Use Tax and Casual Sales Forms Department of Taxation and Finance 2017

What is the Use Tax And Casual Sales Forms Department Of Taxation And Finance

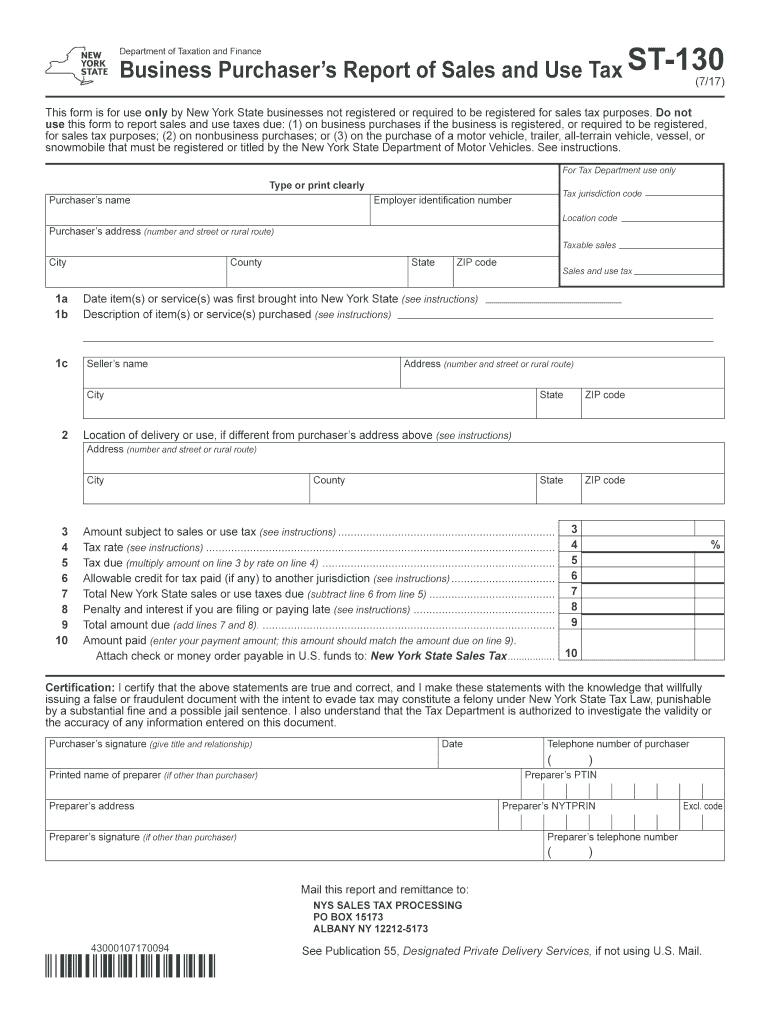

The Use Tax and Casual Sales Forms from the Department of Taxation and Finance are essential documents for reporting and paying taxes on purchases made outside of the state where the buyer resides. These forms are designed to ensure compliance with state tax laws regarding items purchased for use within the state, particularly when sales tax has not been collected at the point of sale. This includes items bought online, from out-of-state vendors, or during casual sales such as garage sales. Understanding these forms is crucial for individuals and businesses to avoid potential penalties and ensure proper tax reporting.

Steps to Complete the Use Tax And Casual Sales Forms Department Of Taxation And Finance

Completing the Use Tax and Casual Sales Forms involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the purchases made, including dates, descriptions of items, and purchase amounts. Next, accurately fill out the form, ensuring that all fields are completed as required. It is important to calculate the total use tax owed based on the applicable state tax rates. Once the form is completed, review it for any errors before signing and dating it. Finally, submit the form according to the specified submission methods, which may include online, by mail, or in person.

Legal Use of the Use Tax And Casual Sales Forms Department Of Taxation And Finance

The legal use of the Use Tax and Casual Sales Forms is governed by state tax laws that require taxpayers to report and remit use tax on items purchased without sales tax being applied. This includes ensuring that the forms are completed accurately and submitted within the designated time frames. Failure to comply with these regulations can result in penalties, interest, and additional tax liabilities. It is essential for taxpayers to understand their obligations under the law to maintain compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Use Tax and Casual Sales Forms are typically aligned with state tax reporting periods. Taxpayers should be aware of the specific due dates for submitting these forms, which may vary based on whether they file annually, quarterly, or monthly. Missing these deadlines can lead to penalties and interest on any unpaid tax amounts. It is advisable to keep a calendar of important tax dates and set reminders to ensure timely filing.

Who Issues the Form

The Use Tax and Casual Sales Forms are issued by the Department of Taxation and Finance in each state. This department is responsible for administering tax laws and ensuring compliance among taxpayers. The forms are typically available on the official state taxation website, where taxpayers can access the most current versions and any related instructions for completing and submitting them.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Use Tax and Casual Sales Forms can result in various penalties. These may include financial penalties based on the amount of tax owed, interest on unpaid taxes, and potential legal actions for repeated violations. Taxpayers are encouraged to understand the implications of failing to file or pay the required use tax to avoid these consequences. Staying informed about state tax laws and maintaining accurate records can help mitigate risks associated with non-compliance.

Quick guide on how to complete use tax and casual sales forms department of taxation and finance

Your assistance manual on how to prepare your Use Tax And Casual Sales Forms Department Of Taxation And Finance

If you’re curious about how to generate and dispatch your Use Tax And Casual Sales Forms Department Of Taxation And Finance, here are some brief instructions on simplifying tax procedures.

To commence, you only need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and revisit to amend details where necessary. Optimize your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Use Tax And Casual Sales Forms Department Of Taxation And Finance in a matter of minutes:

- Set up your account and begin editing PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Use Tax And Casual Sales Forms Department Of Taxation And Finance in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to insert your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Store modifications, print your copy, transmit it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return inaccuracies and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct use tax and casual sales forms department of taxation and finance

FAQs

-

How do you use Quickbooks for dropshipping to keep your finances in check? How do I record all the sales and payments, keeping track of the finances and be ready to submit tax forms and all?

Hi Ricky,Drop shipping product affects how you would track inventory. Typically, one would invoice after the shipment is made. Do you produce inventory or just buy/sell/rep for products? If you produce the inventory yourself, you would want to capture the materials purchased, the assembly, the increase in inventory when built. Then when you ship, you can invoice and it decreases your inventory value and increases your Cost of Goods Sold.QuickBooks is a powerful tool to track all of the transactions that occur. From prepaying your vendor, customer deposits, receiving a vendor bill, invoicing your customer, receiving payments and making deposits. Can you tell I love my accounting software?

-

Where can I learn the essentials of NY state sales tax reporting? Does the Department of Finance and taxation provide any learning materials?

This is not specifically about sales tax reporting but you might find useful information and some interesting links in this NY Sales Tax Guide.Hope this helps!

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

Create this form in 5 minutes!

How to create an eSignature for the use tax and casual sales forms department of taxation and finance

How to generate an electronic signature for your Use Tax And Casual Sales Forms Department Of Taxation And Finance in the online mode

How to make an electronic signature for your Use Tax And Casual Sales Forms Department Of Taxation And Finance in Chrome

How to generate an eSignature for signing the Use Tax And Casual Sales Forms Department Of Taxation And Finance in Gmail

How to generate an electronic signature for the Use Tax And Casual Sales Forms Department Of Taxation And Finance straight from your mobile device

How to create an eSignature for the Use Tax And Casual Sales Forms Department Of Taxation And Finance on iOS

How to generate an eSignature for the Use Tax And Casual Sales Forms Department Of Taxation And Finance on Android

People also ask

-

What are Use Tax And Casual Sales Forms from the Department of Taxation And Finance?

Use Tax And Casual Sales Forms from the Department of Taxation And Finance are documents required for reporting the use tax owed on purchased goods in specific circumstances. These forms help ensure compliance with state tax regulations, making it essential for businesses and individuals to complete them accurately. Understanding these forms can help avoid penalties and ensures proper tax reporting.

-

How can airSlate SignNow assist with completing Use Tax And Casual Sales Forms?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing Use Tax And Casual Sales Forms. With our e-signature capabilities, businesses can easily sign and send these forms electronically, ensuring a quick and efficient process. This helps in meeting deadlines and maintaining compliance with the Department of Taxation And Finance.

-

Are there any costs associated with using airSlate SignNow for Use Tax And Casual Sales Forms?

Yes, airSlate SignNow provides a cost-effective solution for managing Use Tax And Casual Sales Forms. Our pricing plans are designed to fit a variety of budgets, ensuring that you only pay for the features you need. By using our platform, businesses can save time and money compared to traditional document handling methods.

-

What features does airSlate SignNow offer for Use Tax And Casual Sales Forms?

airSlate SignNow includes essential features for Use Tax And Casual Sales Forms, such as customizable templates, secure document storage, and advanced e-signature options. Additionally, users can track the status of their documents in real-time and create workflows to streamline their processes. These features enhance productivity and ensure compliance.

-

How does airSlate SignNow integrate with other software for Use Tax And Casual Sales Forms?

airSlate SignNow provides seamless integrations with popular software applications, making it easier to manage Use Tax And Casual Sales Forms alongside other business processes. Whether you use accounting software or customer relationship management tools, our integrations allow for smooth data transfer and enhanced efficiency. This ensures your records remain accurate and up-to-date.

-

What benefits can I expect from using airSlate SignNow for Use Tax And Casual Sales Forms?

By using airSlate SignNow for Use Tax And Casual Sales Forms, businesses can expect signNow time savings and increased accuracy in document handling. Our platform reduces the likelihood of errors associated with manual paperwork and allows for faster processing times. Plus, the electronic nature of our services promotes eco-friendliness and enhances accessibility.

-

Can airSlate SignNow help with compliance regarding Use Tax And Casual Sales Forms?

Absolutely! airSlate SignNow is designed to help users maintain compliance with regulations surrounding Use Tax And Casual Sales Forms. By providing clear templates and a structured workflow, our platform ensures users follow all necessary steps and meet filing deadlines set by the Department of Taxation And Finance.

Get more for Use Tax And Casual Sales Forms Department Of Taxation And Finance

- Form ss 4pr rev february espanol solicitud de numero de identificacion patronal ein

- Notice of default form

- Minor behavior tracking form koi educationcom

- Complete this form to notify blue cross and blue shield of louisiana of a possible overpayment for an out of state

- 4404a official notice decision of board of civil authority state vt form

- Application license and certificate of marriage form

- 7a 305 costs in civil actions form

- D20a form 03 request for setting

Find out other Use Tax And Casual Sales Forms Department Of Taxation And Finance

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile