City of Cincinnati the Best Template and Form 2020

Understanding the City of Cincinnati Tax Forms

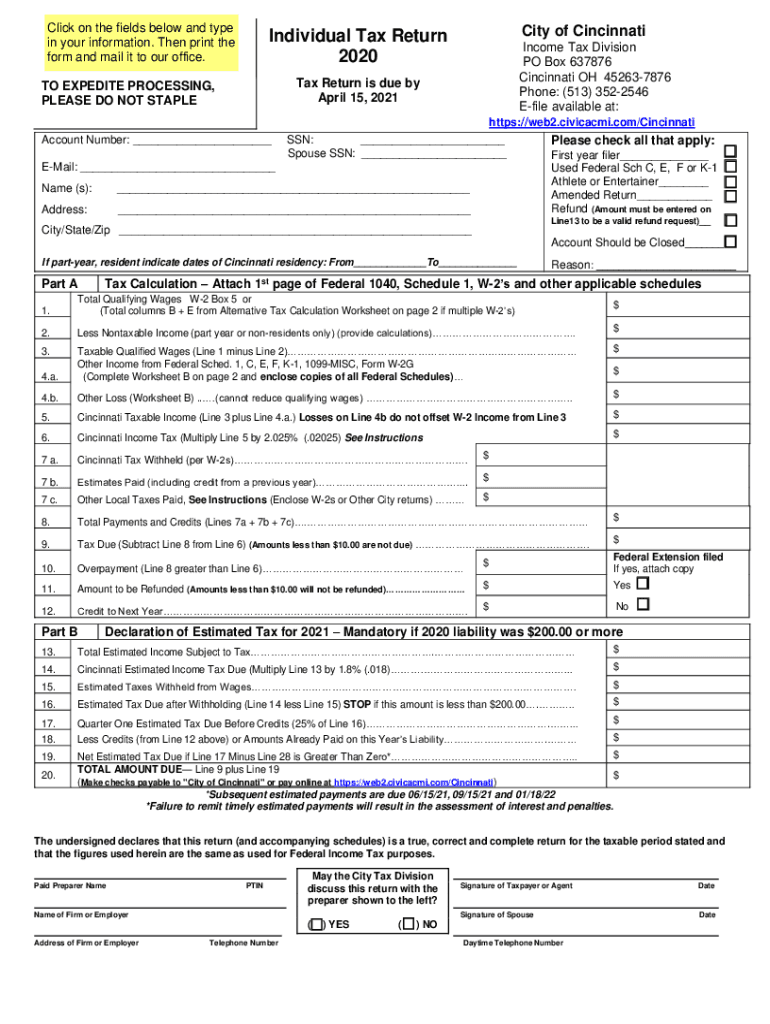

The City of Cincinnati tax forms are essential documents for residents and businesses to report their income and calculate their tax liabilities. These forms are specifically designed to comply with local tax regulations and ensure accurate reporting of income earned within the city. Familiarity with these forms is crucial for both individuals and businesses to fulfill their tax obligations effectively.

Steps to Complete the Cincinnati Tax Forms

Completing the Cincinnati tax forms involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, select the appropriate form based on your tax situation, such as the individual tax return for residents or specific forms for businesses. Carefully fill out each section, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines for Cincinnati tax forms to avoid penalties. Typically, individual tax returns are due by April 15 each year, while business tax filings may have different deadlines depending on the entity type. Staying informed about these dates helps ensure timely submissions and compliance with local tax laws.

Form Submission Methods

Cincinnati tax forms can be submitted through various methods to accommodate different preferences. Residents can choose to file their forms online through the city’s tax portal, which offers a convenient and efficient way to complete the process. Alternatively, forms can be mailed directly to the city’s tax office or submitted in person. Each method has its own guidelines, so it is important to follow the instructions provided for the chosen submission method.

Legal Use of Cincinnati Tax Forms

Utilizing Cincinnati tax forms correctly is essential for legal compliance. These forms are designed to meet the standards set by local tax laws, ensuring that submitted information is valid and enforceable. When filled out accurately and submitted on time, these forms serve as official records of income and tax obligations, protecting taxpayers from potential legal issues related to non-compliance.

Required Documents for Filing

When preparing to file Cincinnati tax forms, certain documents are required to support your income claims and deductions. Commonly needed documents include proof of income, such as W-2 and 1099 forms, receipts for deductible expenses, and any prior year tax returns. Having these documents ready will streamline the filing process and help ensure that all relevant information is accurately reported.

Penalties for Non-Compliance

Failing to comply with Cincinnati tax filing requirements can result in significant penalties. Late submissions may incur fines, and inaccuracies can lead to audits or additional tax liabilities. Understanding these potential consequences emphasizes the importance of timely and accurate filing of tax forms to avoid unnecessary financial burdens.

Quick guide on how to complete city of cincinnati the best free template and form

Complete City Of Cincinnati The Best Template And Form seamlessly on any device

Online document management has become favored by businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to design, modify, and eSign your documents swiftly without delays. Manage City Of Cincinnati The Best Template And Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign City Of Cincinnati The Best Template And Form effortlessly

- Locate City Of Cincinnati The Best Template And Form and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign City Of Cincinnati The Best Template And Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of cincinnati the best free template and form

Create this form in 5 minutes!

How to create an eSignature for the city of cincinnati the best free template and form

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What are Cincinnati tax forms and why are they important?

Cincinnati tax forms are essential documentation required for filing taxes in Cincinnati. They play a crucial role in ensuring compliance with local tax regulations and can affect your business's financial standing. Understanding these forms can help streamline the tax filing process and avoid penalties.

-

How can airSlate SignNow help with Cincinnati tax forms?

airSlate SignNow simplifies the process of managing Cincinnati tax forms by allowing users to easily send, receive, and eSign documents. Our platform ensures all forms are securely stored and easily accessible, making tax season less stressful. Efficient document management minimizing time spent on paperwork and improves overall productivity.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow offers features like customizable templates, secure eSigning, and automated workflows specifically designed for managing Cincinnati tax forms. These tools help users handle multiple documents effortlessly while ensuring legal compliance. Our platform also allows you to track document status in real-time.

-

Is there a free trial for using airSlate SignNow to manage Cincinnati tax forms?

Yes, airSlate SignNow offers a free trial that allows you to explore its functionalities for managing Cincinnati tax forms. This trial includes access to all features, enabling you to assess how we can enhance your document workflow. After the trial, we offer competitive pricing plans to suit various business needs.

-

Can airSlate SignNow integrate with other accounting software for handling Cincinnati tax forms?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage Cincinnati tax forms. This integration helps streamline data sharing between platforms, ensuring that all tax information is current and accurate. Enhanced connectivity can signNowly reduce the chances of errors during tax preparation.

-

What benefits does eSigning Cincinnati tax forms provide?

eSigning Cincinnati tax forms using airSlate SignNow provides several benefits, including faster turnaround times and enhanced security. By eliminating the need for physical signatures, businesses can expedite the tax filing process and reduce paperwork hassles. Additionally, our encryption ensures that your sensitive information is protected.

-

How secure is airSlate SignNow for Cincinnati tax forms?

airSlate SignNow is highly secure for managing Cincinnati tax forms, utilizing advanced encryption and compliance with industry standards. Our platform ensures that all documents are stored safely and accessible only by authorized users. You can trust us to protect your sensitive tax information throughout the entire process.

Get more for City Of Cincinnati The Best Template And Form

- Behavior intervention manual hawthorne form

- 1040 form schedule c instructions

- Exhibit forms for court

- Dekalb medical doctors excuse form

- Daily traffic control template form

- Certificate of domicile of non resident for indonesia tax form

- Stroh responsible driver program form

- Form of certificate to be produced by other backward classes applying

Find out other City Of Cincinnati The Best Template And Form

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA