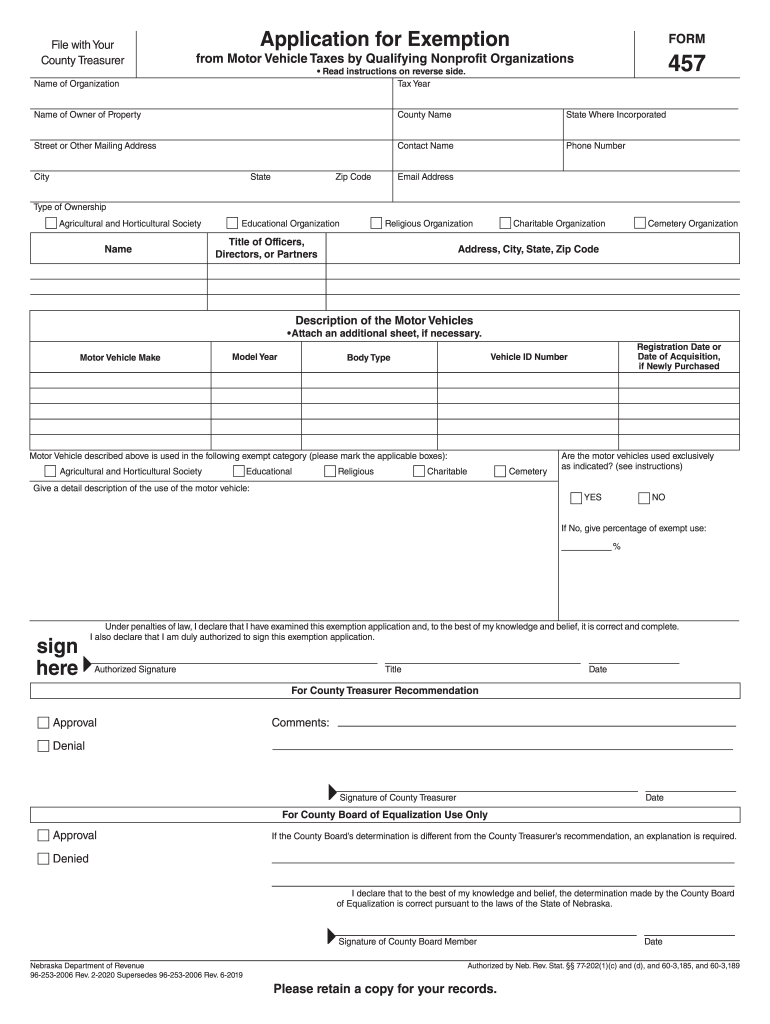

The Form 457 application is essential for individuals seeking an exemption from motor vehicle taxes in Nebraska. This form allows qualifying applicants to request a tax exemption for their vehicles, which can significantly reduce their financial burden. Understanding the specific requirements and eligibility criteria is crucial for a successful application.

Eligibility Criteria for the 457 Exemption

To qualify for the 457 exemption, applicants must meet certain criteria established by the state of Nebraska. Generally, this includes being a non-profit organization, a government entity, or an individual with specific qualifications related to disability or other exemptions. It is important to review the detailed eligibility requirements to ensure compliance before submitting the application.

Steps to Complete the Form 457 Application

Filling out the Form 457 application correctly is vital for approval. Here are the general steps to follow:

- Gather necessary documentation that supports your claim for exemption.

- Complete the form accurately, ensuring all required fields are filled out.

- Provide any additional information or attachments as requested.

- Review the form for accuracy and completeness before submission.

- Submit the application through the designated method, whether online or by mail.

Form Submission Methods

The Form 457 application can be submitted through various methods, allowing flexibility for applicants. Typically, submissions can be made online via the Nebraska motor vehicle department's website, by mail to the appropriate office, or in person at designated locations. Each method has its own processing times, so it is advisable to choose the one that best suits your needs.

Required Documents for the Application

When applying for the 457 exemption, certain documents must accompany the application. These may include proof of eligibility, such as tax-exempt status letters for organizations, identification for individuals, and any other relevant supporting documents. Ensuring you have all required documentation will help streamline the approval process.

Penalties for Non-Compliance

Failing to comply with the requirements of the Form 457 application can result in penalties. This may include the denial of the exemption request, back taxes owed, and potential fines. It is essential to understand the implications of non-compliance and to adhere strictly to the guidelines provided by the Nebraska motor vehicle department.

Quick guide on how to complete not ready to file your taxes extension form forbes

Complete Not Ready To File Your Taxes? Extension Form Forbes effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Not Ready To File Your Taxes? Extension Form Forbes on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Not Ready To File Your Taxes? Extension Form Forbes with ease

- Acquire Not Ready To File Your Taxes? Extension Form Forbes and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Not Ready To File Your Taxes? Extension Form Forbes and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct not ready to file your taxes extension form forbes

Create this form in 5 minutes!

How to create an eSignature for the not ready to file your taxes extension form forbes

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the form 457 application motor vehicle?

The form 457 application motor vehicle is a necessary document that allows you to officially apply for a vehicle in your state. Understanding its requirements is crucial for a smooth application process. By using airSlate SignNow, you can easily fill out and eSign the form 457 application motor vehicle digitally.

-

How does airSlate SignNow simplify the form 457 application motor vehicle process?

airSlate SignNow streamlines the process of submitting the form 457 application motor vehicle by allowing you to complete and sign the document from any device. Its user-friendly interface simplifies the filling process, ensuring that you don't miss any critical details. This saves you time and reduces the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for the form 457 application motor vehicle?

Yes, airSlate SignNow offers various pricing plans that suit different business needs. When you use it for the form 457 application motor vehicle, you benefit from a cost-effective solution that eliminates printing and mailing costs. Additionally, our plans provide access to advanced features that enhance your document management.

-

What features does airSlate SignNow offer for managing the form 457 application motor vehicle?

airSlate SignNow includes a variety of features to assist with the form 457 application motor vehicle, such as templates, eSignatures, and automated workflows. These features help to streamline your document preparation and filing process, making it efficient. You'll find that document tracking and status updates keep everything organized.

-

Can I integrate airSlate SignNow with other applications for the form 457 application motor vehicle?

Yes, airSlate SignNow offers integrations with various applications that can support your efforts with the form 457 application motor vehicle. You can connect it with CRM, project management, and storage tools seamlessly. This ensures that your workflow remains efficient and all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the form 457 application motor vehicle?

By utilizing airSlate SignNow for the form 457 application motor vehicle, you gain the advantage of a paperless process. This not only enhances environmental sustainability but also speeds up the approval process. Moreover, the ease of access from any device allows for quick modifications if necessary.

-

Is training available to help with the form 457 application motor vehicle submissions via airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources to help users with the form 457 application motor vehicle submissions. These resources include tutorials, webinars, and customer support that guide you through the process. This ensures you are equipped to use our platform effectively.

Get more for Not Ready To File Your Taxes? Extension Form Forbes

- 10 sin ming drive singapore 575701 tel 1800 call form

- Motor vehicle administration 6601 ritchie highway form

- Form 701 6 application for oklahoma certificate of title for a vehicle trailer or manufactured home

- Sf 0395 dec 18 form

- Reg 227 application for replacement or transfer of title index ready this form is used in a variety of situations such as but

- Idaho motor vehicle drivers license record request form

- Vp 104 bill of sale form

- Application to titlereg a vehicle nobles county form

Find out other Not Ready To File Your Taxes? Extension Form Forbes

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement