Puerto Rico Question About Form as 26451 2018-2026

Understanding the Puerto Rico Question About Form AS 26451

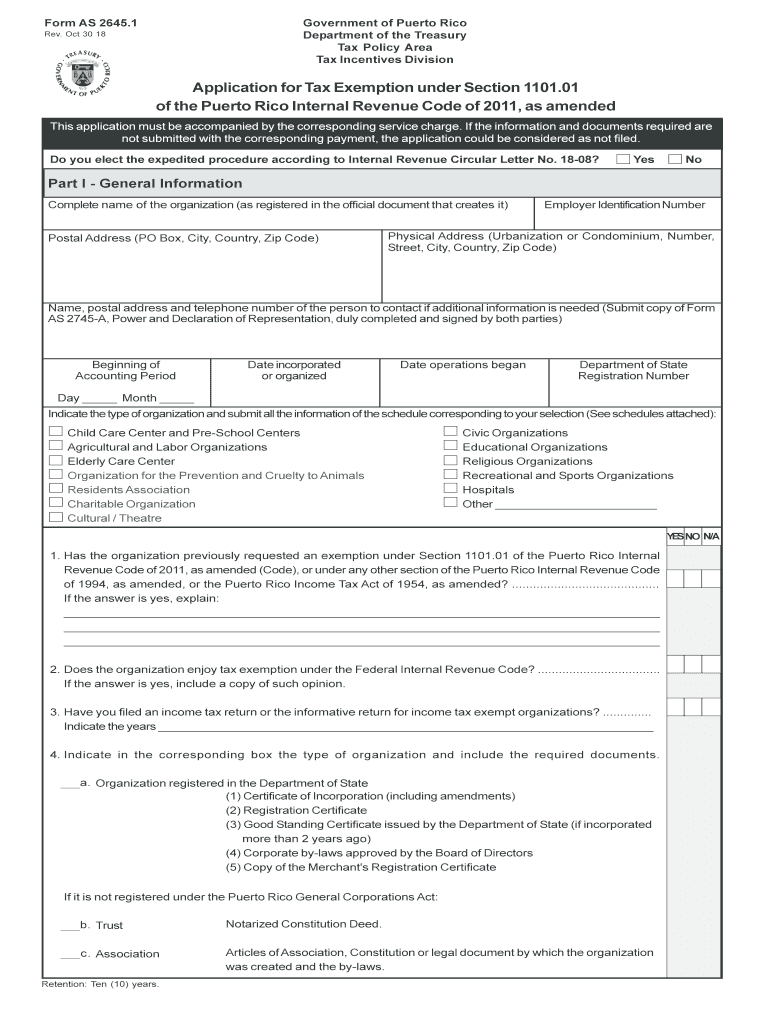

The Puerto Rico Question About Form AS 26451 is a crucial document for individuals and businesses operating within Puerto Rico. This form is primarily designed to address specific tax-related inquiries that pertain to the unique tax structure of Puerto Rico. It serves as a means for the IRS to gather essential information regarding a taxpayer's residency status and eligibility for exemptions or deductions under the Puerto Rican tax code. Understanding the nuances of this form is vital for compliance and to ensure accurate tax reporting.

Steps to Complete the Puerto Rico Question About Form AS 26451

Completing the Puerto Rico Question About Form AS 26451 involves several key steps:

- Gather necessary personal and financial information, including Social Security numbers and income details.

- Carefully read each question on the form to ensure accurate responses.

- Provide information regarding your residency status, including the duration of your stay in Puerto Rico.

- Double-check all entries for accuracy before submitting the form.

- Sign and date the form as required to validate your submission.

Following these steps helps ensure that the form is completed correctly, minimizing the risk of errors that could lead to compliance issues.

Legal Use of the Puerto Rico Question About Form AS 26451

The legal use of the Puerto Rico Question About Form AS 26451 is governed by U.S. tax law, specifically regarding the taxation of residents in Puerto Rico. This form is legally binding and must be filled out truthfully to avoid potential penalties. Misrepresentation or failure to disclose relevant information can result in fines or legal repercussions. It is essential for taxpayers to understand their obligations under both federal and Puerto Rican tax laws when completing this form.

Eligibility Criteria for the Puerto Rico Question About Form AS 26451

Eligibility to complete the Puerto Rico Question About Form AS 26451 generally includes:

- Individuals who are residents of Puerto Rico for more than half of the tax year.

- Taxpayers who have income sourced from Puerto Rico.

- Those seeking to claim specific tax benefits or exemptions available to Puerto Rican residents.

Meeting these criteria is essential for individuals to ensure they are filling out the form correctly and in accordance with IRS regulations.

Filing Deadlines for the Puerto Rico Question About Form AS 26451

Filing deadlines for the Puerto Rico Question About Form AS 26451 typically align with the federal tax filing deadlines. Generally, taxpayers must submit this form by April 15 of the following tax year. However, it is advisable to check for any specific extensions or changes that may apply, especially in light of recent adjustments to tax regulations. Timely submission is crucial to avoid penalties and ensure compliance with tax obligations.

Form Submission Methods for the Puerto Rico Question About Form AS 26451

The Puerto Rico Question About Form AS 26451 can be submitted through various methods:

- Online submission through authorized e-filing platforms.

- Mailing a physical copy to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can enhance the efficiency of the filing process and ensure that the form is received by the IRS in a timely manner.

Quick guide on how to complete puerto rico question about form as 26451 2018 2019

Your assistance manual on how to prepare your Puerto Rico Question About Form As 26451

If you’re uncertain about how to finalize and submit your Puerto Rico Question About Form As 26451, here are some brief recommendations on how to simplify the tax process.

To start, you simply need to set up your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, create, and complete your tax paperwork with ease. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures while going back to modify information as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your Puerto Rico Question About Form As 26451 in just minutes:

- Create your account and start working on PDFs in no time.

- Utilize our catalog to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Puerto Rico Question About Form As 26451 in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally binding electronic signature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper may lead to mistakes on returns and delay refunds. Of course, before electronically filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico question about form as 26451 2018 2019

FAQs

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the puerto rico question about form as 26451 2018 2019

How to create an electronic signature for your Puerto Rico Question About Form As 26451 2018 2019 in the online mode

How to create an eSignature for the Puerto Rico Question About Form As 26451 2018 2019 in Chrome

How to make an eSignature for signing the Puerto Rico Question About Form As 26451 2018 2019 in Gmail

How to generate an eSignature for the Puerto Rico Question About Form As 26451 2018 2019 straight from your smart phone

How to create an eSignature for the Puerto Rico Question About Form As 26451 2018 2019 on iOS

How to generate an eSignature for the Puerto Rico Question About Form As 26451 2018 2019 on Android

People also ask

-

What is form as 2645 1 and why is it important?

Form as 2645 1 is a standardized document used for specific transactions that require attention to detail and compliance. Understanding how to manage this form effectively is crucial for businesses to ensure accuracy and avoid potential issues during processing.

-

How does airSlate SignNow help with managing form as 2645 1?

airSlate SignNow streamlines the process by allowing users to create, send, and eSign form as 2645 1 electronically. This reduces paperwork, saves time, and ensures that all parties can manage their signatures smoothly, enhancing overall productivity.

-

What are the pricing options for using airSlate SignNow with form as 2645 1?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including options specifically designed for handling documents like form as 2645 1. By choosing a suitable plan, you can maximize your document management capabilities while staying within budget.

-

Are there any specific features in airSlate SignNow for form as 2645 1?

Yes, airSlate SignNow provides features like template creation, document tagging, and real-time tracking that are particularly beneficial for managing form as 2645 1. These tools help ensure that all necessary fields are filled correctly and signatures are obtained timely.

-

What benefits does airSlate SignNow offer for using form as 2645 1?

Using airSlate SignNow to manage form as 2645 1 offers numerous benefits, including increased efficiency, reduced turnaround time for document processing, and improved accuracy through automated workflows. This leads to a signNow enhancement in operational productivity.

-

Can airSlate SignNow integrate with other applications to handle form as 2645 1?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to sync data and manage form as 2645 1 alongside your other business tools. This integration capability helps in centralizing workflows and enhancing overall operational efficiency.

-

Is it safe to use airSlate SignNow for form as 2645 1?

Yes, airSlate SignNow prioritizes security and offers robust measures to protect your data. By utilizing high-level encryption and compliance with industry standards, businesses can confidently use airSlate SignNow for handling sensitive documents like form as 2645 1.

Get more for Puerto Rico Question About Form As 26451

- Field trip medical release form school district of plantsings

- Yep reference form municipality of anchorage muni

- Sign lighting california energy commission energy ca form

- Dshs form ec 67

- To download a membership application in michigan democratic party form

- Www pdffiller com516686877 proof of paymentfillable online proof of payment affidavit form fax email

- Form elec stk and form diss stk

- Reports ampamp formsbakersfield ca official website

Find out other Puerto Rico Question About Form As 26451

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure