Business Personal Property Rendition of Taxable Property Form 50 144 2021

What is the Business Personal Property Rendition Of Taxable Property Form 50 144

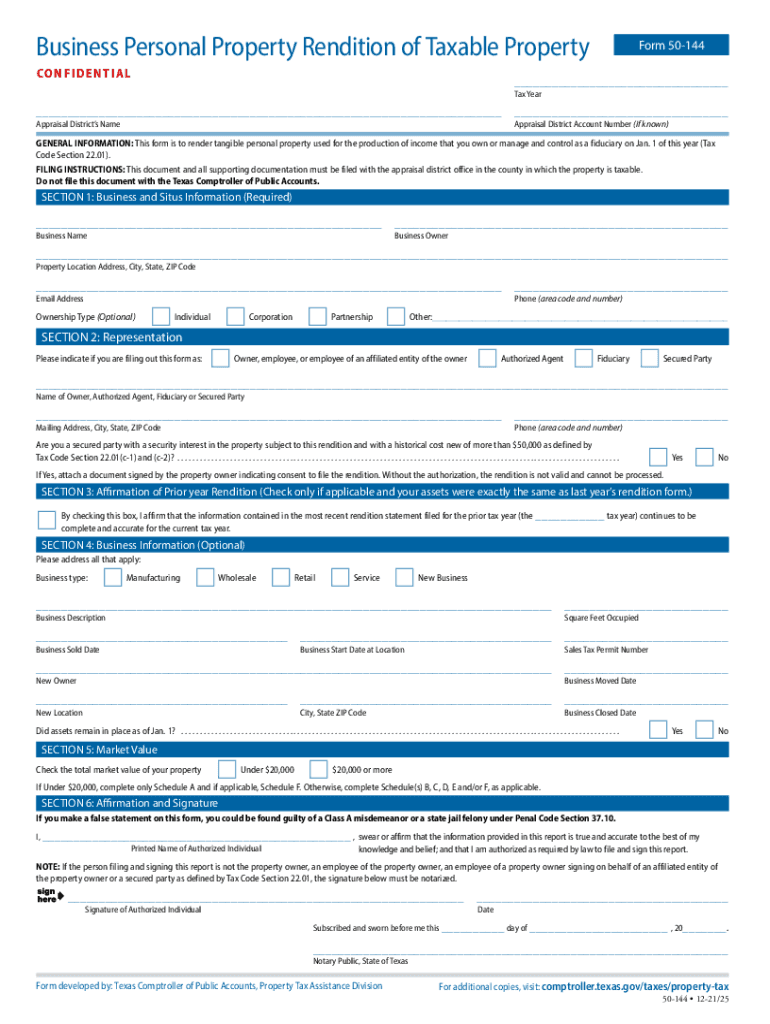

The Business Personal Property Rendition Of Taxable Property Form 50 144, commonly referred to as form 50 144, is a crucial document used in the United States for reporting personal property owned by businesses for tax purposes. This form is essential for local tax authorities to assess the value of taxable personal property, which may include equipment, machinery, and furniture. By accurately completing this form, businesses ensure compliance with state tax laws and help determine their property tax liability.

How to use the Business Personal Property Rendition Of Taxable Property Form 50 144

Using the Business Personal Property Rendition Of Taxable Property Form 50 144 involves several steps that require careful attention to detail. First, gather all relevant information regarding the personal property owned by the business. This includes details such as the type of property, its location, and its estimated value. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it can be submitted to the appropriate local tax authority, either online or by mail, depending on the jurisdiction's submission methods.

Steps to complete the Business Personal Property Rendition Of Taxable Property Form 50 144

Completing the Business Personal Property Rendition Of Taxable Property Form 50 144 involves a systematic approach. Follow these steps for accurate completion:

- Gather necessary documentation, including previous tax returns and property valuations.

- Identify all taxable personal property owned by the business.

- Fill out the form, ensuring that all sections are completed with accurate information.

- Review the completed form for any errors or omissions.

- Submit the form to the local tax authority by the specified deadline.

Key elements of the Business Personal Property Rendition Of Taxable Property Form 50 144

The Business Personal Property Rendition Of Taxable Property Form 50 144 includes several key elements that must be addressed. These elements typically consist of:

- Business Information: Name, address, and contact details of the business.

- Property Description: A detailed list of all personal property owned, including type and location.

- Estimated Value: The assessed value of each item of personal property.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Business Personal Property Rendition Of Taxable Property Form 50 144 can vary by state and local jurisdiction. Typically, businesses are required to submit this form annually, often by April fifteenth. It is crucial to check with the local tax authority for specific deadlines to avoid penalties. Late submissions can result in fines or increased tax assessments, making timely filing essential for compliance.

Penalties for Non-Compliance

Failure to file the Business Personal Property Rendition Of Taxable Property Form 50 144 by the deadline can lead to significant penalties. These may include fines, interest on unpaid taxes, and even an estimated assessment by the tax authority, which could be higher than the actual tax liability. It is important for businesses to understand these potential consequences and ensure that they meet all filing requirements to avoid unnecessary financial burdens.

Quick guide on how to complete business personal property rendition of taxable property form 50 144

Complete Business Personal Property Rendition Of Taxable Property Form 50 144 seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Business Personal Property Rendition Of Taxable Property Form 50 144 on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Business Personal Property Rendition Of Taxable Property Form 50 144 with ease

- Locate Business Personal Property Rendition Of Taxable Property Form 50 144 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your device of choice. Alter and electronically sign Business Personal Property Rendition Of Taxable Property Form 50 144 and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business personal property rendition of taxable property form 50 144

Create this form in 5 minutes!

How to create an eSignature for the business personal property rendition of taxable property form 50 144

The way to make an e-signature for your PDF document online

The way to make an e-signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the property tax form 50 144?

The property tax form 50 144 is a document used to report and claim exemptions for certain properties in various jurisdictions. It assists homeowners and business owners in reducing their property tax liabilities by providing essential details about the property.

-

How can airSlate SignNow help with the property tax form 50 144?

airSlate SignNow simplifies the process of filling out and signing the property tax form 50 144. With our easy-to-use platform, you can electronically sign and send the form securely, ensuring that it signNowes the appropriate authorities without delays.

-

Is there a cost associated with using airSlate SignNow for the property tax form 50 144?

Yes, airSlate SignNow offers a cost-effective solution with various pricing plans tailored to your needs. You can choose a plan that fits your budget and enjoy unlimited access to features when preparing and submitting the property tax form 50 144.

-

What key features does airSlate SignNow offer for the property tax form 50 144?

airSlate SignNow provides features such as customizable templates, secure eSigning, and cloud storage for your property tax form 50 144. These tools enhance your productivity and ensure that your documents are always accessible.

-

Can airSlate SignNow integrate with other applications for managing the property tax form 50 144?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive and Salesforce, making it easy to manage your property tax form 50 144 alongside other essential documents and workflows.

-

What are the benefits of using airSlate SignNow for the property tax form 50 144?

Using airSlate SignNow for your property tax form 50 144 offers numerous benefits, including enhanced efficiency, reduced paper usage, and quicker turnaround times. Electronic signing improves accuracy, ensuring that your submission complies with relevant regulations.

-

Is it easy to navigate the airSlate SignNow platform for the property tax form 50 144?

Yes, airSlate SignNow is designed with user-friendliness in mind. Whether you are tech-savvy or a beginner, you will find it straightforward to navigate the platform when preparing your property tax form 50 144.

Get more for Business Personal Property Rendition Of Taxable Property Form 50 144

- Foundation contract for contractor massachusetts form

- Plumbing contract for contractor massachusetts form

- Brick mason contract for contractor massachusetts form

- Roofing contract for contractor massachusetts form

- Electrical contract for contractor massachusetts form

- Sheetrock drywall contract for contractor massachusetts form

- Flooring contract for contractor massachusetts form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract massachusetts form

Find out other Business Personal Property Rendition Of Taxable Property Form 50 144

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding