New Taxpayer Registration Form 2019

What is the New Taxpayer Registration Form

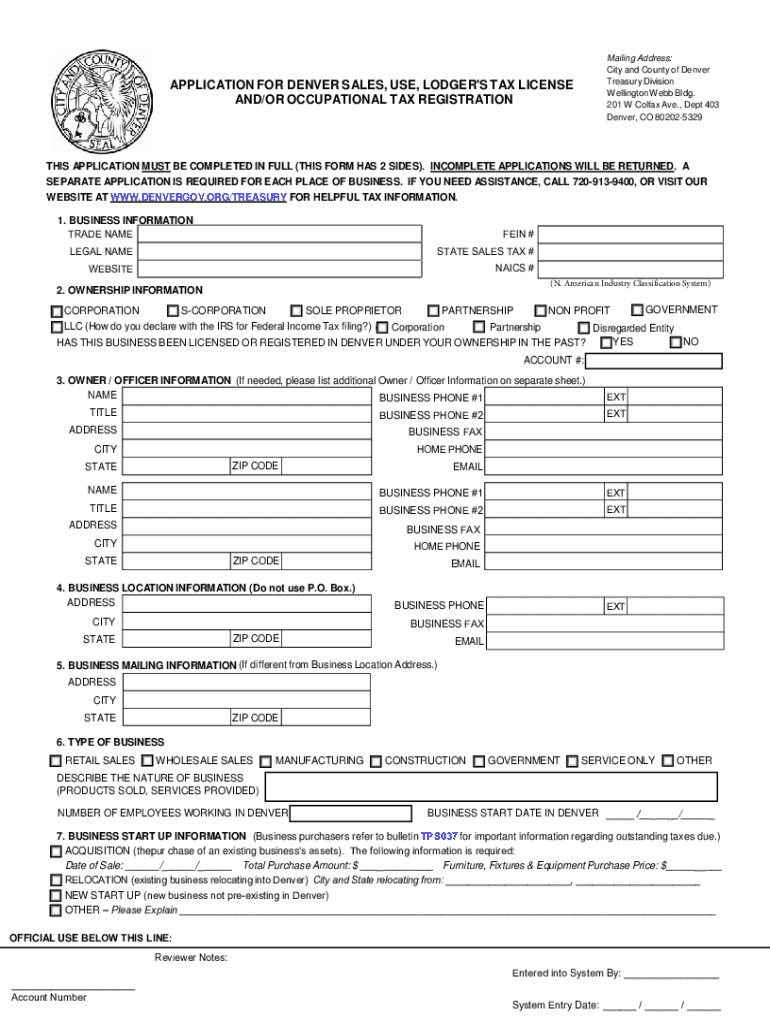

The New Taxpayer Registration Form is a crucial document for individuals and businesses in the United States who need to register with the Internal Revenue Service (IRS). This form is primarily used to establish a taxpayer's identity and ensure compliance with federal tax obligations. It collects essential information such as the taxpayer's name, address, and Social Security number or Employer Identification Number (EIN). By submitting this form, taxpayers can officially notify the IRS of their status and facilitate their tax reporting responsibilities.

Steps to complete the New Taxpayer Registration Form

Completing the New Taxpayer Registration Form involves several straightforward steps:

- Gather necessary information: Collect your personal details, including your name, address, and Social Security number or EIN.

- Access the form: Obtain the New Taxpayer Registration Form from the IRS website or through authorized tax professionals.

- Fill out the form: Carefully enter your information in the required fields, ensuring accuracy to avoid delays.

- Review your submission: Double-check all entries for correctness and completeness.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

How to obtain the New Taxpayer Registration Form

The New Taxpayer Registration Form can be easily obtained from the IRS website. It is available in a downloadable format, allowing taxpayers to print and fill it out at their convenience. Additionally, local IRS offices and tax professionals may provide physical copies of the form. Ensure that you are using the most current version to comply with IRS requirements.

Legal use of the New Taxpayer Registration Form

The New Taxpayer Registration Form is legally required for individuals and entities that need to establish their taxpayer status with the IRS. Failing to submit this form when necessary can lead to complications in tax reporting and potential penalties. It is essential to use this form correctly to ensure compliance with federal tax laws and regulations.

Required Documents

When completing the New Taxpayer Registration Form, certain documents may be required to validate your identity and taxpayer status. These documents typically include:

- Social Security card or number for individuals

- Employer Identification Number (EIN) for businesses

- Proof of residency, such as a utility bill or lease agreement

- Any prior tax returns, if applicable

Form Submission Methods

Taxpayers have several options for submitting the New Taxpayer Registration Form:

- Online: Many taxpayers prefer to submit the form electronically through the IRS e-file system, which offers a quick and efficient method.

- By mail: The completed form can be printed and sent to the appropriate IRS address, as specified in the form instructions.

- In person: Taxpayers may also choose to deliver the form directly to their local IRS office for immediate processing.

Quick guide on how to complete new taxpayer registration form

Easily Create New Taxpayer Registration Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and without delay. Handle New Taxpayer Registration Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Edit and Electronically Sign New Taxpayer Registration Form Effortlessly

- Obtain New Taxpayer Registration Form and select Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method for sending the form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate worries about lost or misfiled documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and electronically sign New Taxpayer Registration Form to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new taxpayer registration form

Create this form in 5 minutes!

How to create an eSignature for the new taxpayer registration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Taxpayer Registration Form?

The New Taxpayer Registration Form is a document that allows individuals and businesses to register as taxpayers with the relevant tax authorities. This form is essential for ensuring compliance with tax regulations and can be easily completed and submitted using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with the New Taxpayer Registration Form?

airSlate SignNow streamlines the process of completing the New Taxpayer Registration Form by providing an intuitive platform for filling out and eSigning documents. Users can quickly send the form for signatures, track its status, and ensure timely submission to tax authorities.

-

Is there a cost associated with using airSlate SignNow for the New Taxpayer Registration Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that simplify the completion and management of the New Taxpayer Registration Form, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for the New Taxpayer Registration Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and integration with popular applications. These features enhance the efficiency of managing the New Taxpayer Registration Form and ensure a smooth user experience.

-

Can I integrate airSlate SignNow with other software for the New Taxpayer Registration Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to seamlessly incorporate the New Taxpayer Registration Form into their existing workflows. This integration capability enhances productivity and simplifies document management.

-

What are the benefits of using airSlate SignNow for the New Taxpayer Registration Form?

Using airSlate SignNow for the New Taxpayer Registration Form provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for anyone to complete and submit the form efficiently.

-

Is airSlate SignNow secure for handling the New Taxpayer Registration Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the New Taxpayer Registration Form, are protected with advanced encryption and secure storage. Users can trust that their sensitive information is safe throughout the signing process.

Get more for New Taxpayer Registration Form

- Ca 20 48 02 99 form

- Demographic sheet 231998817 form

- Form fcapea 04 florida administrative code

- State of wisconsin f 62470 fillable form

- Kinderwait form

- Jennies volleyball camp registration formcamper i

- 4th grade report card west platte school district wpsd form

- Affidavit of compliance with section 285500 rsmo et desperesmo form

Find out other New Taxpayer Registration Form

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer