Texas Form Ta 144 2018

What is the Texas Form Ta 144

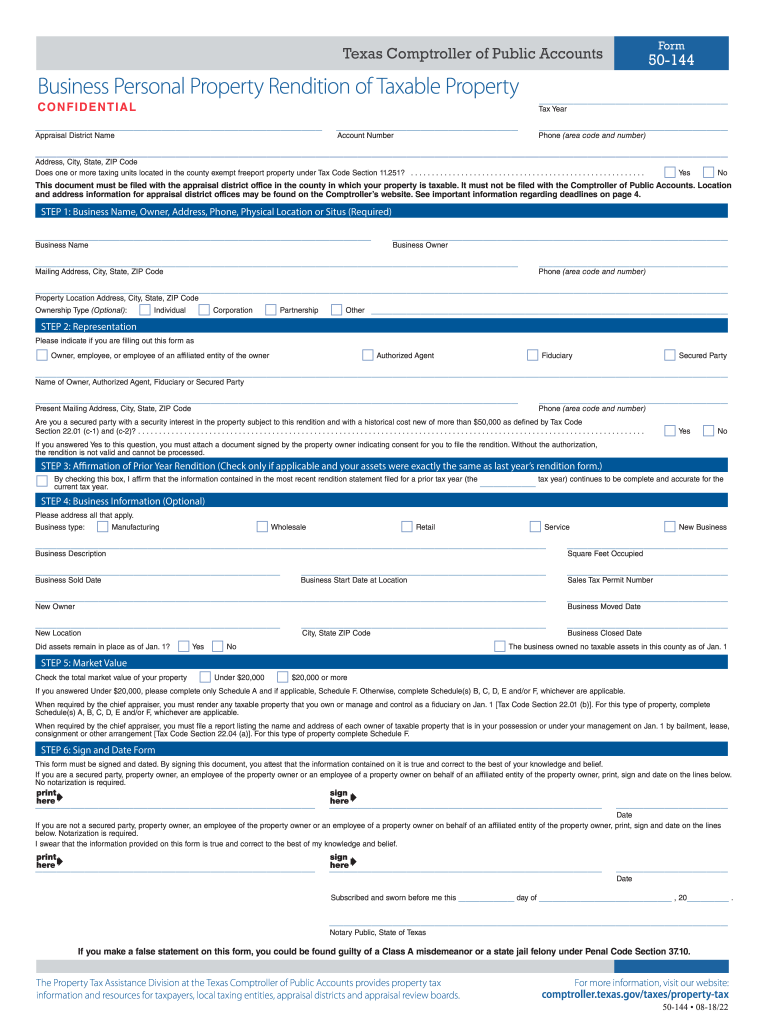

The Texas Form Ta 144, also known as the Wilbarger County Appraisal District Form 50 144, is a property tax form used by property owners in Texas to apply for a property tax exemption. This form is essential for individuals seeking to reduce their property tax burden by qualifying for various exemptions available under Texas law. The form collects information about the property, the owner, and the nature of the exemption being requested.

How to use the Texas Form Ta 144

Using the Texas Form Ta 144 involves several steps to ensure proper completion and submission. First, gather all necessary information about the property, including its location, ownership details, and any relevant exemption criteria. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it must be submitted to the appropriate local appraisal district office for processing. It is advisable to keep a copy of the submitted form for personal records.

Steps to complete the Texas Form Ta 144

Completing the Texas Form Ta 144 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Wilbarger County Appraisal District or relevant local authority.

- Enter the property owner's name and contact information in the designated fields.

- Provide the property address and legal description as required.

- Indicate the specific exemption being requested and provide any supporting documentation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Texas Form Ta 144

The Texas Form Ta 144 is legally recognized for property tax exemption applications within Texas. To ensure compliance, it is important to adhere to all state laws and regulations regarding property tax exemptions. Submitting false information on this form can lead to penalties, including denial of the exemption and potential legal repercussions. Therefore, it is crucial to provide truthful and accurate information when completing the form.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Form Ta 144 vary based on the type of exemption being requested. Generally, property owners must submit their applications by April 30 of the tax year to qualify for exemptions. It is important to check with the local appraisal district for specific deadlines and any changes that may occur annually. Missing the deadline can result in the loss of potential tax savings for that year.

Required Documents

When submitting the Texas Form Ta 144, certain documents may be required to support the exemption claim. Commonly required documents include:

- Proof of ownership, such as a deed or title.

- Identification documents of the property owner.

- Any additional documentation specific to the exemption type being requested.

It is advisable to check with the local appraisal district for a complete list of required documents to avoid delays in processing the application.

Quick guide on how to complete texas form 50 144 fillable 2018 2019

Your assistance manual on how to prepare your Texas Form Ta 144

If you’re curious about how to complete and submit your Texas Form Ta 144, here are some brief instructions on how to simplify tax processing.

Initially, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to edit, draft, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to modify information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the steps below to finalize your Texas Form Ta 144 in just minutes:

- Establish your account and start working on PDFs swiftly.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Texas Form Ta 144 in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save modifications, print your copy, forward it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can increase return errors and delay reimbursements. Certainly, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct texas form 50 144 fillable 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the texas form 50 144 fillable 2018 2019

How to make an electronic signature for your Texas Form 50 144 Fillable 2018 2019 online

How to create an electronic signature for your Texas Form 50 144 Fillable 2018 2019 in Google Chrome

How to generate an electronic signature for putting it on the Texas Form 50 144 Fillable 2018 2019 in Gmail

How to make an eSignature for the Texas Form 50 144 Fillable 2018 2019 right from your smart phone

How to generate an eSignature for the Texas Form 50 144 Fillable 2018 2019 on iOS devices

How to create an eSignature for the Texas Form 50 144 Fillable 2018 2019 on Android devices

People also ask

-

What is the wilbarger county appraisal district form 50 144?

The wilbarger county appraisal district form 50 144 is a required document used for property tax appraisal purposes in Wilbarger County. This form provides essential information about property ownership and valuation to help determine property taxes accurately.

-

How can airSlate SignNow help with the wilbarger county appraisal district form 50 144?

airSlate SignNow streamlines the process of filling out and signing the wilbarger county appraisal district form 50 144. With our platform, you can easily upload, edit, and eSign the form, ensuring a quick and efficient process.

-

Are there any costs associated with using airSlate SignNow for the wilbarger county appraisal district form 50 144?

Using airSlate SignNow is a cost-effective solution for handling the wilbarger county appraisal district form 50 144. We offer various pricing plans that cater to businesses of all sizes, allowing you to choose the best option for your needs.

-

Can I store the wilbarger county appraisal district form 50 144 in airSlate SignNow?

Yes, airSlate SignNow provides secure storage solutions for your documents, including the wilbarger county appraisal district form 50 144. This means you can easily access and manage your forms anytime from anywhere.

-

What are the key features of airSlate SignNow for handling the wilbarger county appraisal district form 50 144?

Key features of airSlate SignNow include template creation, eSignature capabilities, document tracking, and automated workflows. These tools make managing the wilbarger county appraisal district form 50 144 efficient and user-friendly.

-

Is airSlate SignNow compatible with other software for managing the wilbarger county appraisal district form 50 144?

Yes, airSlate SignNow offers numerous integrations with popular software platforms, enhancing your ability to manage the wilbarger county appraisal district form 50 144 seamlessly. This includes compatibility with CRM systems, cloud storage, and more.

-

How secure is the process of signing the wilbarger county appraisal district form 50 144 with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform offers advanced encryption and compliance with legal standards, ensuring that your wilbarger county appraisal district form 50 144 is signed securely and safely.

Get more for Texas Form Ta 144

- Co format for vietnam customs form c no 5290 12 customs go

- Proof of payment form 22275121

- Ncha judges sheet form

- Nys filing receipt example form

- City of pittsburgh party wall program sharon taylor form

- Taxusa 6110376 form

- Petition for expungement utah courts utcourts form

- Colorado renunciation and disclaimer of property from will by testate form

Find out other Texas Form Ta 144

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP