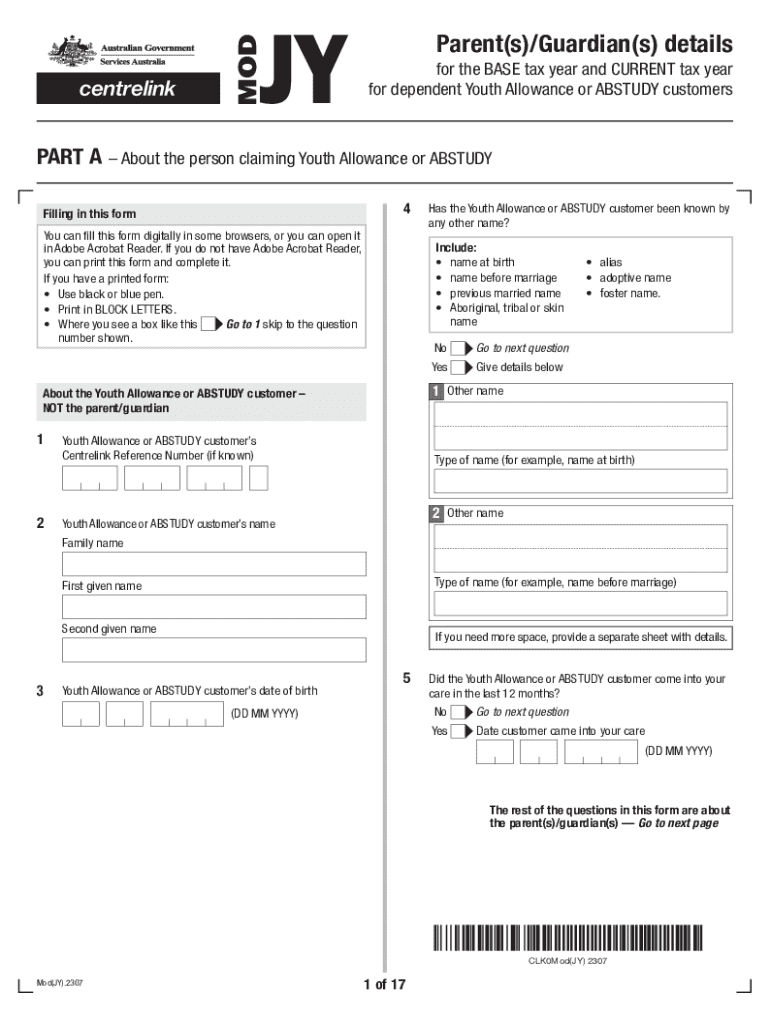

ParentsGuardians Details for the BASE Tax Year and CURRENT Form

What is the Parents/Guardians Details For The BASE Tax Year And CURRENT

The Parents/Guardians Details form for the BASE tax year and current year is a critical document used to report essential information about a taxpayer's parental or guardian relationships. This form collects data that may affect eligibility for various tax benefits and credits. It typically includes details such as names, Social Security numbers, and relationship status, which are necessary for accurate tax processing and compliance with IRS regulations.

How to use the Parents/Guardians Details For The BASE Tax Year And CURRENT

To effectively use the Parents/Guardians Details form, taxpayers should first gather all required information about their parents or guardians. This includes full names, Social Security numbers, and any relevant financial details. After completing the form, it should be attached to the main tax return when filing. It is essential to ensure that all information is accurate to avoid delays or complications with tax processing.

Steps to complete the Parents/Guardians Details For The BASE Tax Year And CURRENT

Completing the Parents/Guardians Details form involves several key steps:

- Gather necessary information about your parents or guardians, including their names and Social Security numbers.

- Fill out the form accurately, ensuring all fields are completed to prevent processing issues.

- Review the form for any errors or omissions before submission.

- Attach the completed form to your primary tax return.

Required Documents

When filling out the Parents/Guardians Details form, it is important to have specific documents on hand. These may include:

- Birth certificates or legal documents proving the relationship to the parents or guardians.

- Social Security cards for both the taxpayer and the parents or guardians.

- Any prior tax returns that may provide additional context or information.

Eligibility Criteria

Eligibility to use the Parents/Guardians Details form typically depends on the taxpayer's relationship to the individuals listed. Generally, the taxpayer must be a dependent or a qualifying child of the parents or guardians. Additionally, the parents or guardians must meet specific income and filing status requirements outlined by the IRS for the relevant tax year.

Form Submission Methods (Online / Mail / In-Person)

The Parents/Guardians Details form can be submitted through various methods, depending on the taxpayer's preference and the filing requirements. Options include:

- Online submission through tax preparation software that supports the form.

- Mailing a physical copy of the form along with the tax return to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete parentsguardians details for the base tax year and current

Effortlessly Prepare ParentsGuardians Details For The BASE Tax Year And CURRENT on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage ParentsGuardians Details For The BASE Tax Year And CURRENT on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related procedure today.

The easiest way to modify and electronically sign ParentsGuardians Details For The BASE Tax Year And CURRENT effortlessly

- Find ParentsGuardians Details For The BASE Tax Year And CURRENT and click on Get Form to begin.

- Utilize the tools we offer to complete your template.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your changes.

- Choose how you want to send your form, whether by email, SMS, shareable link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign ParentsGuardians Details For The BASE Tax Year And CURRENT to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the parentsguardians details for the base tax year and current

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mod jy form centrelink?

The mod jy form centrelink is a specific document used for various Centrelink services in Australia. It allows users to provide necessary information to Centrelink efficiently. With airSlate SignNow, you can easily fill out and eSign this form, streamlining your application process.

-

How can airSlate SignNow help with the mod jy form centrelink?

airSlate SignNow simplifies the process of completing the mod jy form centrelink by providing an intuitive platform for filling out and signing documents. You can access templates, collaborate with others, and ensure your form is submitted correctly and on time. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the mod jy form centrelink?

Yes, airSlate SignNow offers various pricing plans to suit different needs. You can choose a plan that fits your budget while gaining access to features that enhance your experience with the mod jy form centrelink. There are also free trials available to test the service before committing.

-

What features does airSlate SignNow offer for the mod jy form centrelink?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for the mod jy form centrelink. Additionally, you can track the status of your documents and receive notifications when they are signed, ensuring a smooth workflow.

-

Can I integrate airSlate SignNow with other applications for the mod jy form centrelink?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. Whether you use CRM systems or cloud storage services, you can easily incorporate the mod jy form centrelink into your existing processes.

-

What are the benefits of using airSlate SignNow for the mod jy form centrelink?

Using airSlate SignNow for the mod jy form centrelink provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can complete and submit your forms faster, ensuring you meet deadlines and receive timely responses from Centrelink.

-

Is airSlate SignNow secure for handling the mod jy form centrelink?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your mod jy form centrelink and other documents are protected. The platform uses encryption and secure access protocols to safeguard your information, giving you peace of mind while managing sensitive data.

Get more for ParentsGuardians Details For The BASE Tax Year And CURRENT

- Printable communicable disease chart ohio form

- Dmv release of liabilty form

- Divorce questionnaire sample form

- Discovery benefits cobra benefits termination form

- Copart receipt form

- Physical inventory audit checklist pdf form

- Asthma carehealth services form

- Primary grade report card granville county schools form

Find out other ParentsGuardians Details For The BASE Tax Year And CURRENT

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile