Cincinnati Tax Forms 2019

What is the Cincinnati Tax Forms

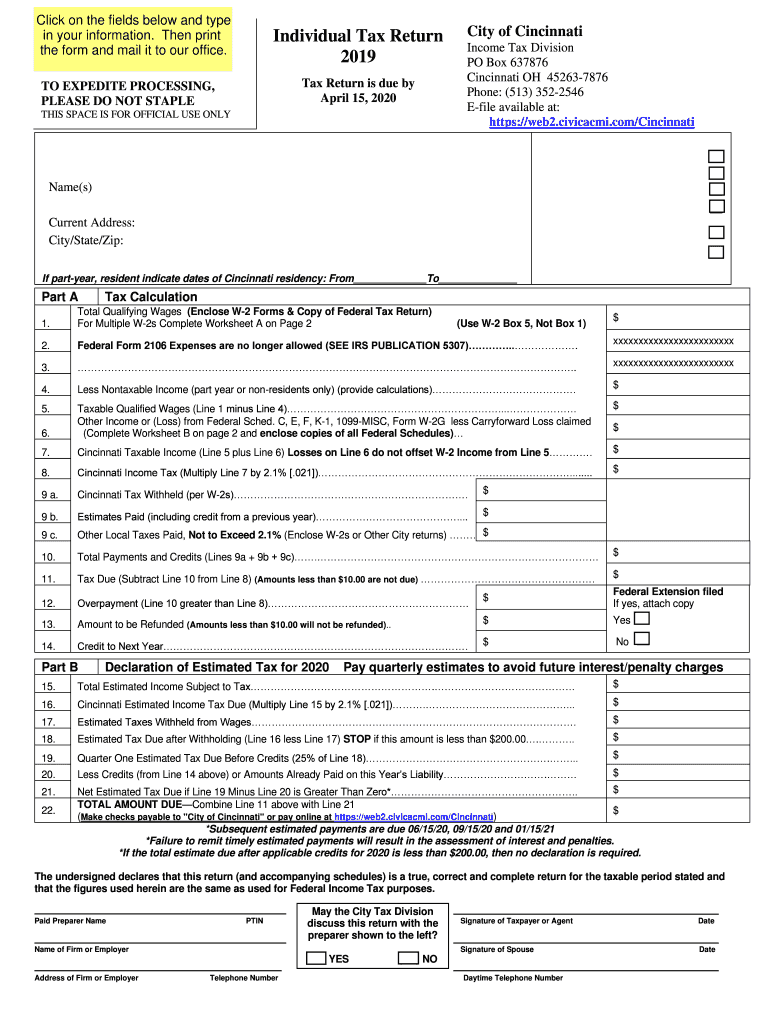

The Cincinnati tax forms are essential documents required for filing local income taxes within the city of Cincinnati, Ohio. These forms are used by residents and businesses to report their earnings and determine their tax liabilities. The forms include various types, such as individual income tax returns, business tax returns, and other related documents necessary for compliance with local tax regulations.

How to use the Cincinnati Tax Forms

Using the Cincinnati tax forms involves several steps. First, you need to determine which specific form applies to your situation, whether it is for individual income tax or business taxes. Next, gather all necessary financial information, such as income statements and deductions. Once you have completed the form, it can be submitted either electronically or via mail, depending on the specific requirements for the form you are using.

Steps to complete the Cincinnati Tax Forms

To complete the Cincinnati tax forms, follow these steps:

- Identify the correct form for your tax situation.

- Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions.

- Submit the form by the specified deadline, either online or by mail.

Legal use of the Cincinnati Tax Forms

The legal use of Cincinnati tax forms is governed by local tax laws and regulations. It is crucial to ensure that the forms are filled out accurately and submitted on time to avoid penalties. The forms must be signed and dated, and electronic submissions should comply with the guidelines set forth by the city of Cincinnati to ensure their validity.

Filing Deadlines / Important Dates

Filing deadlines for Cincinnati tax forms typically align with the federal tax deadlines. Individual income tax returns are usually due by April 15 each year. However, it is essential to check for any specific local extensions or changes that may apply. Keeping track of these important dates helps ensure timely filing and compliance with local tax regulations.

Required Documents

When completing the Cincinnati tax forms, certain documents are required to support your filing. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as rental or investment income

- Documentation for any deductions or credits you plan to claim

Form Submission Methods (Online / Mail / In-Person)

Cincinnati tax forms can be submitted through various methods. You can file online via the city’s tax portal, which offers a convenient way to submit your forms electronically. Alternatively, you can mail your completed forms to the appropriate tax office address. In-person submissions may also be accepted during designated hours at local tax offices, providing another option for taxpayers who prefer direct interaction.

Quick guide on how to complete individual taxesindividual tax forms and instructions

Effortlessly Manage Cincinnati Tax Forms on Any Device

The management of online documents has gained signNow traction among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Cincinnati Tax Forms on any device using the airSlate SignNow apps for Android or iOS and enhance your document-focused workflow today.

Easily Modify and Electronically Sign Cincinnati Tax Forms

- Locate Cincinnati Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information using the tools available from airSlate SignNow specifically designed for this purpose.

- Generate your electronic signature with the Sign tool, which only takes a moment and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your method of sharing the form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching through forms, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Cincinnati Tax Forms and ensure clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual taxesindividual tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the individual taxesindividual tax forms and instructions

How to make an eSignature for your Individual Taxesindividual Tax Forms And Instructions in the online mode

How to generate an eSignature for your Individual Taxesindividual Tax Forms And Instructions in Chrome

How to generate an eSignature for signing the Individual Taxesindividual Tax Forms And Instructions in Gmail

How to generate an electronic signature for the Individual Taxesindividual Tax Forms And Instructions from your smart phone

How to make an electronic signature for the Individual Taxesindividual Tax Forms And Instructions on iOS

How to create an electronic signature for the Individual Taxesindividual Tax Forms And Instructions on Android

People also ask

-

What is airSlate SignNow and how can it help with tax Cincinnati?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents easily. For those dealing with tax Cincinnati, it streamlines the document signing process, making it more efficient and less time-consuming.

-

How much does airSlate SignNow cost for tax Cincinnati users?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on tax Cincinnati. Whether you are a solo entrepreneur or a larger business, you can choose a plan that fits your budget while providing essential features for efficient document management.

-

What features does airSlate SignNow provide for managing tax-related documents in Cincinnati?

airSlate SignNow includes features like customizable templates, advanced security, and integration capabilities specifically designed to handle tax Cincinnati forms. These features enable businesses to create, send, and sign tax documents with maximum efficiency.

-

Can I integrate airSlate SignNow with other software for tax Cincinnati purposes?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it an ideal choice for tax Cincinnati needs. Whether you use accounting software or CRM systems, you can enhance your workflow by integrating airSlate SignNow to manage tax documents.

-

What are the primary benefits of using airSlate SignNow for tax Cincinnati?

The primary benefits of using airSlate SignNow for tax Cincinnati include its ease of use, cost-effectiveness, and enhanced security features. Businesses can save time, reduce paperwork, and ensure compliance when managing their tax documents.

-

Is airSlate SignNow suitable for both small and large businesses in Cincinnati dealing with taxes?

Absolutely! airSlate SignNow is a versatile solution suitable for both small and large businesses in Cincinnati that manage tax-related documents. Its scalable pricing and feature set make it easy for any business size to benefit from eSignatures.

-

How does airSlate SignNow ensure the security of tax documents in Cincinnati?

airSlate SignNow prioritizes security, employing advanced encryption and secure cloud storage for all tax documents in Cincinnati. This ensures that sensitive information remains confidential and protected from unauthorized access.

Get more for Cincinnati Tax Forms

- Versicherungs nr ams form

- Pdf vidhyajyothi iob bank form

- California meal form

- Resource master answers geometry chapter 10 form

- Tenant emergency contact form

- Dh1054b employment income details to be completed by the employer to confirm income details for their employee who is a client form

- Crane erection application form civil aviation

- Trailer condition report jones motor form

Find out other Cincinnati Tax Forms

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now