Cincinnati Income Tax New Account Application 2024-2026

What is the Cincinnati Income Tax New Account Application

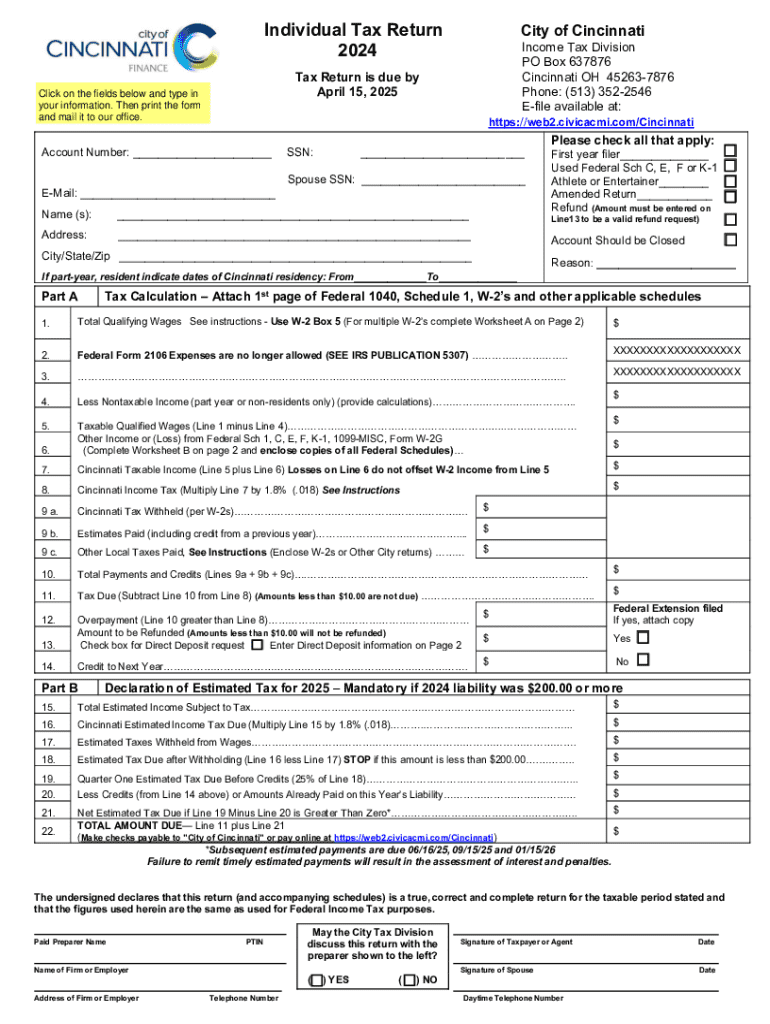

The Cincinnati Income Tax New Account Application is a form used by individuals and businesses to register for a new income tax account within the city of Cincinnati. This application is essential for those who are newly employed, starting a business, or relocating to Cincinnati, as it allows the city to track tax obligations and ensure compliance with local tax laws. Completing this application is a crucial step in fulfilling tax responsibilities and avoiding penalties.

Steps to complete the Cincinnati Income Tax New Account Application

Completing the Cincinnati Income Tax New Account Application involves several key steps:

- Gather necessary information, including your Social Security number or Employer Identification Number (EIN), business name (if applicable), and contact details.

- Obtain the application form, which can be accessed online or at designated city offices.

- Fill out the application accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application via the preferred method, which may include online submission, mailing, or in-person delivery.

Required Documents

When applying for a new income tax account in Cincinnati, certain documents may be required to support your application. These typically include:

- Proof of identity, such as a driver's license or state ID.

- Social Security number or Employer Identification Number (EIN).

- Any relevant business registration documents if applying as a business entity.

- Contact information, including a valid address and phone number.

Form Submission Methods

The Cincinnati Income Tax New Account Application can be submitted through various methods to accommodate different preferences:

- Online: Submit the application through the official city tax website for a quick and efficient process.

- Mail: Send the completed application form to the designated city tax office address.

- In-Person: Deliver the application directly to a city tax office for immediate processing.

Eligibility Criteria

To qualify for a Cincinnati Income Tax New Account, applicants must meet specific eligibility criteria. Generally, these include:

- Individuals who have recently moved to Cincinnati.

- New employees working within the city limits.

- Business owners establishing a new business in Cincinnati.

Penalties for Non-Compliance

Failure to complete the Cincinnati Income Tax New Account Application may result in penalties. These can include:

- Fines for late registration.

- Interest on unpaid taxes.

- Potential legal action for continued non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct cincinnati income tax new account application

Create this form in 5 minutes!

How to create an eSignature for the cincinnati income tax new account application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to tax Cincinnati?

airSlate SignNow is a powerful eSignature solution that allows businesses in Cincinnati to streamline their document signing processes. By using airSlate SignNow, companies can efficiently manage tax-related documents, ensuring compliance and reducing turnaround times. This makes it an ideal choice for businesses dealing with tax Cincinnati.

-

How much does airSlate SignNow cost for businesses in Cincinnati?

The pricing for airSlate SignNow is competitive and designed to fit the budgets of businesses in Cincinnati. We offer various plans that cater to different needs, ensuring that you only pay for the features you require. This cost-effective solution is perfect for managing tax Cincinnati efficiently.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow provides a range of features tailored for handling tax documents in Cincinnati, including customizable templates, secure eSigning, and document tracking. These features help ensure that your tax Cincinnati documents are processed quickly and securely, enhancing your overall workflow.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various software solutions commonly used for tax management in Cincinnati. This includes accounting software and CRM systems, allowing for a more streamlined approach to handling tax Cincinnati documents. Integration helps reduce manual data entry and improves accuracy.

-

How does airSlate SignNow enhance security for tax documents?

Security is a top priority for airSlate SignNow, especially for sensitive tax documents in Cincinnati. Our platform uses advanced encryption and complies with industry standards to protect your data. This ensures that your tax Cincinnati documents are safe from unauthorized access.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone in Cincinnati to navigate the platform. Even if you're new to eSigning, our intuitive interface will guide you through the process of managing tax Cincinnati documents effortlessly.

-

What benefits can businesses in Cincinnati expect from using airSlate SignNow?

Businesses in Cincinnati can expect numerous benefits from using airSlate SignNow, including increased efficiency, reduced paper usage, and faster turnaround times for tax documents. By digitizing your tax Cincinnati processes, you can focus more on your core business activities and less on paperwork.

Get more for Cincinnati Income Tax New Account Application

Find out other Cincinnati Income Tax New Account Application

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form