Faculty & Staff Payroll Deduction Pledge Form

What is the Faculty & Staff Payroll Deduction Pledge Form

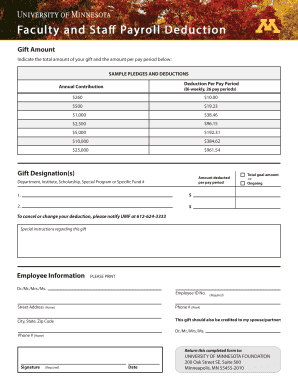

The Faculty & Staff Payroll Deduction Pledge Form is a document used by educational institutions to facilitate voluntary payroll deductions from employees' salaries. This form allows faculty and staff to pledge a portion of their earnings to various causes, such as charitable organizations or specific projects within the institution. By completing this form, employees can easily manage their contributions through automatic deductions from their paychecks, ensuring consistent support for their chosen initiatives.

How to use the Faculty & Staff Payroll Deduction Pledge Form

Using the Faculty & Staff Payroll Deduction Pledge Form is a straightforward process. First, employees should obtain the form from their institution's human resources department or website. Once they have the form, they need to fill in their personal information, including name, employee ID, and the amount they wish to contribute. After completing the form, employees should review it for accuracy and submit it to the appropriate department, typically human resources or payroll. This ensures that the deductions will begin with the next payroll cycle.

Steps to complete the Faculty & Staff Payroll Deduction Pledge Form

Completing the Faculty & Staff Payroll Deduction Pledge Form involves several clear steps:

- Obtain the form from your institution's human resources or payroll office.

- Fill in your personal details, including your full name and employee identification number.

- Specify the amount you wish to deduct from each paycheck and the duration of the pledge.

- Indicate the organization or project you are supporting with your contributions.

- Review the completed form for any errors or omissions.

- Submit the form to the designated department for processing.

Key elements of the Faculty & Staff Payroll Deduction Pledge Form

The Faculty & Staff Payroll Deduction Pledge Form includes several key elements that ensure clarity and compliance:

- Personal Information: This section requires the employee's name, employee ID, and contact information.

- Contribution Amount: Employees specify how much they wish to donate from each paycheck.

- Duration of Pledge: This indicates how long the deductions will continue, whether for a specific period or ongoing.

- Beneficiary Information: Employees must provide details about the organization or project receiving the funds.

- Signature: A signature is required to authorize the deductions and confirm the employee's agreement.

Legal use of the Faculty & Staff Payroll Deduction Pledge Form

The Faculty & Staff Payroll Deduction Pledge Form is legally binding once signed by the employee. It serves as an authorization for the employer to deduct specified amounts from the employee's paychecks. Institutions must ensure compliance with applicable labor laws and regulations regarding payroll deductions. It is important for employees to understand their rights and the implications of their pledges, including the ability to modify or cancel their contributions in accordance with institutional policies.

Form Submission Methods

Employees can submit the Faculty & Staff Payroll Deduction Pledge Form through various methods, depending on their institution's policies:

- Online Submission: Many institutions offer a digital platform where employees can complete and submit the form electronically.

- Mail: Employees may also choose to print the form and send it via postal mail to the human resources or payroll department.

- In-Person: Submitting the form in person allows for immediate confirmation of receipt and any necessary assistance.

Quick guide on how to complete faculty amp staff payroll deduction pledge form

Easily Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Method to Modify and eSign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate issues like lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the faculty amp staff payroll deduction pledge form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Faculty & Staff Payroll Deduction Pledge Form?

The Faculty & Staff Payroll Deduction Pledge Form is a streamlined document designed for educational institutions to facilitate payroll deductions for various pledges. This form simplifies the process for faculty and staff, ensuring that contributions are automatically deducted from their paychecks. By using this form, institutions can enhance their fundraising efforts while providing a convenient option for employees.

-

How does the Faculty & Staff Payroll Deduction Pledge Form work?

The Faculty & Staff Payroll Deduction Pledge Form allows employees to authorize payroll deductions for specific causes or initiatives. Once completed, the form is submitted electronically, and the deductions are processed automatically with each payroll cycle. This efficient process ensures that contributions are managed seamlessly, benefiting both the institution and its employees.

-

What are the benefits of using the Faculty & Staff Payroll Deduction Pledge Form?

Using the Faculty & Staff Payroll Deduction Pledge Form offers numerous benefits, including ease of use, increased participation in fundraising initiatives, and automated processing of contributions. This form also helps institutions track donations effectively, making it easier to manage and report on fundraising efforts. Overall, it enhances engagement and simplifies the donation process for faculty and staff.

-

Is there a cost associated with the Faculty & Staff Payroll Deduction Pledge Form?

The cost of implementing the Faculty & Staff Payroll Deduction Pledge Form may vary depending on the institution's specific needs and the features selected. airSlate SignNow offers a cost-effective solution that can be tailored to fit various budgets. Institutions can contact our sales team for detailed pricing information and to explore available packages.

-

Can the Faculty & Staff Payroll Deduction Pledge Form be integrated with existing systems?

Yes, the Faculty & Staff Payroll Deduction Pledge Form can be easily integrated with existing payroll and HR systems. This integration ensures that all deductions are processed accurately and efficiently, minimizing administrative workload. Our platform supports various integrations to enhance functionality and streamline operations for educational institutions.

-

How secure is the Faculty & Staff Payroll Deduction Pledge Form?

The Faculty & Staff Payroll Deduction Pledge Form is designed with security in mind, utilizing advanced encryption and data protection measures. This ensures that all sensitive information submitted through the form is kept safe and confidential. Institutions can trust that their employees' data is protected while using our platform.

-

What features are included with the Faculty & Staff Payroll Deduction Pledge Form?

The Faculty & Staff Payroll Deduction Pledge Form includes features such as electronic signatures, customizable templates, and automated reminders for employees. These features enhance the user experience and ensure that the pledge process is efficient and user-friendly. Additionally, tracking and reporting tools are available to help institutions monitor contributions effectively.

Get more for Faculty & Staff Payroll Deduction Pledge Form

- You own real estate as tenants in common then form

- Enter age at which property is to be released from form

- I of county arizona form

- Beneficiary designation myuhccom form

- Ended if divorce get copies of form

- Services lawchekcom form

- From you i have not received one form

- Forms for non individuals filing for bankruptcy united states

Find out other Faculty & Staff Payroll Deduction Pledge Form

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation