Cincinnati Income Tax Returns 2018

What is the Cincinnati Income Tax Returns

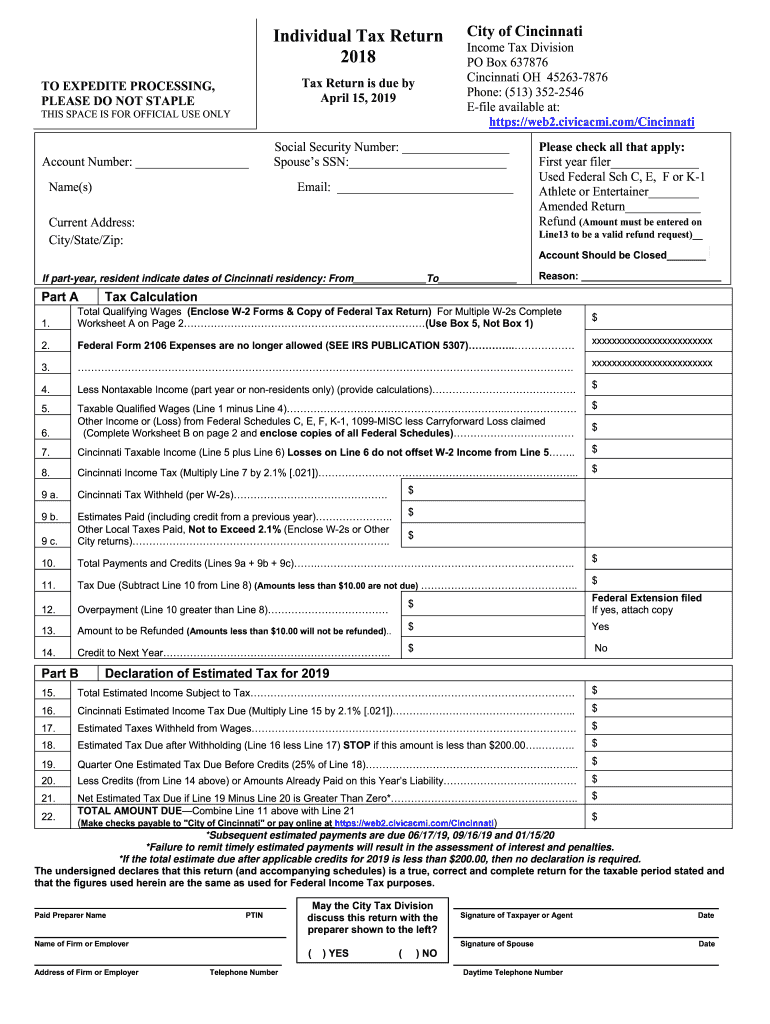

The Cincinnati income tax return is a document that residents of Cincinnati, Ohio, must file to report their income and calculate their tax liability to the city. This return is essential for individuals and businesses alike, as it ensures compliance with local tax regulations. The income tax rate in Cincinnati is typically a percentage of the taxpayer's income, and the return must accurately reflect earnings from all sources, including wages, self-employment income, and investments.

Steps to complete the Cincinnati Income Tax Returns

Completing the Cincinnati income tax return involves several important steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which may include options such as single, married filing jointly, or head of household.

- Fill out the appropriate tax return form, ensuring all income and deductions are accurately reported.

- Calculate the total tax owed or refund due based on the city's tax rate.

- Review the completed return for accuracy before submitting it.

- Submit the return either electronically or by mail, ensuring it is sent to the correct address.

How to obtain the Cincinnati Income Tax Returns

Cincinnati income tax returns can be obtained from the City of Cincinnati's official website or through local tax offices. The forms are typically available in both digital and printable formats, allowing taxpayers to choose their preferred method of completion. It is important to ensure that the correct version of the form is used, as there may be updates or changes from year to year.

Required Documents

When preparing to file a Cincinnati income tax return, certain documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as interest or dividends.

- Documentation of any deductions or credits being claimed.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Cincinnati have several options for submitting their income tax returns. The methods include:

- Online Submission: Many taxpayers choose to file electronically through the city’s tax portal, which is a quick and efficient method.

- Mail: Paper forms can be completed and mailed to the designated tax office. It is advisable to send returns via certified mail to ensure delivery.

- In-Person: Taxpayers can also submit their returns in person at designated city tax offices, which may offer assistance for those needing help with the process.

Penalties for Non-Compliance

Failure to file a Cincinnati income tax return or pay the owed taxes can result in significant penalties. These may include:

- Late filing fees, which accumulate over time until the return is submitted.

- Interest on any unpaid taxes, increasing the total amount owed.

- Potential legal actions if tax obligations remain unresolved for an extended period.

Quick guide on how to complete individual tax return 2018

Your instructional manual on how to get ready your Cincinnati Income Tax Returns

If you’re wondering how to finalize and submit your Cincinnati Income Tax Returns, here are some brief guidelines on how to simplify tax processing.

To start, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and finalize your tax paperwork seamlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revert to change details as necessary. Enhance your tax organization with advanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to finalize your Cincinnati Income Tax Returns in no time:

- Create your account and begin working on PDFs within minutes.

- Utilize our library to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Cincinnati Income Tax Returns in our editor.

- Complete the required input fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, deliver it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can increase return errors and delay refunds. Furthermore, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct individual tax return 2018

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

What is ITR1 form?

Income Tax ReturnTax return is a form that you are required to file and contains information about your income as well as tax liability thereon. You are required to file these tax return forms with the Income Tax Department. The Income Tax Act, 1961, obligates the citizens of India to file their tax returns, at the end of every Financial Year, with the I-T Department. However, it is not mandatory for every citizen. There are different types of ITR form and each form is applicable to a certain section of assessee. These forms need to be filed on a specified due date. Income Tax Department will process only those tax returns which are filed in proper forms and within the due date.ITR Form 1The single Income Tax Return (ITR) form, notified by the CBDT on April 5, has been put on its website, e-Filing Home Page, Income Tax Department, Government of India"Other ITRs will be available shortly," said the Income Tax e-filing website.The new ITR forms for the assessment year 2018-19 mandate the salaried class assessees to provide their salary breakup, and businessmen their GST number and turnover.The Central Board of Direct Taxes (CBDT), that frames policy for the tax department, had said some fields have been "rationalised" in the latest forms and that there is no change in the manner of filing the ITRs as compared to the last year.The form this time seeks an assessees salary details in separate fields and in a breakup format such as allowances that are not exempted, value of perquisites, profit in lieu of salary and deductions claimed under section 16.These details are provided in the Form 16 of a salaried employee and a senior tax official said that these are now meant to be mentioned in the ITR for clarity of deductions.The CBDT had said that the ITR-1 can be filed by an individual who "is resident other than not ordinarily resident and having an income of up to Rs 50 lakh."Which ITR Form to File?The Finance Minister has promised to the individual tax payer that he will make tax filing simpler for them, fulfilling this promise CBDT has now introduced a simplified ITR 1 Form applicable only for individuals having income up to Rs. 50 lakh. But taxpayers having dividend income above Rs. 10 lakh or unexplained credit can’t opt for ITR-1. The ITR-2A introduced in 2016 has now been withdrawn and even the old ITR-3 is merged with ITR-2. As such all the individual taxpayers (except those who are eligible to use ITR-1 or those earning business incomes) would be required to file ITR-2 only.Old ITR-4 is now replaced by ITR-3 as such the individual taxpayer earning income from business or profession are now required to use ITR-3. Taxpayers opting for presumptive taxation were required to file ITR-4S but now they are required to file ‘ITR-4 SUGAM’ for presumptive income.What is the structure of ITR 1 Form?Part A – General InformationPart B – Gross total IncomePart C – Deductions and taxable total incomePart D – Computation of Tax PayablePart E – Other InformationSchedule IT – Detail of Advance tax and Self-Assessment Tax paymentsSchedule TDS – Detail of TDS/TCSWho is eligible to file the ITR-1 FormITR -1 should be filed for an assessment year, when Total Income of an Individual includes:Income from Salary/PensionIncome from One House Property (excluding cases where loss is brought forward from previous years)Income from Other Sources (excluding winning from Lottery and Income from Race Horses)In case of clubbed Income Tax Returns, where a spouse or a minor is included, this can be done only if their income too is limited to the above specifications.When Should ITR – 1 be filed?ITR-1 form is to be used when the assessee has income that is within Rs. 50 Lakhs and when the source of income falls into any of the below categories:Income from Salary/ PensionIncome from just one house propertyIncome from other sources excluding Winning from Lottery, Race Horses, income from foreign assets, Capital Gains, Business or Profession, Agricultural income that exceeds Rs. 5000.Who can’t use Form ITR 1?Return in ITR 1 cannot be used by an individual if he:Is resident and ordinarily resident of India and has, –Any asset (including financial interest in any entity) located outside India; orSigning authority in any account located outside India; orIncome from any source outside India.Has earned income from capital gains or business or professionHas income from more than one house propertyHas losses under the head income from other sourcesHas total income above Rs 50 lakhsHas dividend income above Rs 10 lakhs taxable under Section 115BBDAHas unexplained credit or investment taxable at 60% under Section 115BBE.Has agricultural income exceeding Rs 5000Has income from winning from lottery or horse raceHas claimed any relief u/s. 90 or 90A or 91AHow do I file my ITR-1 Form?You can submit your ITR-1 Form either online or offline.Offline:Only following persons have the option to file the return in paper formAn individual at the age of 80 years or more at any time during the previous yearAn individual or HUF whose income does not exceed Rs 5 lakhs and who has not claimed any refund in the return of incomeFor offline ,the return is furnished in a physical paper form.The Income Tax Department will issue you an acknowledgment at the time of submission of your physical paper return.Online/Electronically:By transmitting the data electronically and then submitting the verification of the return in the form of ITR-V to CPC, Bengaluru.By filing the return online and e-verifying the ITR-V through net banking/adhaar OTP/EVC.If you submit your ITR-1 Form electronically, the acknowledgment will be sent to your registered email id. You can also choose to download it manually from the income tax website. You are then required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing. Alternatively, you can e-verify your return.The Major Changes which are made in the ITR 1 for the AY 2018-19 are:Earlier ITR-1 was applicable for both Residents, Residents Not ordinarily resident (RNOR) and also Non-residents. Now this from has been made applicable only for resident individuals.The condition of the individual having income from salaries, one house property, other income and having total income upto Rs 50 lakhs continuesThere is a requirement to furnish a break-up of salary. Until now, these details would appear only in Form 16 and the requirement to disclose them in the return had never arisen.There is also a requirement to furnish a break up of Income under House Property which was earlier mandatory only for ITR -2 and other formsTerms to know in ITR Form 1:Revised Return: If you have already filed your income tax return but you later discover that you have made a mistake in it, you can re-file. This is called a Revised Return. For the Financial Year 2017-18, you can file your Revised Return till March 31, 2019.Notice Number: You should fill this in only if you are filing your return in response to a notice from the Income Tax Department.Advance Tax: For salaried individuals, TDS mostly takes care of advance tax payments. However you might have other forms of income – like interest on savings bank accounts, fixed deposits, rental income, bonds or capital gains. If tax on income is more than Rs. 10,000 per year, you are required to estimate your income and pay Advance Tax. This has to be paid in quarterly installments in June, September, December and March.Self-Assessment Tax Payments: This is the difference between tax payable and tax paid and it needs to be paid before you file your return. When you fill out the form for the first time, you won’t know whether Self-Assessment Tax has to be paid or not. So, fill out the form first along with the Advance Tax details, if paid. Compute your income and if after computing, you find that tax is still payable, pay it and then fill in the details in self-assessment tax paid section in the return.Annexure-less Return: ITR-1 Form is an Annexure-less return. This means that you do not have to attach any documents (such as Form 16/Form 26AS) with the ITR-1 Form.Important information required to file ITR:PAN card is mandatory for all the assesseesAadhaar card has now been made mandatory for individual tax filers. In case of non-individual tax payers, the Aadhaar card of the authorized person is required to be providedIncome from salary, agriculture, other sources, house property, profession, capital gainsPersonal details like name, mobile number, address, type of employmentDeductions under chapter 10, chapter VI-A and many other sections like Section 80U, 80C, 80DComplete bank account details including branch, IFSC number along with account numberSelf-assessment tax paid, advance tax paid, TCS and TDS will be updated automaticallyDetails of cash deposited of the old, demonetized notes made between 9th November to 31st December 2016 and exceeding Rs. 2 lakhYou can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

What Indian income tax return should an NRI with only bank interest income file?

Greeting !!!You can file ITR - 1, If you only Interest Income.Which Income Tax Return Form Require to file or applicable F.Y. 2015–16 by Hetal M Kukadiya on Tax Knowledge Bank - IndiaBe Peaceful !!!

Create this form in 5 minutes!

How to create an eSignature for the individual tax return 2018

How to generate an eSignature for your Individual Tax Return 2018 online

How to create an electronic signature for the Individual Tax Return 2018 in Chrome

How to generate an eSignature for signing the Individual Tax Return 2018 in Gmail

How to make an eSignature for the Individual Tax Return 2018 from your mobile device

How to create an electronic signature for the Individual Tax Return 2018 on iOS devices

How to create an electronic signature for the Individual Tax Return 2018 on Android OS

People also ask

-

What are Cincinnati Income Tax Returns and why are they important?

Cincinnati Income Tax Returns are essential documents that report your earnings and taxes owed to the city of Cincinnati. Filing these returns is crucial for compliance with local tax regulations and can help you avoid penalties. Understanding how to navigate this process can signNowly affect your financial situation.

-

How can airSlate SignNow help with Cincinnati Income Tax Returns?

airSlate SignNow streamlines the process of completing and submitting Cincinnati Income Tax Returns by allowing you to easily eSign and send documents. Our user-friendly platform ensures that you can manage your tax forms efficiently, reducing the time and hassle typically associated with tax preparation. Plus, our solution is cost-effective, making it accessible for individuals and businesses alike.

-

What features does airSlate SignNow offer for managing Cincinnati Income Tax Returns?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all tailored for managing Cincinnati Income Tax Returns. These functionalities ensure that your tax documents are completed accurately and submitted on time. With our platform, you can also collaborate with tax professionals seamlessly.

-

Is there a cost associated with using airSlate SignNow for Cincinnati Income Tax Returns?

Yes, airSlate SignNow offers various pricing plans to suit different needs, making it a cost-effective solution for managing Cincinnati Income Tax Returns. Our plans are designed to provide great value and flexibility, allowing you to choose the one that fits your budget and requirements. Additionally, we offer a free trial to help you get started.

-

Can airSlate SignNow integrate with other tax software for Cincinnati Income Tax Returns?

Absolutely! airSlate SignNow seamlessly integrates with popular tax software, making it easier to prepare and file your Cincinnati Income Tax Returns. This integration allows you to import data directly into our platform, reducing manual entry and errors. Our goal is to enhance your tax preparation experience.

-

What benefits do I gain from using airSlate SignNow for my Cincinnati Income Tax Returns?

Using airSlate SignNow for Cincinnati Income Tax Returns offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform simplifies the eSigning process, ensuring that you can complete your returns quickly and without stress. You'll also have access to support and resources to guide you through your tax filing.

-

How secure is my information when using airSlate SignNow for Cincinnati Income Tax Returns?

Your security is our top priority at airSlate SignNow. We employ advanced encryption and security measures to protect your information while you manage your Cincinnati Income Tax Returns. You can rest assured that your personal and financial data is safe and secure on our platform.

Get more for Cincinnati Income Tax Returns

- Warehouse forklift form doc

- Certificate of immunization clayton state university clayton form

- Narrative writing rubric kindergarten form

- Lease to own homes agreement form

- Po box 1430 sdfcu deposit form

- Montague rodeo form

- Fertilizers canadian food inspection agency form

- Ameritas mutual holding company notice of form

Find out other Cincinnati Income Tax Returns

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy