Schedule 11 How to Calculate Your Student Tax Credits 2023-2026

What is the Schedule 11 How To Calculate Your Student Tax Credits

The Schedule 11 form is specifically designed to help students and their families calculate eligible tax credits for educational expenses. This form is crucial for claiming credits such as the American Opportunity Tax Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed or increase a tax refund. Understanding how to accurately fill out Schedule 11 is essential for maximizing potential savings on educational costs.

Key elements of the Schedule 11 How To Calculate Your Student Tax Credits

Schedule 11 includes several key elements that are necessary for calculating student tax credits. These elements typically include:

- Qualified Education Expenses: This includes tuition, fees, and course materials required for enrollment.

- Student Information: Personal details about the student, such as Social Security number and enrollment status.

- Taxpayer Information: Information about the taxpayer claiming the credits, including their relationship to the student.

- Credit Calculation: A section dedicated to calculating the amount of credit based on the expenses reported.

Steps to complete the Schedule 11 How To Calculate Your Student Tax Credits

Completing Schedule 11 involves several straightforward steps:

- Gather all necessary documentation, including Form 1098-T, which reports tuition payments.

- Identify qualified education expenses that can be claimed for tax credits.

- Fill out the student and taxpayer information sections accurately.

- Calculate the total eligible expenses and determine the credit amount based on IRS guidelines.

- Review the completed form for accuracy before submission.

How to use the Schedule 11 How To Calculate Your Student Tax Credits

Using Schedule 11 effectively requires understanding its structure and purpose. Begin by filling in the required student and taxpayer information. Next, list all qualified education expenses, ensuring that they align with IRS definitions. After entering the expenses, use the provided calculations to determine the total tax credits available. Finally, attach the completed Schedule 11 to your tax return when filing.

IRS Guidelines

The IRS provides specific guidelines for using Schedule 11, which include eligibility criteria for claiming educational tax credits. It is important to refer to the IRS instructions for the most current information, as tax laws can change. Key guidelines include:

- Eligibility of expenses: Only certain types of expenses qualify for credits.

- Income limitations: There are income thresholds that may affect eligibility for credits.

- Filing requirements: Ensure that Schedule 11 is filed with the appropriate tax return forms.

Required Documents

To complete Schedule 11 accurately, several documents are required:

- Form 1098-T: This form provides information about tuition payments made during the tax year.

- Receipts: Keep detailed receipts for all qualified education expenses.

- Tax Return: Your completed tax return form where Schedule 11 will be attached.

Quick guide on how to complete schedule 11 how to calculate your student tax credits

Complete Schedule 11 How To Calculate Your Student Tax Credits effortlessly on any gadget

Online document administration has become widely embraced by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides all the resources you require to design, modify, and eSign your documents swiftly without delays. Manage Schedule 11 How To Calculate Your Student Tax Credits on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Schedule 11 How To Calculate Your Student Tax Credits with ease

- Locate Schedule 11 How To Calculate Your Student Tax Credits and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Schedule 11 How To Calculate Your Student Tax Credits to ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 11 how to calculate your student tax credits

Create this form in 5 minutes!

How to create an eSignature for the schedule 11 how to calculate your student tax credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 11 and how does it relate to student tax credits?

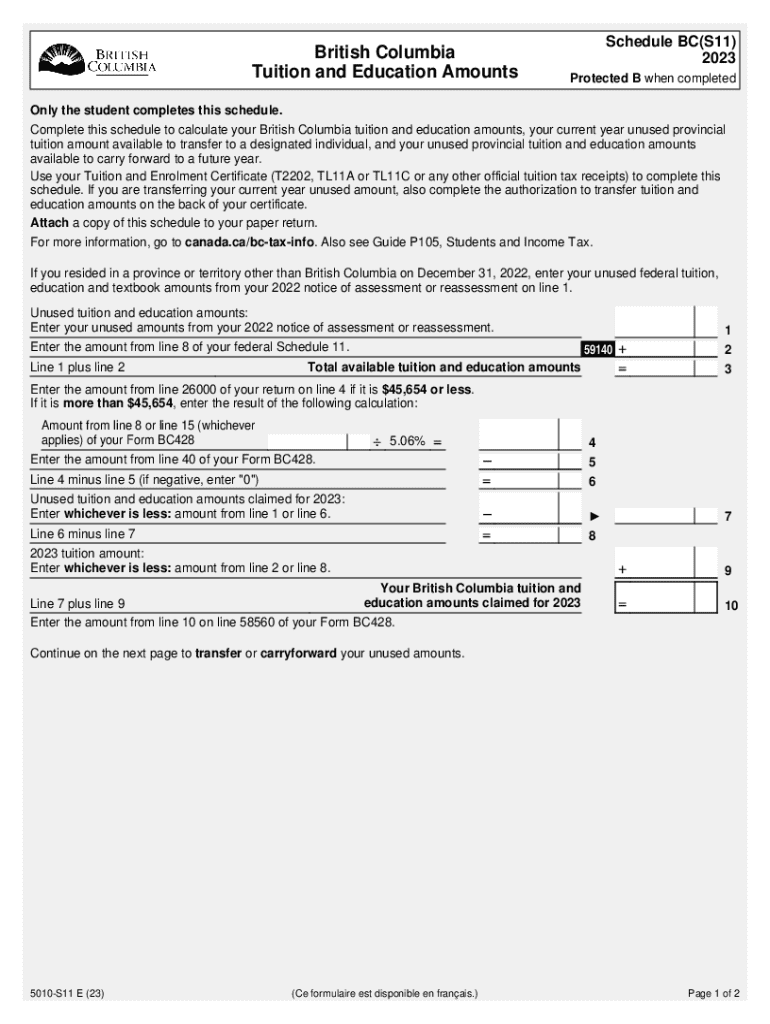

Schedule 11 is a form used in Canada to calculate your student tax credits. It helps you determine the amount of tuition and education amounts you can claim on your tax return. Understanding how to fill out Schedule 11 is essential for maximizing your student tax credits.

-

How can airSlate SignNow help me with my Schedule 11 submissions?

airSlate SignNow provides a seamless way to eSign and send your Schedule 11 documents securely. With our easy-to-use platform, you can ensure that your submissions are completed accurately and on time, helping you maximize your student tax credits.

-

Are there any costs associated with using airSlate SignNow for Schedule 11?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions ensure that you can manage your Schedule 11 submissions without breaking the bank, allowing you to focus on maximizing your student tax credits.

-

What features does airSlate SignNow offer for managing tax documents like Schedule 11?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking. These tools simplify the process of managing your Schedule 11 submissions, ensuring you can easily calculate and claim your student tax credits.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software. This integration allows you to streamline your workflow and efficiently manage your Schedule 11 submissions while maximizing your student tax credits.

-

What are the benefits of using airSlate SignNow for my Schedule 11 calculations?

Using airSlate SignNow for your Schedule 11 calculations offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that you can focus on accurately calculating your student tax credits without the hassle of traditional paperwork.

-

Is airSlate SignNow suitable for students who are new to tax filing?

Yes, airSlate SignNow is designed to be user-friendly, making it suitable for students who are new to tax filing. Our resources and support can guide you through the process of completing Schedule 11 and calculating your student tax credits with confidence.

Get more for Schedule 11 How To Calculate Your Student Tax Credits

Find out other Schedule 11 How To Calculate Your Student Tax Credits

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed