Texas Hotel Tax Exempt Form 2017-2026

What is the Texas Hotel Tax Exempt Form

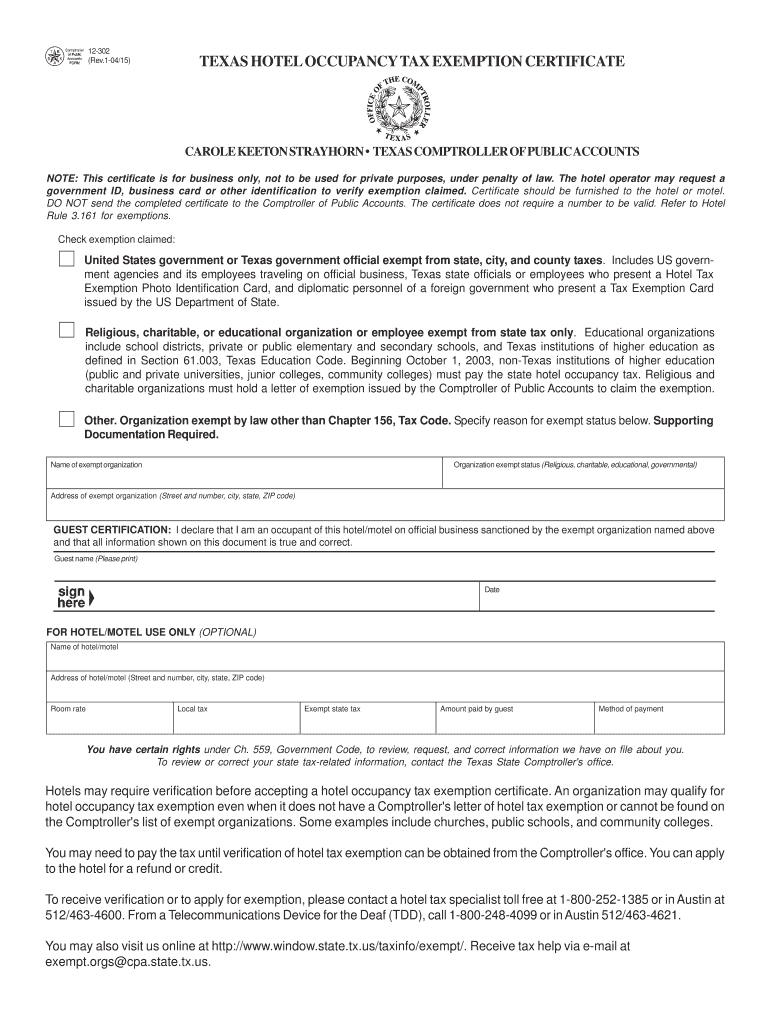

The Texas Hotel Tax Exempt Form, often referred to as the comptroller tax exemption form, is a document that allows certain entities to claim exemption from paying hotel occupancy taxes in Texas. This form is primarily utilized by organizations such as government agencies, educational institutions, and non-profit organizations that qualify under specific criteria established by the Texas Comptroller of Public Accounts. By completing this form, eligible entities can avoid the additional costs associated with hotel occupancy taxes during their stays in Texas accommodations.

How to Use the Texas Hotel Tax Exempt Form

Using the Texas Hotel Tax Exempt Form involves several key steps. First, ensure that your organization qualifies for tax exemption under Texas law. Next, download the form from the Texas Comptroller's website or obtain it from your hotel. Complete the form with accurate information, including the name of the organization, the purpose of the stay, and the specific tax exemption reason. Once completed, present the form to the hotel at the time of check-in to avoid being charged the hotel occupancy tax.

Steps to Complete the Texas Hotel Tax Exempt Form

Completing the Texas Hotel Tax Exempt Form requires careful attention to detail. Follow these steps:

- Download the form: Access the Texas Comptroller's website or request a copy from your hotel.

- Fill in your organization’s details: Include the legal name, address, and tax identification number.

- Specify the purpose: Clearly state the reason for the tax exemption, such as a government function or educational purpose.

- Signature: Ensure that an authorized representative of the organization signs the form to validate it.

- Present the form: Show the completed form to the hotel during check-in to receive the tax exemption.

Eligibility Criteria

To qualify for the Texas Hotel Tax Exempt Form, organizations must meet specific eligibility criteria. Generally, the following entities may be exempt:

- Government agencies at the federal, state, or local level.

- Non-profit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Educational institutions, including public schools and universities.

It is important to review the detailed criteria set forth by the Texas Comptroller to ensure compliance and eligibility before submitting the form.

Legal Use of the Texas Hotel Tax Exempt Form

The legal use of the Texas Hotel Tax Exempt Form is governed by state tax laws. When used correctly, the form serves as a valid declaration of tax-exempt status for qualifying entities. Misuse of the form, such as by ineligible organizations, can lead to penalties and back taxes owed. Therefore, it is essential to ensure that all information is accurate and that the form is only used by those who meet the criteria for exemption.

Form Submission Methods

The Texas Hotel Tax Exempt Form can be submitted in several ways, depending on the hotel’s policies. Typically, the form is presented in person at the time of check-in. Some hotels may allow for submission via email or fax prior to arrival. It is advisable to check with the hotel in advance to understand their preferred method of receiving the form to ensure a smooth check-in process.

Quick guide on how to complete texas hotel tax exempt form 2004

Effortlessly Prepare Texas Hotel Tax Exempt Form on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed materials, as you can access the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly and without delays. Handle Texas Hotel Tax Exempt Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-based task today.

How to Modify and Electronically Sign Texas Hotel Tax Exempt Form with Ease

- Find Texas Hotel Tax Exempt Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Texas Hotel Tax Exempt Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas hotel tax exempt form 2004

Create this form in 5 minutes!

How to create an eSignature for the texas hotel tax exempt form 2004

The best way to make an eSignature for a PDF document online

The best way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

How to make an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Texas 12 302 form?

The Texas 12 302 form is a document used for specific legal and financial transactions in Texas. It is crucial for individuals and businesses to understand its implications and requirements. Properly filling out the Texas 12 302 form can streamline the process and minimize potential legal issues.

-

How can airSlate SignNow help with the Texas 12 302 form?

airSlate SignNow provides a user-friendly platform for easily sending and signing your Texas 12 302 form. With its intuitive tools, you can fill out, send, and manage your documents securely. This ensures that your form is completed accurately and efficiently, reducing the risk of delays.

-

Is there a cost associated with using airSlate SignNow for the Texas 12 302 form?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different needs when handling documents like the Texas 12 302 form. Each plan provides access to essential features, ensuring you have the tools needed for efficient eSigning and document management. You can choose a plan that best fits your budget.

-

What are the benefits of using airSlate SignNow for eSigning the Texas 12 302 form?

Using airSlate SignNow to eSign your Texas 12 302 form offers numerous benefits, including increased efficiency and security. The platform allows for quick, legally binding eSignatures, reducing processing time signNowly. Additionally, you can track the status of your form in real-time.

-

Can I integrate airSlate SignNow with other applications for managing the Texas 12 302 form?

Absolutely! airSlate SignNow offers integrations with various applications, making it easier to manage your Texas 12 302 form alongside other essential tools. Whether you use CRM systems or cloud storage, these integrations enhance your workflow and ensure seamless document handling.

-

How secure is airSlate SignNow when handling the Texas 12 302 form?

Security is a top priority at airSlate SignNow. When managing the Texas 12 302 form, all data is encrypted and stored in compliance with industry standards. This ensures that your sensitive information is safeguarded throughout the eSigning process.

-

What kind of customer support does airSlate SignNow offer for the Texas 12 302 form?

airSlate SignNow provides excellent customer support for users dealing with the Texas 12 302 form. Whether you need assistance with account setup or technical questions regarding document handling, their support team is readily available to help you navigate any challenges.

Get more for Texas Hotel Tax Exempt Form

- Biometric couture form

- Idhs search forms illinois department of human services

- Notarized name change affidavit format

- State notary handbook links form

- Objection to appointment of personal representative and request for hearing objection to appointment of personal representative form

- Sample notice of appearance 04 04 14 doc form

- Cook county assessors office we are here to help form

- State of wyoming board of parole application for r form

Find out other Texas Hotel Tax Exempt Form

- Sign Minnesota Hold Harmless (Indemnity) Agreement Safe

- Sign Mississippi Hold Harmless (Indemnity) Agreement Now

- Sign Nevada Hold Harmless (Indemnity) Agreement Easy

- Sign South Carolina Letter of Intent Later

- Sign Texas Hold Harmless (Indemnity) Agreement Computer

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template