APPLICATION for DENVER SALES, USE, LODGER'S TAX LICENSE and 2020-2026

Understanding the Application for Denver Sales, Use, Lodger's Tax License

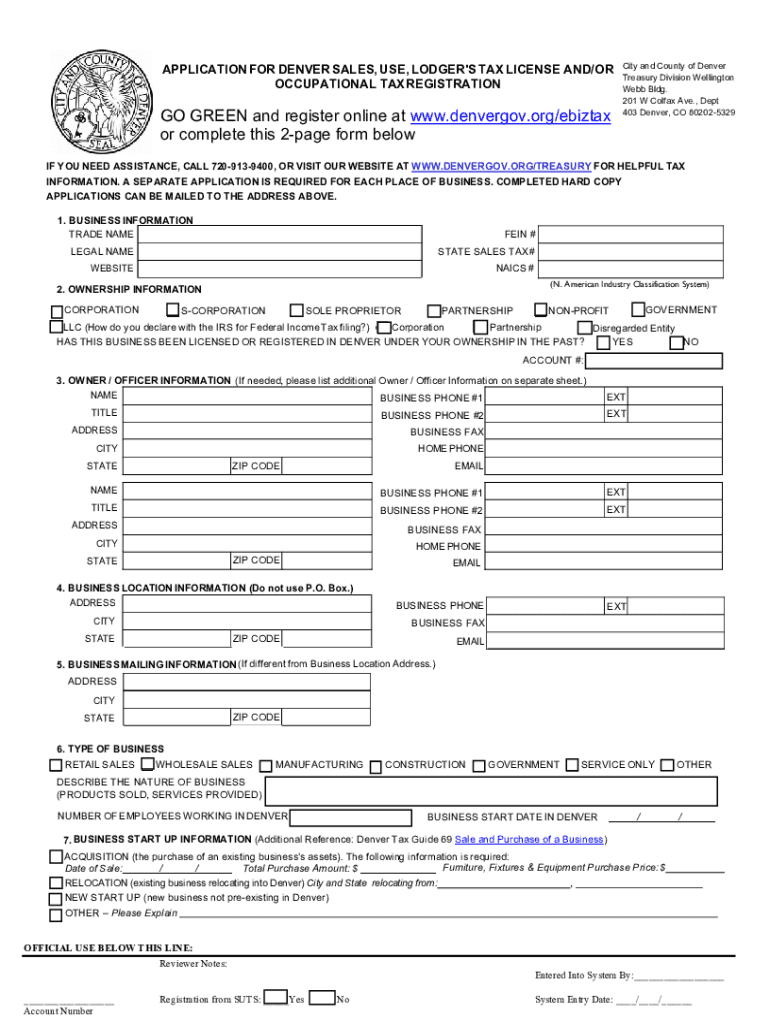

The Application for Denver Sales, Use, Lodger's Tax License is a crucial document for businesses operating within Denver. This application allows businesses to collect and remit sales tax, use tax, and lodger's tax, ensuring compliance with local regulations. Understanding the purpose of this application helps businesses avoid penalties and maintain good standing with the city.

Steps to Complete the Application for Denver Sales, Use, Lodger's Tax License

Completing the application involves several steps:

- Gather necessary information, including your business name, address, and federal tax identification number.

- Determine the type of business entity you are operating, such as a sole proprietorship, LLC, or corporation.

- Fill out the application form accurately, ensuring all details are complete to avoid delays.

- Submit the application online through the Denver eBiz portal or via mail if preferred.

- Keep a copy of the submitted application for your records.

Required Documents for the Application

When applying for the Denver Sales, Use, Lodger's Tax License, specific documents are necessary to support your application:

- Proof of business registration with the state of Colorado.

- Federal Employer Identification Number (EIN) or Social Security Number (SSN).

- Identification documents for the business owner or responsible party.

- Any additional licenses or permits required for your specific business type.

Eligibility Criteria for the Application

To be eligible for the Denver Sales, Use, Lodger's Tax License, businesses must meet certain criteria:

- Operate a business within the city limits of Denver.

- Engage in activities that require the collection of sales tax or lodger's tax.

- Be in good standing with the state and local authorities.

Application Process and Approval Time

The application process for the Denver Sales, Use, Lodger's Tax License typically follows these stages:

- Submission of the completed application and required documents.

- Review by the Denver Department of Finance.

- Approval or request for additional information, usually within a few weeks.

Once approved, businesses will receive their license, allowing them to operate legally within Denver.

Penalties for Non-Compliance

Failing to obtain the necessary Sales, Use, Lodger's Tax License can lead to significant penalties, including:

- Fines for operating without a license.

- Back taxes owed, including interest and penalties.

- Potential legal action from the city.

It is essential for businesses to comply with local tax laws to avoid these consequences.

Quick guide on how to complete application for denver sales use lodgers tax license and

Complete APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents promptly without delays. Manage APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND with ease

- Find APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors requiring new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for denver sales use lodgers tax license and

Create this form in 5 minutes!

How to create an eSignature for the application for denver sales use lodgers tax license and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the denver ebiz login process for airSlate SignNow?

To access airSlate SignNow, users can initiate the denver ebiz login by visiting the official website and clicking on the login button. Enter your registered email and password to gain access to your account. If you encounter any issues, you can use the password recovery option to reset your credentials.

-

Is there a cost associated with the denver ebiz login?

The denver ebiz login itself is free; however, airSlate SignNow offers various pricing plans based on the features you need. These plans are designed to cater to different business sizes and requirements. You can choose a plan that best fits your needs after logging in.

-

What features are available after the denver ebiz login?

Once you complete the denver ebiz login, you can access a range of features including document creation, eSigning, and workflow automation. The platform also allows you to track document status and manage templates efficiently. These features are designed to streamline your document management process.

-

How does airSlate SignNow benefit businesses using the denver ebiz login?

By using the denver ebiz login, businesses can enhance their document workflow efficiency and reduce turnaround times. The platform provides a user-friendly interface that simplifies the eSigning process, making it easier for teams to collaborate. This ultimately leads to improved productivity and cost savings.

-

Can I integrate other applications with airSlate SignNow after the denver ebiz login?

Yes, airSlate SignNow supports various integrations with popular applications such as Google Drive, Salesforce, and Dropbox. After the denver ebiz login, you can easily connect these tools to streamline your document management processes. This integration capability enhances the overall functionality of the platform.

-

What support options are available for users after the denver ebiz login?

After completing the denver ebiz login, users have access to a variety of support options including a comprehensive knowledge base, live chat, and email support. The airSlate SignNow team is dedicated to helping users resolve any issues they may encounter. This ensures a smooth experience while using the platform.

-

Is there a mobile app for airSlate SignNow accessible via the denver ebiz login?

Yes, airSlate SignNow offers a mobile app that allows users to access their accounts via the denver ebiz login on the go. The app provides essential features such as document signing and management, ensuring that you can handle your documents anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND

Find out other APPLICATION FOR DENVER SALES, USE, LODGER'S TAX LICENSE AND

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later