W9 Nm 2014

What is the W-9 NM?

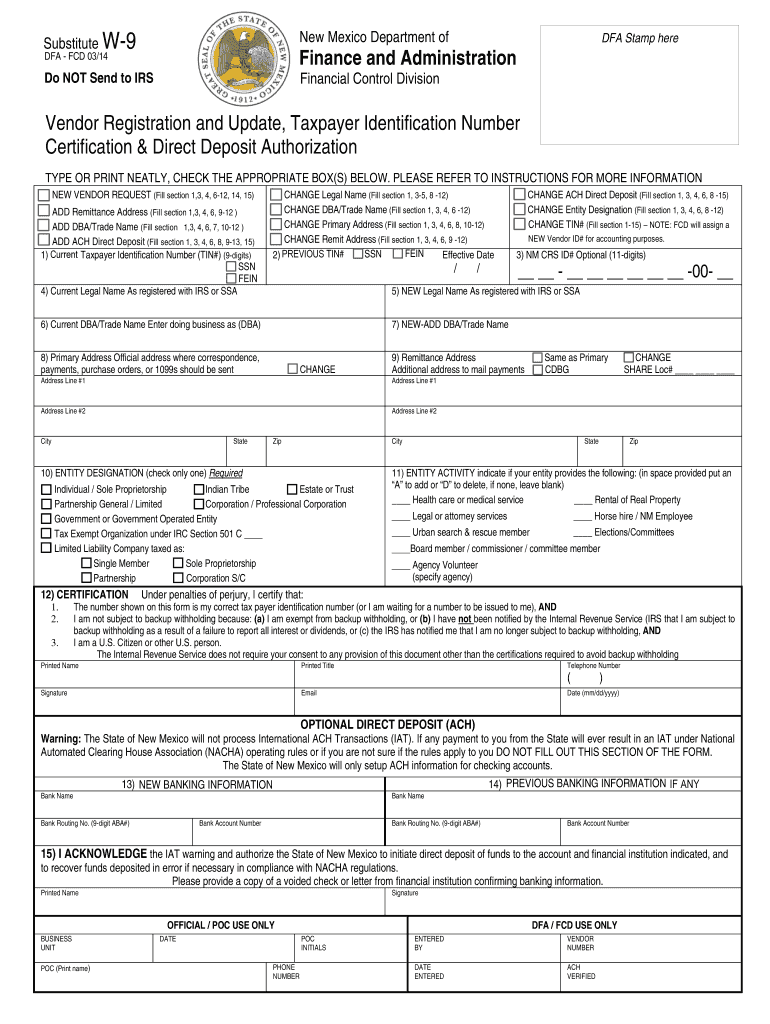

The W-9 NM, or New Mexico W-9 form, is a tax document used by individuals and businesses to provide their taxpayer identification information to parties that will report payments made to them. This form is essential for ensuring accurate tax reporting and compliance with IRS regulations. It typically includes fields for the name, business name (if applicable), address, taxpayer identification number (TIN), and certification of the information provided.

Steps to Complete the W-9 NM

Completing the W-9 NM form involves several straightforward steps:

- Gather your personal and business information, including your name, business name, and TIN.

- Fill in the appropriate sections of the form, ensuring all information is accurate.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify that the information is correct.

It is essential to ensure that the form is filled out completely to avoid delays in processing or potential penalties.

How to Obtain the W-9 NM

The W-9 NM form can be obtained through various methods. You can download it directly from the New Mexico Department of Taxation and Revenue website or request a copy from the entity that requires it. Many businesses also provide their own versions of the form for convenience. Ensure that you are using the most current version to comply with IRS standards.

Legal Use of the W-9 NM

The legal use of the W-9 NM is primarily for tax reporting purposes. It is used by businesses and individuals to report payments made to contractors, freelancers, and other service providers. By providing accurate information on this form, taxpayers help ensure compliance with federal tax laws, which can prevent issues with the IRS, such as audits or penalties.

Key Elements of the W-9 NM

The key elements of the W-9 NM form include:

- Name: The legal name of the individual or business.

- Business Name: If applicable, the name under which the business operates.

- Taxpayer Identification Number (TIN): This can be a Social Security number (SSN) or Employer Identification Number (EIN).

- Address: The physical address where the taxpayer resides or operates the business.

- Certification: A signature certifying that the information provided is accurate and complete.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the W-9 NM form. It is important to follow these guidelines to ensure compliance. The IRS requires that the information on the form be accurate and up-to-date. Additionally, the form should be submitted to the requester rather than directly to the IRS. Familiarizing yourself with these guidelines can help prevent errors and ensure proper handling of your tax information.

Quick guide on how to complete printable w 9 nm 2014 2019 form

Your assistance manual on preparing your W9 Nm

If you wish to understand how to finalize and submit your W9 Nm, here are a few brief tips to simplify tax processing.

To get started, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document platform that enables you to edit, draft, and finalize your tax paperwork with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures while returning to edit information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to complete your W9 Nm in just a few minutes:

- Create your account and start working on PDFs in a matter of minutes.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to open your W9 Nm in our editor.

- Fill in the necessary fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically using airSlate SignNow. Keep in mind that paper submissions can lead to increased errors and delayed refunds. Before e-filing your taxes, be sure to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct printable w 9 nm 2014 2019 form

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

Why do you need to fill out a W-9 form to get back a broker fee from renting an apartment?

Is the person requesting that you fill out this form going to be cutting you a check for this fee? In other words, is this broker fee a payment to you for services you rendered? Money that you need to declare as income and thus pay income taxes to the IRS?If not, if this check is for some other reason, then I don’t believe that you should complete this form.I’m not a lawyer, so there could very well be something that I am unaware of, but it looks suspicious to me. I sure would like to know more about this issue.

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

Create this form in 5 minutes!

How to create an eSignature for the printable w 9 nm 2014 2019 form

How to create an electronic signature for your Printable W 9 Nm 2014 2019 Form in the online mode

How to generate an electronic signature for the Printable W 9 Nm 2014 2019 Form in Google Chrome

How to create an eSignature for putting it on the Printable W 9 Nm 2014 2019 Form in Gmail

How to generate an electronic signature for the Printable W 9 Nm 2014 2019 Form right from your mobile device

How to generate an eSignature for the Printable W 9 Nm 2014 2019 Form on iOS

How to create an eSignature for the Printable W 9 Nm 2014 2019 Form on Android devices

People also ask

-

What is a W9 Nm form and why is it important?

The W9 Nm form is a tax form used in New Mexico for businesses to request taxpayer identification numbers from freelancers or contractors. It's important because it ensures that the correct information is collected for tax reporting purposes. Using airSlate SignNow, you can easily send and eSign W9 Nm forms, streamlining your document management process.

-

How can airSlate SignNow facilitate the completion of W9 Nm forms?

airSlate SignNow simplifies the completion of W9 Nm forms by providing an intuitive platform for electronic signatures and document management. Users can quickly fill out the form, add signatures, and securely send it to the necessary parties. This eliminates the hassle of printing and mailing physical documents.

-

Is airSlate SignNow cost-effective for handling W9 Nm forms?

Yes, airSlate SignNow offers a cost-effective solution for handling W9 Nm forms. With various pricing plans available, businesses can choose the one that best fits their needs while benefiting from unlimited document signing and storage. This makes it an ideal choice for managing your W9 Nm forms without breaking the bank.

-

What are the key features of airSlate SignNow for managing W9 Nm forms?

Key features of airSlate SignNow for managing W9 Nm forms include customizable templates, secure cloud storage, and comprehensive tracking options. These features allow users to create, send, and manage W9 Nm forms efficiently, ensuring that all documents are completed accurately and on time.

-

Can I integrate airSlate SignNow with other applications for W9 Nm management?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and Dropbox. This allows you to manage your W9 Nm forms alongside your other business tools, enhancing productivity and making document management a breeze.

-

How does airSlate SignNow ensure the security of my W9 Nm forms?

AirSlate SignNow prioritizes security by employing advanced encryption technologies and secure storage solutions for all W9 Nm forms. Additionally, the platform complies with industry standards and regulations to protect your sensitive information, giving you peace of mind when managing your documents.

-

Can multiple users collaborate on a W9 Nm form using airSlate SignNow?

Yes, airSlate SignNow supports collaborative work on W9 Nm forms, allowing multiple users to access and edit the document simultaneously. This feature is particularly useful for teams that need to review or approve forms before finalizing them, ensuring efficiency in your document workflow.

Get more for W9 Nm

Find out other W9 Nm

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe