Texas Form 50 144 Fillable 2017

What is the Texas Form 50 144 Fillable

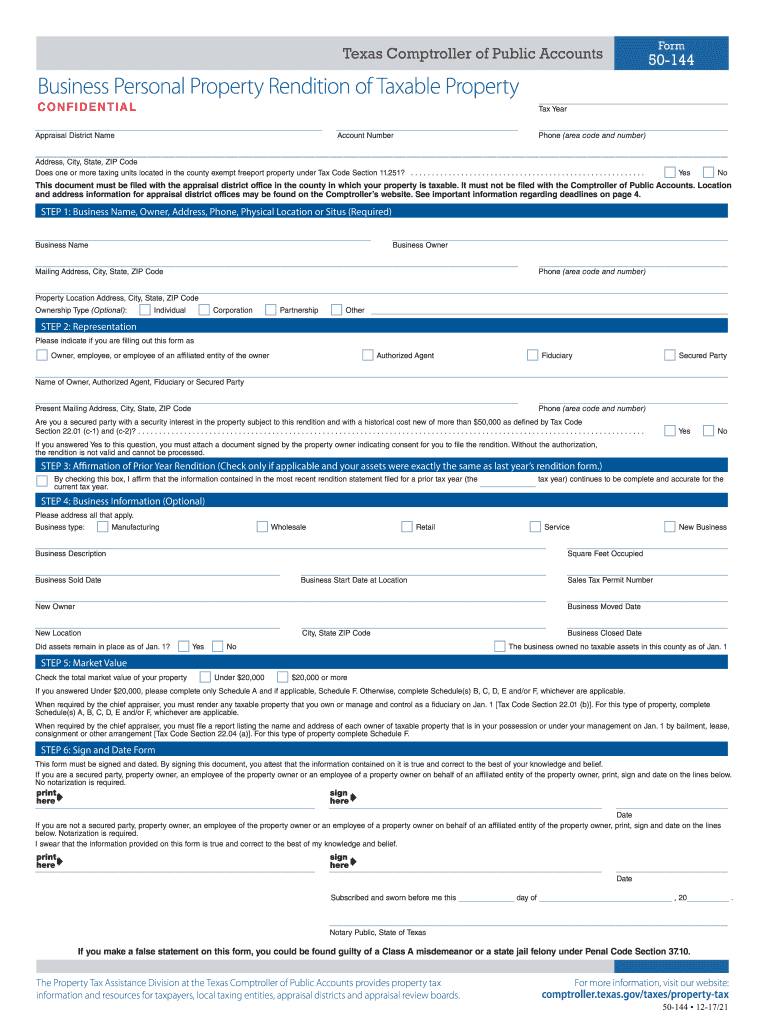

The Texas Form 50 144 Fillable is a document used primarily for property tax exemption applications in the state of Texas. This form allows property owners to claim exemptions for various types of properties, such as residential homesteads or properties owned by disabled veterans. The fillable format enables users to complete the form digitally, ensuring accuracy and ease of submission. By using this form, applicants can provide necessary information to local appraisal districts, which is essential for determining eligibility for tax exemptions.

How to use the Texas Form 50 144 Fillable

Using the Texas Form 50 144 Fillable involves several straightforward steps. First, access the form through a reliable platform that supports digital filling. Once you have the form open, carefully enter the required information, including personal details and property specifics. Ensure that all fields are completed accurately to avoid delays in processing. After filling out the form, review it for any errors or omissions. Finally, submit the completed form electronically or print it for mailing, depending on your preference and the submission guidelines provided by your local appraisal district.

Steps to complete the Texas Form 50 144 Fillable

Completing the Texas Form 50 144 Fillable involves a series of clear steps:

- Obtain the form from a trusted source.

- Open the form in a compatible PDF reader that allows fillable fields.

- Input your name, address, and other relevant personal information in the designated fields.

- Provide details about the property for which you are claiming an exemption, including its location and type.

- Attach any required documentation that supports your exemption claim.

- Review the completed form for accuracy.

- Submit the form electronically or print it for mailing as per your local appraisal district's instructions.

Legal use of the Texas Form 50 144 Fillable

The Texas Form 50 144 Fillable is legally recognized for property tax exemption claims in Texas. To ensure its legal validity, it must be completed accurately and submitted within the deadlines set by local appraisal districts. The form must also be accompanied by any necessary documentation that proves eligibility for the claimed exemption. Understanding the legal requirements surrounding this form is crucial for property owners to successfully navigate the exemption process and avoid potential penalties.

Key elements of the Texas Form 50 144 Fillable

Several key elements are essential for the Texas Form 50 144 Fillable:

- Applicant Information: This includes the name, address, and contact information of the property owner.

- Property Details: Information about the property, such as its location, type, and current use.

- Exemption Type: The specific exemption being claimed, such as a homestead exemption or a veteran exemption.

- Supporting Documentation: Any required documents that substantiate the claim for exemption.

- Signature: A declaration that the information provided is accurate and complete, which may require an electronic or handwritten signature.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Form 50 144 Fillable vary depending on the type of exemption being claimed. Generally, property owners must submit the form by April 30 of the tax year for which they are seeking the exemption. It is important to check with your local appraisal district for specific deadlines and any additional requirements that may apply. Missing the deadline may result in the denial of the exemption, so timely submission is crucial.

Quick guide on how to complete texas form 50 144 fillable 2017

Your assistance manual on how to prepare your Texas Form 50 144 Fillable

If you’re interested in understanding how to generate and dispatch your Texas Form 50 144 Fillable, here are a few concise instructions on how to simplify tax submission.

To get started, you simply need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, create, and finalize your tax documents effortlessly. Utilizing its editor, you can switch between text, checkboxes, and electronic signatures and return to modify information as required. Optimize your tax administration with advanced PDF manipulation, electronic signing, and user-friendly sharing.

Follow the steps below to complete your Texas Form 50 144 Fillable in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to obtain any IRS tax form; search through variations and schedules.

- Click Obtain form to access your Texas Form 50 144 Fillable in our editor.

- Complete the essential fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to apply your legally-binding electronic signature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Kindly be aware that paper filing can lead to increased errors and delayed refunds. Additionally, before electronically filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct texas form 50 144 fillable 2017

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the texas form 50 144 fillable 2017

How to make an electronic signature for your Texas Form 50 144 Fillable 2017 online

How to create an eSignature for your Texas Form 50 144 Fillable 2017 in Google Chrome

How to make an electronic signature for putting it on the Texas Form 50 144 Fillable 2017 in Gmail

How to create an electronic signature for the Texas Form 50 144 Fillable 2017 right from your smartphone

How to generate an eSignature for the Texas Form 50 144 Fillable 2017 on iOS devices

How to make an electronic signature for the Texas Form 50 144 Fillable 2017 on Android

People also ask

-

What is the Texas Form 50 144 Fillable?

The Texas Form 50 144 Fillable is a state-specific form used for education-related purposes in Texas, allowing users to input necessary data digitally. This fillable form simplifies the completion process, ensuring that all required information is submitted correctly and efficiently. By using airSlate SignNow, users can easily access and manage this form online.

-

How can I access the Texas Form 50 144 Fillable?

You can access the Texas Form 50 144 Fillable directly through the airSlate SignNow platform. Our intuitive interface allows you to find this form quickly and start filling it out right away. Once it’s completed, you can easily eSign and send it to the necessary parties without any hassle.

-

Is there a cost associated with using the Texas Form 50 144 Fillable?

Yes, using the Texas Form 50 144 Fillable through airSlate SignNow comes with a subscription fee. However, our pricing plans are designed to be cost-effective and include numerous features that enhance your document management experience. You can choose from various plans based on your business needs and usage frequency.

-

What features are included with the Texas Form 50 144 Fillable?

The Texas Form 50 144 Fillable includes features such as easy document editing, electronic signature capabilities, and secure cloud storage. Users can also collaborate in real-time, ensuring that multiple stakeholders can input information as needed. These features streamline the process and improve overall efficiency.

-

Can I integrate the Texas Form 50 144 Fillable with other software?

Yes, the Texas Form 50 144 Fillable can be integrated with various software platforms available on airSlate SignNow. This allows for seamless workflows and helps to consolidate your documentation processes. Integration options include popular services such as Google Drive, Dropbox, and more.

-

What are the benefits of using the Texas Form 50 144 Fillable for my business?

Using the Texas Form 50 144 Fillable offers signNow benefits, including increased efficiency, reduced errors, and enhanced compliance with state regulations. The digital format allows for easy edits and quick submissions, saving time for your team. Additionally, electronic signatures improve the speed of approvals and documentation turnaround.

-

How secure is the Texas Form 50 144 Fillable on airSlate SignNow?

Security is a top priority when using the Texas Form 50 144 Fillable on airSlate SignNow. Our platform employs advanced encryption methods to protect your documents and sensitive information. Additionally, we comply with industry standards to ensure your data remains safe and secure throughout the entire signing process.

Get more for Texas Form 50 144 Fillable

- Happy estimator 101437438 form

- Dnd personal information request form

- Emancipation petition and instructions vermont judiciary vermontjudiciary form

- Meal builder worksheet form

- Zombie notes acls pdf form

- Wholesale retail agreement template form

- Jd cv 23 form

- Out of state child custody agreement template form

Find out other Texas Form 50 144 Fillable

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document