Business Personal Property Rendition of Taxable 2023-2026

Understanding the Business Personal Property Rendition of Taxable

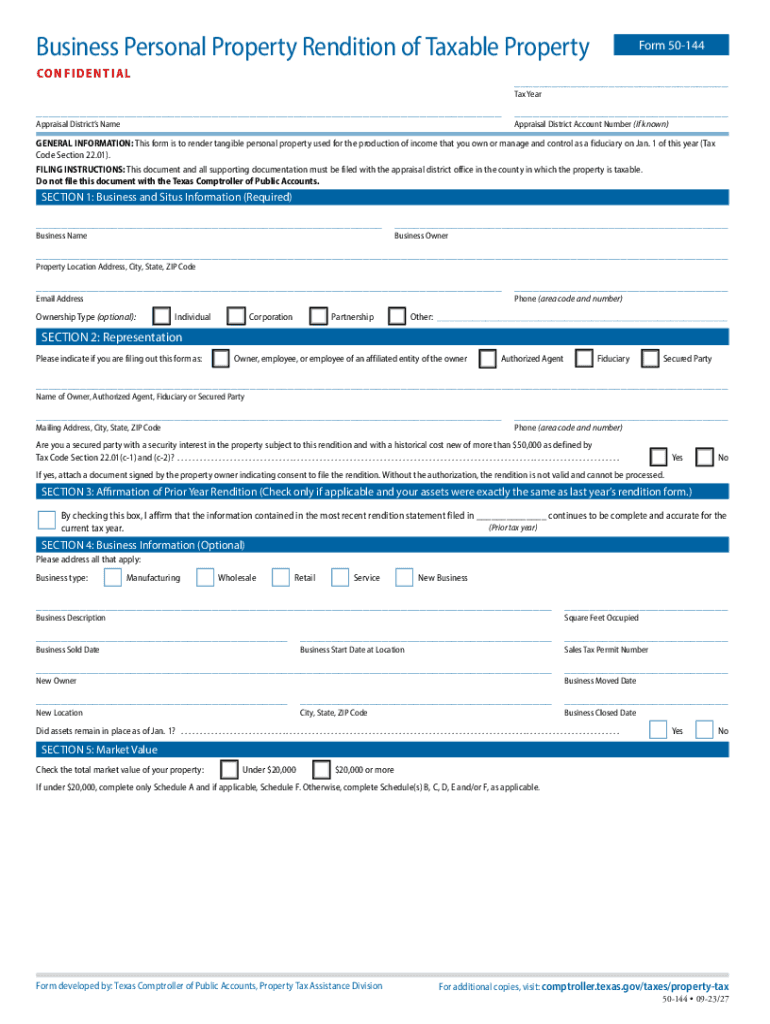

The Business Personal Property Rendition of Taxable is a crucial document for businesses in the United States, particularly in Texas. This form is used to report personal property owned by a business, including equipment, machinery, and inventory, to the local appraisal district. Accurate reporting is essential as it directly impacts property tax assessments. The form helps ensure that businesses comply with state regulations regarding property taxation.

Steps to Complete the Business Personal Property Rendition of Taxable

Completing the Business Personal Property Rendition involves several important steps:

- Gather all necessary information about your business assets, including purchase dates and values.

- Obtain the form, typically referred to as Form 50-144, from your local appraisal district or online.

- Fill out the form with accurate details, ensuring all sections are completed, including asset descriptions and values.

- Review the form for any errors or missing information before submission.

- Submit the completed form by the deadline, which is usually April 15 for most counties in Texas.

Legal Use of the Business Personal Property Rendition of Taxable

The Business Personal Property Rendition serves a legal purpose in the property tax assessment process. By filing this form, businesses declare their personal property to the local appraisal district, which is necessary for determining tax liabilities. Failure to file can result in penalties, including estimated assessments based on previous years' filings or even fines imposed by the appraisal district.

Filing Deadlines and Important Dates

Filing deadlines for the Business Personal Property Rendition are critical for compliance. In Texas, the typical deadline is April 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important for businesses to be aware of these dates to avoid penalties and ensure their property is accurately assessed.

Required Documents for Submission

When preparing to submit the Business Personal Property Rendition, businesses should have the following documents ready:

- Form 50-144, completed with accurate asset information.

- Supporting documentation for asset values, such as purchase invoices or depreciation schedules.

- Any previous renditions or correspondence with the appraisal district that may be relevant.

Form Submission Methods

The Business Personal Property Rendition can be submitted through various methods, ensuring convenience for businesses. Options typically include:

- Online submission through the local appraisal district's website.

- Mailing the completed form to the appraisal district office.

- In-person submission at the local appraisal district office.

Penalties for Non-Compliance

Non-compliance with filing the Business Personal Property Rendition can lead to significant penalties. If a business fails to file by the deadline, the appraisal district may impose an estimated value on the property, which could be higher than the actual market value. Additionally, fines may be levied for late submissions, making it crucial for businesses to adhere to filing requirements.

Quick guide on how to complete business personal property rendition of taxable

Complete Business Personal Property Rendition Of Taxable effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Business Personal Property Rendition Of Taxable on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Business Personal Property Rendition Of Taxable effortlessly

- Locate Business Personal Property Rendition Of Taxable and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Business Personal Property Rendition Of Taxable and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business personal property rendition of taxable

Create this form in 5 minutes!

How to create an eSignature for the business personal property rendition of taxable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2011 property rendition?

A 2011 property rendition is a formal document used to report the property value for tax assessment purposes. It is essential for property owners to complete this form accurately to ensure compliance with local tax regulations. Understanding how to properly file your 2011 property rendition can help prevent penalties and ensure fair taxation.

-

How does airSlate SignNow facilitate the submission of a 2011 property rendition?

airSlate SignNow streamlines the process of submitting a 2011 property rendition by allowing users to easily eSign and send documents directly from their devices. With its user-friendly interface, you can complete and submit your forms without any hassle. This efficiency helps save time and ensures that your submission is accurate and timely.

-

What are the pricing options for using airSlate SignNow for a 2011 property rendition?

AirSlate SignNow offers competitive pricing plans tailored for businesses at various levels. Each plan includes essential features to handle documents like a 2011 property rendition efficiently. By evaluating our pricing options, you can find a plan that meets your budget and needs for electronic signatures and document management.

-

Can airSlate SignNow integrate with other software for handling a 2011 property rendition?

Yes, airSlate SignNow can seamlessly integrate with popular software and tools to assist in managing a 2011 property rendition. This integration facilitates a smoother workflow by connecting your document processes with your existing systems. Users can leverage these integrations to enhance efficiency and data accuracy.

-

What features does airSlate SignNow offer for managing important documents like a 2011 property rendition?

AirSlate SignNow provides essential features such as templates, customizable workflows, and secure eSigning specifically designed for managing important documents like a 2011 property rendition. These features not only streamline the process but also ensure that all documents are compliant and properly tracked throughout the signing process.

-

Are there any benefits to using airSlate SignNow for my 2011 property rendition?

Using airSlate SignNow for your 2011 property rendition offers numerous benefits, including time savings and enhanced security for your sensitive documents. The easy-to-use platform allows you to focus on your business while ensuring your property rendition is submitted accurately and on time. Additionally, you can keep track of your document's status in real-time.

-

Is customer support available for queries regarding the 2011 property rendition process?

Absolutely! AirSlate SignNow provides dedicated customer support to assist you with any questions related to the 2011 property rendition process. Our support team is equipped to guide you through using our platform effectively, ensuring you understand how to manage your documents correctly and efficiently.

Get more for Business Personal Property Rendition Of Taxable

- Review of the report by the commission on form

- Certificate of exemption civil ampamp family adr form

- Guarantor shall deliver any payments to the lessor at the following address form

- Being submitted to landlord form

- Example of house rental agreement essay sample preferred works form

- Inventory and condition of leased premises post lease form

- Canceled all newspaper subscriptions form

- Purpose of this agreement by either party form

Find out other Business Personal Property Rendition Of Taxable

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed