Puerto Rico Question About Form as 26451 2017

What is the Puerto Rico Question About Form As 26451

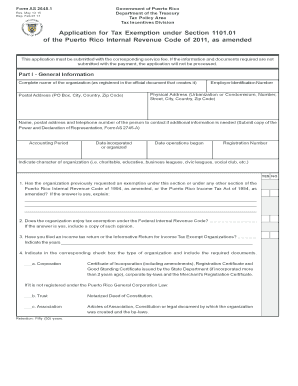

The Puerto Rico Question About Form AS 26451 is a specific tax form used by residents of Puerto Rico to report their income and claim certain tax benefits. This form is essential for individuals who need to clarify their residency status and tax obligations to the Internal Revenue Service (IRS). It is designed to ensure compliance with U.S. tax laws while accommodating the unique circumstances of Puerto Rican taxpayers.

How to use the Puerto Rico Question About Form As 26451

Using the Puerto Rico Question About Form AS 26451 involves several key steps. First, gather all necessary documentation, including income statements and any relevant tax records. Next, access the form online, where it can be filled out digitally. Ensure that all required fields are completed accurately to reflect your financial situation. Once filled, review the form for any errors before submitting it electronically or by mail.

Steps to complete the Puerto Rico Question About Form As 26451

Completing the Puerto Rico Question About Form AS 26451 can be done efficiently by following these steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Access the form through a secure online platform.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your income and any deductions you plan to claim.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print and mail it to the appropriate IRS address.

Legal use of the Puerto Rico Question About Form As 26451

The legal use of the Puerto Rico Question About Form AS 26451 is crucial for compliance with U.S. tax regulations. This form helps establish your tax residency status, which can significantly impact your tax obligations. Using this form correctly ensures that you meet IRS requirements and can help avoid penalties associated with incorrect filings. It is advisable to consult a tax professional if you have questions about your specific situation.

IRS Guidelines

The IRS provides specific guidelines for completing the Puerto Rico Question About Form AS 26451. These guidelines include instructions on eligibility, necessary documentation, and deadlines for submission. Familiarizing yourself with these guidelines can help ensure that your form is filled out correctly and submitted on time, reducing the risk of issues with your tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico Question About Form AS 26451 are typically aligned with federal tax deadlines. It is important to note that these dates can vary, especially for residents of Puerto Rico. Generally, taxpayers should aim to submit their forms by April 15 each year, but extensions may be available. Keeping track of these dates is essential to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Puerto Rico Question About Form AS 26451 can be submitted through various methods. Taxpayers have the option to file online using secure e-filing services, which is often the fastest and most efficient method. Alternatively, forms can be printed and mailed to the IRS or submitted in person at designated IRS offices. Each method has its own advantages, and choosing the right one depends on individual preferences and circumstances.

Quick guide on how to complete puerto rico question about form as 26451 2017

Your assistance manual on how to prepare your Puerto Rico Question About Form As 26451

If you’re curious about how to complete and submit your Puerto Rico Question About Form As 26451, here are some straightforward instructions on how to simplify tax declaring.

To begin, you just need to sign up for your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and effective document solution that enables you to modify, create, and finalize your tax documents with ease. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures and revert to alter information where required. Optimize your tax management with enhanced PDF editing, eSigning, and intuitive sharing options.

Follow the steps below to complete your Puerto Rico Question About Form As 26451 in no time:

- Create your account and start managing PDFs within moments.

- Access our directory to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to launch your Puerto Rico Question About Form As 26451 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding electronic signature (if necessary).

- Double-check your entry and correct any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Leverage this manual to electronically file your taxes with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and delayed reimbursements. Naturally, before e-filing your taxes, consult the IRS website for declaring regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico question about form as 26451 2017

FAQs

-

How do Hawaii residents and first-respondents feel about the federal support to Puerto Rico after the 2017 hurricanes?

I think the question is implying that because Hawaii is so far from the Mainland that the Trump Administration might decide to ignore us too, if we should be hit by a major hurricane. And yes, especially because Hawaii is predominantly Democratic and Trump is such an immature individual, I think it's quite possible that it could happen that way.

-

How do US citizens feel about Puerto Rico adding a star to the US flag as propaganda for statehood?

Well, my first response was "They did that? Interesting." In all honestly, most Americans just don't think of Puerto Rican statehood. Statehood for the District of Columbia is more of an issue, because DC is very vocal about it. But even then, I'm biased, having lived near, though not in, DC for twenty five years now. I suppose you could say I support Puerto Rican statehood in that I'd be for it if it came to a Congressional vote and the people of Puerto Rico clearly favored it. It's hardly a big issue for me, though. Others might oppose it, but very few would get really angry about it, with the exception of bigots who don't want a Hispanic state added to the Union. As for the tactic of adding a star, I think it's probably ill-considered. The words "publicity stunt" spring to mind. I'd say it's most likely to tick off people who view the flag as sacred and inviolable.

-

Which private college form should I fill out as I expect to get a 155 in the JEE Mains 2017?

Before trying to fill out private college forms, have a through knowing on filling up JOSAA, hope you will land up around +/- 25k rank in jee main, so you could easily get into iiit kanjeepuram and iiit Sri City, compared to last year data.

-

How do I remove an area of "expertise" from my Quora profile? I made one supportive comment about Puerto Rico to one question, and now I get endless questions about Puerto Rico. How do I convince Quora I'm not an expert?

On the right side of your profile, you can edit your “Credentials” as well as your “Knows About” topics. But I don’t see Puerto Rico in either of those categories. And it doesn’t look like you’re following the topic, either.What I do see, which you forgot to mention in your question, is that you have written two answers on Quora - both to questions about Puerto Rico.So when someone writes a question about Puerto Rico, and Quora is looking for people to answer it… well, Quora doesn’t know if you know anything at all about any other topics, but it does know you’ve written two answers to questions about Puerto Rico!Short of flat-out deleting your answers, all I can suggest is answering questions about other topics, and hoping that enough other people will answer enough questions about Puerto Rico that you wind up “far down the list” when people are looking for people to ask.But yeah, a lot of us get asked questions about things we have no knowledge of…

-

How do we have 10 billion for a damn wall but are quick to pull help out of Puerto Rico as we still help New Orleans?

The facts of the US financial situation tell us that there isn’t money for a wall nor is there money for Puerto Rico’s so called recovery or any area’s recovery for that matter (the government isn’t even close to the most effective way to find recovery, so let’s be grateful private businesses get an opportunity to serve potential customers as they desire to be). There isn’t money for much of anything. The US government has been spending stolen funds as if there’s no end to the flow.This video with Professor Antony Davies offers perspective on how the government has no chance to resolve this problem without drastic changes in their spending. Further taxation won’t solve it. Massive cuts in spending is the only way.This video, again with Professor Davies, helps us visualize how horrific the US government budget has been neglected and abused.Personally I don’t feel any responsibility for the abuse, neglect, or any of the debt at all. The bureaucrats who have plundered productive individuals in society are responsible. Instead of feeling responsible, I feel it’s best to find a way to donate time, money, and effort to needs I feel are worthy of that time, money, and effort. As a large group of individual actors we can make a much more signNow difference than the outrageously inefficient government.

-

How can I get a rough idea about my probable % (ile) in the CAT 2017, so it might help me fill out application forms for MBA colleges accordingly?

+/- 10 percentile of these mocksi can provide you onlinea) xat 6 full length tests + 12 sectional tests for rs 500b) iift 6 full length tests + 18 sectional tests for rs. 450c) snap 6 full length tests + 5 gk tests for rs 400/-d) nmat 12 full length tests for rs 1200/-e) combo of a to d for rs 1500/-f) combo of a to d + 24 full length cats + 18 cat sectionals for rs 3100/-g) add rs 3400 to f for 31 booklets in print home delivered for cat xat iift nmat snaph) only cat 25 full length tests + 18 sectional tests at rs 2000 onlinei) combo of a to d (Online) + g (print and home delivered) = 4800currently, approx 8000 students are taking these testsyou will get national percentile and full analysis with solutionsMoheet Gupta 09830231975Cat or cat equivalent percentile reqmt for getting calls from different b-schools (based on their entrance exams), these are indicative and may vary little bit depending on applications receivedIim/ xl/ MDI/ iift/ imt gzbad/ nm mumbai/ ximb/ fms/ iit mumbai Delhi kgp 95+Imi/ fore/ tapmi/ kj som/ scmhrd/ sibm 90+Nirma/ ifmr/ bimtech 85+Imt Nagpur n Bangalore/ symbiosis Hyderabad/ NM Bangalore n Hyderabad/ sdm imd Mysore 80+Sectoral programs like finance, hr, etc may have cut-offs lower than those indicated above by upto 5 percentileFor gd pi wat contact 09830231975 kolkata; pi n wat can be done over phone or Skype tooAlmost 100% conversion for last 18 yrsMoheet Gupta, bmd 1993, xlri

Create this form in 5 minutes!

How to create an eSignature for the puerto rico question about form as 26451 2017

How to create an eSignature for the Puerto Rico Question About Form As 26451 2017 in the online mode

How to make an electronic signature for the Puerto Rico Question About Form As 26451 2017 in Google Chrome

How to make an electronic signature for putting it on the Puerto Rico Question About Form As 26451 2017 in Gmail

How to generate an electronic signature for the Puerto Rico Question About Form As 26451 2017 straight from your smartphone

How to generate an eSignature for the Puerto Rico Question About Form As 26451 2017 on iOS

How to make an eSignature for the Puerto Rico Question About Form As 26451 2017 on Android

People also ask

-

What is the Puerto Rico Question About Form As 26451?

The Puerto Rico Question About Form As 26451 is a specific document that businesses often need for compliance in Puerto Rico. With airSlate SignNow, you can easily fill out, sign, and manage this form digitally, ensuring that you meet all local requirements efficiently.

-

How does airSlate SignNow assist with the Puerto Rico Question About Form As 26451?

airSlate SignNow streamlines the process of handling the Puerto Rico Question About Form As 26451 by allowing users to eSign documents and store them securely. This means you can complete your forms quickly, reduce paperwork, and maintain easy access to all your signed documents.

-

Are there any costs associated with using airSlate SignNow for the Puerto Rico Question About Form As 26451?

airSlate SignNow offers a cost-effective solution for managing the Puerto Rico Question About Form As 26451. Pricing plans are flexible, allowing you to choose one that fits your business needs and budget without compromising on features or security.

-

What unique features does airSlate SignNow offer for the Puerto Rico Question About Form As 26451?

With airSlate SignNow, you gain access to features like template creation, automated workflows, and advanced security measures tailored for the Puerto Rico Question About Form As 26451. These features help ensure your documentation processes are efficient and compliant with local regulations.

-

Can airSlate SignNow integrate with other tools for the Puerto Rico Question About Form As 26451?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing the handling of the Puerto Rico Question About Form As 26451. Whether you're using CRM, project management, or other software tools, you can streamline your processes and maintain all documents in one place.

-

Is support available for businesses using airSlate SignNow with the Puerto Rico Question About Form As 26451?

Absolutely! airSlate SignNow provides dedicated customer support to help you navigate the complexities of the Puerto Rico Question About Form As 26451. Our team is here to assist you with any queries or challenges you may face, ensuring a smooth experience.

-

What benefits does airSlate SignNow provide for managing the Puerto Rico Question About Form As 26451?

Using airSlate SignNow for the Puerto Rico Question About Form As 26451 offers numerous benefits, including time savings, improved accuracy, and enhanced security. By adopting our solution, businesses can eliminate manual errors and accelerate their document workflows signNowly.

Get more for Puerto Rico Question About Form As 26451

- Va form 4637 48980778

- Amsa 107 application for revalidationreplacement form

- Medication action plan example form

- Oversize overweight permit application form

- Lawyer form

- Oregon temporary post judgment immediate danger fillable pdffiller form

- Safety quiz form

- California nonprofit corporation short form dissolution certificate form dsf np

Find out other Puerto Rico Question About Form As 26451

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online