Ny 130 2018

What is the NY 130?

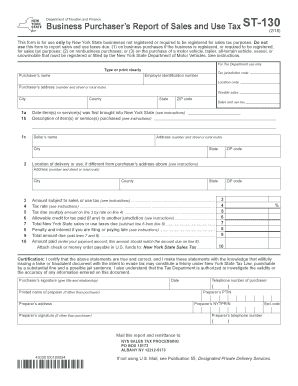

The NY 130, also known as the New York State Form 130, is a crucial document used primarily for tax purposes in New York. This form is specifically designed for individuals and businesses to report their income and calculate their tax liabilities. It encompasses various sections that require detailed information about income sources, deductions, and credits applicable to the filer. Understanding the NY 130 is essential for ensuring compliance with state tax regulations and avoiding potential penalties.

How to Use the NY 130

Using the NY 130 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. Be mindful of the specific instructions provided for each section, as errors can lead to delays or complications in processing. Once completed, the form can be submitted electronically or via mail, depending on the preference of the filer.

Steps to Complete the NY 130

Completing the NY 130 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather all relevant income documentation, such as W-2s and 1099s.

- Review the instructions for the NY 130 to understand the requirements for each section.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report all sources of income in the designated sections.

- Include any applicable deductions and credits to reduce your taxable income.

- Double-check all entries for accuracy before signing and dating the form.

- Submit the completed form by the specified deadline, either electronically or by mail.

Legal Use of the NY 130

The NY 130 must be used in accordance with New York State tax laws. Filing this form accurately is essential for legal compliance and to avoid penalties. The information reported on the NY 130 is subject to verification by state tax authorities, and any discrepancies may result in audits or additional assessments. It is important to keep copies of all submitted forms and supporting documents for your records, as they may be required for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the NY 130 are critical to ensure timely submission and avoid penalties. Typically, the form must be filed by April 15 for the previous tax year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to stay informed about any changes in deadlines or filing requirements, especially during tax season, as these can vary from year to year.

Required Documents

To complete the NY 130, several documents are required to provide accurate information. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year's tax return for reference

Having these documents ready will streamline the process of completing the form and help ensure accuracy in reporting.

Quick guide on how to complete ny st 130 2018 2019 form

Your assistance manual on how to prepare your Ny 130

If you’re wondering how to create and submit your Ny 130, here are some straightforward recommendations on how to make tax filing signNowly simpler.

To begin, all you need to do is set up your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to amend, draft, and finalize your income tax forms effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and return to adjust responses where necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and a user-friendly sharing experience.

Follow the steps below to complete your Ny 130 in no time:

- Create your account and commence working on PDFs in just a few minutes.

- Browse our catalog to find any IRS tax form; review various versions and schedules.

- Click Get form to access your Ny 130 in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to apply your legally-recognized eSignature (if needed).

- Review your document and amend any inaccuracies.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Refer to this manual to file your taxes digitally with airSlate SignNow. Please be aware that submitting on paper may lead to increased return errors and delayed refunds. Of course, prior to e-filing your taxes, visit the IRS website for the filing guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ny st 130 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

Create this form in 5 minutes!

How to create an eSignature for the ny st 130 2018 2019 form

How to create an electronic signature for the Ny St 130 2018 2019 Form in the online mode

How to make an electronic signature for the Ny St 130 2018 2019 Form in Google Chrome

How to create an electronic signature for signing the Ny St 130 2018 2019 Form in Gmail

How to generate an electronic signature for the Ny St 130 2018 2019 Form from your smart phone

How to generate an electronic signature for the Ny St 130 2018 2019 Form on iOS devices

How to generate an eSignature for the Ny St 130 2018 2019 Form on Android

People also ask

-

What is the ST 130 form and how can airSlate SignNow help with it?

The ST 130 form is a tax-exempt certificate used for purchases in certain jurisdictions. With airSlate SignNow, businesses can create, send, and eSign ST 130 forms effortlessly, ensuring compliance and streamlining the documentation process.

-

How does airSlate SignNow ensure the security of my ST 130 forms?

AirSlate SignNow prioritizes security by using advanced encryption methods to protect your ST 130 forms. Additionally, user authentication and audit trails ensure that only authorized individuals can access and sign these sensitive documents.

-

What are the pricing options for using airSlate SignNow with ST 130 forms?

AirSlate SignNow offers flexible pricing plans to cater to different business needs, making it affordable for anyone needing to manage ST 130 forms. You can choose from monthly or annual subscriptions, and there’s a free trial available to test its features.

-

Can I integrate airSlate SignNow with other software for handling ST 130 forms?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage ST 130 forms. Whether you are using CRM software or document management systems, these integrations streamline your workflow and improve efficiency.

-

What features does airSlate SignNow offer for enhancing ST 130 form processing?

AirSlate SignNow includes features such as customizable templates, reminder notifications, and real-time tracking for ST 130 forms. These tools enhance your ability to manage documents effectively and ensure timely completion of the signing process.

-

Is it easy to use airSlate SignNow for beginners managing ST 130 forms?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind, making it accessible to beginners who need to manage ST 130 forms. The intuitive interface and helpful resources guide users through the process of creating and eSigning documents effortlessly.

-

How can I track the status of my ST 130 forms in airSlate SignNow?

With airSlate SignNow, you have complete visibility on the status of your ST 130 forms. You can receive notifications as multiple signers complete their tasks, and access a detailed log of all activities associated with your documents at any time.

Get more for Ny 130

- Dd 1172 for housing form

- Santa cruz masonic temple foundation sc slv38 org form

- Raffle prize request letter form

- Hqp pff 053 100408326 form

- Centum mortgage application doc www3 telus form

- Schedule z additional information required for net metering service

- Vr 308 03 04 qxd form

- Add or remove tenants to lesase agreementdocx form

Find out other Ny 130

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document