Ny St 130 Form 2015

What is the Ny St 130 Form

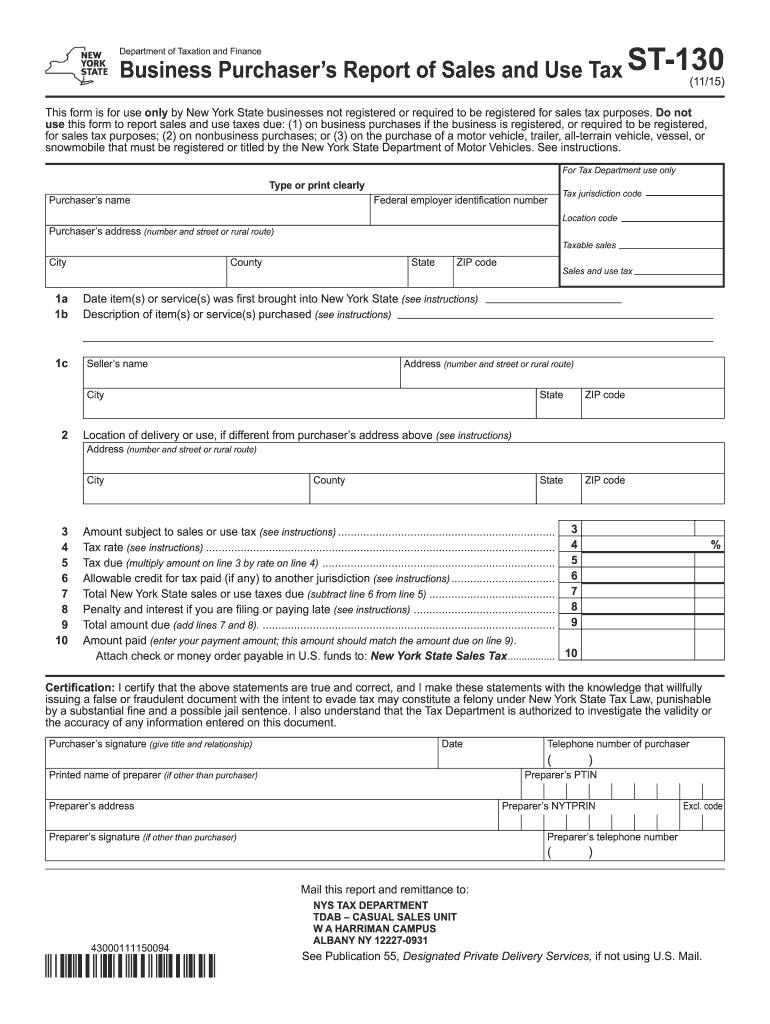

The Ny St 130 Form is a tax-related document used by individuals and businesses in New York State to report specific financial information. It is essential for ensuring compliance with state tax regulations. The form is designed to collect data necessary for accurate tax assessment and reporting, making it a vital component of the tax filing process in New York.

How to use the Ny St 130 Form

Using the Ny St 130 Form involves several straightforward steps. First, gather all necessary financial information relevant to the reporting period. This may include income statements, expense records, and any other documentation required. Next, access the form online or obtain a physical copy. Fill in the required fields accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the Ny St 130 Form

Completing the Ny St 130 Form can be broken down into a series of clear steps:

- Gather all relevant financial documents, including income and expense records.

- Access the Ny St 130 Form through an online platform or download a physical copy.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any mistakes or missing information.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Ny St 130 Form

The Ny St 130 Form is legally recognized for tax reporting purposes in New York State. It must be completed in accordance with state tax laws to ensure its validity. Proper use of the form helps individuals and businesses meet their tax obligations and avoid potential penalties. It is important to keep a copy of the submitted form for your records, as it may be required for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Ny St 130 Form vary based on the type of filer and the specific tax year. Generally, individuals and businesses should be aware of the annual deadlines for submitting their tax forms to avoid late fees. It is advisable to check the New York State Department of Taxation and Finance website for specific dates related to the current tax year, as these can change annually.

Required Documents

To complete the Ny St 130 Form, certain documents are required. These typically include:

- Income statements, such as W-2 or 1099 forms.

- Records of deductible expenses.

- Any prior year tax returns for reference.

- Documentation of any credits or deductions you plan to claim.

Form Submission Methods (Online / Mail / In-Person)

The Ny St 130 Form can be submitted through various methods, providing flexibility for filers. Options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a printed copy of the form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete ny st 130 2015 form

Your assistance manual on how to prepare your Ny St 130 Form

If you’re curious about how to finalize and submit your Ny St 130 Form, here are a few brief recommendations on making tax reporting easier.

To begin, you just need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax paperwork seamlessly. With its editor, you can toggle between text, check boxes, and eSignatures and revert to modify answers when necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finish your Ny St 130 Form within minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to access any IRS tax form; browse through variations and schedules.

- Click Get form to launch your Ny St 130 Form in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your version, send it to your intended recipient, and download it to your device.

Utilize this manual to submit your taxes digitally with airSlate SignNow. Please be aware that submitting on paper can increase return mistakes and delay refunds. Naturally, prior to e-filing your taxes, verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ny st 130 2015 form

FAQs

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

Will they suspend my B-1 visa if my husband fills out an I-130 form?

Usually no. Typically your B1 is not affected if any relative, including a husband, files a I130 Form. There is no system to notify officials with authority to cancel a visa that a I130 has been filed.An interesting point is that a relative, including a husband, can file an I130 petition without the consent of the beneficiary and even without the knowledge of the beneficiary. Therefore it is entirely possible that a B1 visa applicant can be asked if an I130 has been filed on their behalf and can truthfully answer ““not that I know.” Ignorance can be bliss.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

Create this form in 5 minutes!

How to create an eSignature for the ny st 130 2015 form

How to make an eSignature for your Ny St 130 2015 Form online

How to generate an electronic signature for your Ny St 130 2015 Form in Chrome

How to generate an electronic signature for putting it on the Ny St 130 2015 Form in Gmail

How to create an electronic signature for the Ny St 130 2015 Form right from your smartphone

How to make an eSignature for the Ny St 130 2015 Form on iOS

How to create an electronic signature for the Ny St 130 2015 Form on Android devices

People also ask

-

What is the Ny St 130 Form and how is it used?

The Ny St 130 Form is a legal document used for specific filing purposes in New York State. It allows users to formally submit applications or requests applicable in various scenarios. With airSlate SignNow, you can easily create, send, and eSign the Ny St 130 Form quickly, ensuring compliance and efficiency.

-

How does airSlate SignNow simplify the completion of the Ny St 130 Form?

airSlate SignNow simplifies the process of completing the Ny St 130 Form by providing a user-friendly interface and customizable templates. Users can easily fill out the necessary fields and add signatures, making the process seamless. Furthermore, automating workflows with SignNow ensures that the Ny St 130 Form is processed promptly.

-

What are the pricing options for using airSlate SignNow to manage the Ny St 130 Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Depending on the number of users and features required for handling the Ny St 130 Form, you can choose from several packages. Each plan targets businesses looking for cost-effective solutions to streamline document workflows, including eSigning and document management.

-

Can I integrate airSlate SignNow with other applications while using the Ny St 130 Form?

Yes, airSlate SignNow supports various integrations with popular business applications, enhancing efficiency when handling the Ny St 130 Form. You can connect SignNow with CRM systems, cloud storage, and other tools to simplify your workflow. This integration capability allows users to easily manage documents and data associated with the Ny St 130 Form.

-

What benefits does airSlate SignNow offer for users dealing with the Ny St 130 Form?

Using airSlate SignNow for the Ny St 130 Form provides numerous benefits, including streamlined eSigning processes and signNow time savings. Users can quickly send and receive signed documents without the hassles of printing or scanning. Additionally, SignNow ensures that your data is secure, compliant, and easily accessible.

-

Is it possible to track the status of the Ny St 130 Form once it's sent for eSignature?

Yes, airSlate SignNow offers real-time tracking capabilities for documents, including the Ny St 130 Form. Users can monitor when the document has been viewed, signed, or completed, providing transparency throughout the signing process. This feature allows for better management and follow-up on important paperwork.

-

Does airSlate SignNow provide security for documents like the Ny St 130 Form?

Absolutely, airSlate SignNow prioritizes document security, especially for important forms like the Ny St 130 Form. All documents are encrypted, and access controls ensure that only authorized users can view or sign the document. Compliance with legal standards further enhances the security of your electronic signing process.

Get more for Ny St 130 Form

- Withdrawal of foreign registration statement form

- Change of owner form 7 pdf 238kb ohio dnr division of oil

- R e q u e s t for c h a n g e of o w n e r form 7

- Suta request form pdf

- Pc 211 connecticut probate courts form

- Affidavit for filing will not submitted for probate pc 211 form

- Affidavit in support of motion for confidentiality legalhelpwy form

- B 201 notice of available chapters rev cacb uscourts form

Find out other Ny St 130 Form

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later