Dshs Individual Provider 2018-2026

What is the DSHS Individual Provider?

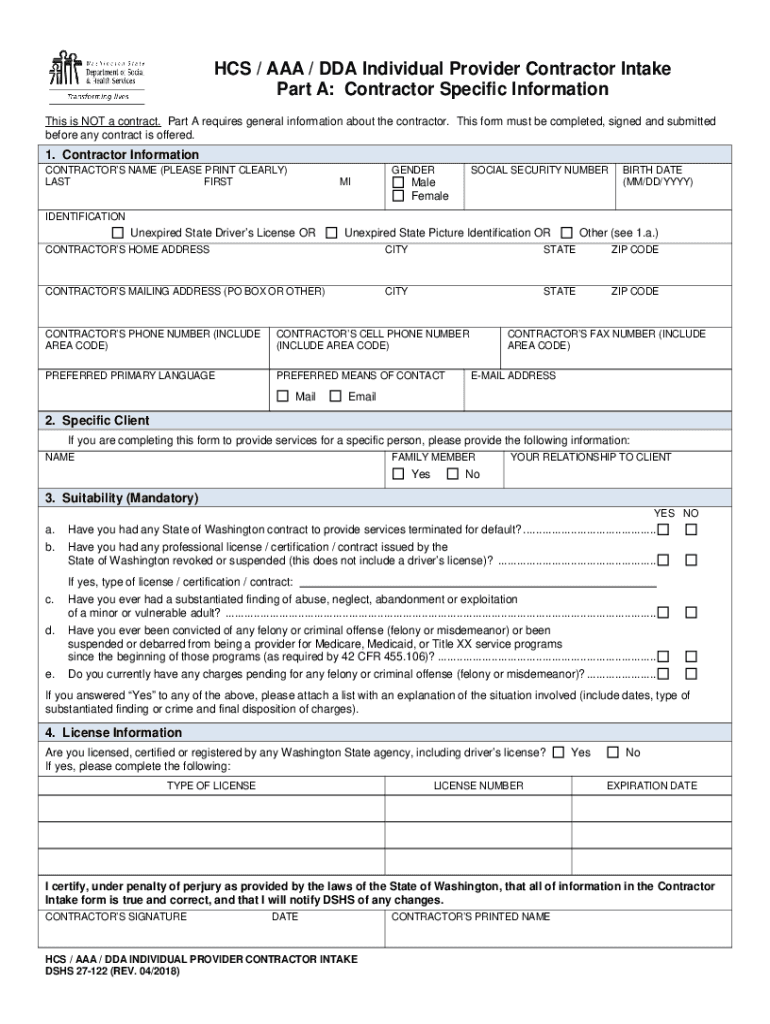

The DSHS Individual Provider application is a crucial document for individuals seeking to provide care services under the Washington State Department of Social and Health Services (DSHS). This application is specifically designed for those who wish to become individual providers for clients receiving services through the Developmental Disabilities Administration (DDA) or the Home and Community Services (HCS). By completing this application, individuals can ensure they meet the necessary criteria to deliver care, support, and assistance to clients in need.

Steps to Complete the DSHS Individual Provider Application

Completing the DSHS Individual Provider application involves several key steps to ensure accuracy and compliance. Follow these steps for a successful application:

- Gather necessary documentation, including identification and proof of residency.

- Complete the application form, ensuring all sections are filled out accurately.

- Provide any additional information required, such as references or background checks.

- Review the application for completeness and accuracy before submission.

- Submit the application through the designated method, which may include online submission or mailing it to the appropriate DSHS office.

Eligibility Criteria for the DSHS Individual Provider

To qualify as an individual provider under the DSHS, applicants must meet specific eligibility criteria. These criteria typically include:

- Being at least eighteen years old.

- Having a valid Washington State identification or driver’s license.

- Passing a background check to ensure safety and compliance.

- Demonstrating the ability to provide care and support to individuals with developmental disabilities or other needs.

Required Documents for the DSHS Individual Provider Application

When applying for the DSHS Individual Provider position, certain documents are required to support your application. These may include:

- A completed DSHS Individual Provider application form.

- Proof of identity, such as a government-issued ID.

- Background check authorization form.

- Documentation of any relevant training or certifications in caregiving.

Form Submission Methods for the DSHS Individual Provider Application

Applicants have various options for submitting the DSHS Individual Provider application. The available methods typically include:

- Online submission through the DSHS portal, which allows for a quicker processing time.

- Mailing the completed application to the appropriate DSHS office.

- In-person submission at designated DSHS locations, where assistance may be available.

Legal Use of the DSHS Individual Provider Application

The DSHS Individual Provider application is governed by state regulations that ensure the legal and ethical provision of care services. It is essential for applicants to understand their rights and responsibilities under the law. This includes adhering to privacy regulations, maintaining confidentiality of client information, and complying with all DSHS guidelines during the application process.

Quick guide on how to complete hcs aaa dda individual provider contractor intake

Explore the simpler method to handle your Dshs Individual Provider

The traditional approach to filling out and approving documents consumes an excessive amount of time in comparison to modern document management options. Previously, you would search for appropriate forms, print them out, fill in all the details, and mail them. Now, you can find, complete, and sign your Dshs Individual Provider within a single browser tab using airSlate SignNow. Completing your Dshs Individual Provider is easier than ever.

Steps to fill out your Dshs Individual Provider with airSlate SignNow

- Navigateto the category page you need and find your state-specific Dshs Individual Provider. Alternatively, utilize the search feature.

- Ensure the version of the form is accurate by reviewing it.

- Click Acquire form and enter editing mode.

- Fill in your document with the necessary details using the editing tools.

- Review the entered information and click the Sign tool to validate your form.

- Select the most convenient method to create your signature: generate it, sketch your signature, or upload an image of it.

- Click COMPLETE to apply the changes.

- Download the document to your device or go to Sharing options to send it electronically.

Robust online tools like airSlate SignNow optimize the process of completing and submitting your forms. Try it to discover how quickly document management and approval processes can be completed. You will conserve a great deal of time.

Create this form in 5 minutes or less

Find and fill out the correct hcs aaa dda individual provider contractor intake

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I fill out the form of DTE MPonline to take admission in IET DAVV Indore? Provide the site (link).

See their is no seperate form for iet davv, you have to fill this college during the choice filling stage of counselling.The procedure for the DTE counselling is very simple thier are 3 main steps you need to follow.RegistrationChoice fillingReporting to alloted institute.For all this the website you should visit is https://dte.mponline.gov.in/port...Here at the top right corner you will see a menu as select course for counselling, click on it, select bachelor of engineering then full time and then apply online. This is how you will register for counselling.Hope it helps.Feel free to ask any other problem you face regarding counselling or college selection.

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the hcs aaa dda individual provider contractor intake

How to create an electronic signature for the Hcs Aaa Dda Individual Provider Contractor Intake in the online mode

How to generate an electronic signature for the Hcs Aaa Dda Individual Provider Contractor Intake in Google Chrome

How to generate an eSignature for putting it on the Hcs Aaa Dda Individual Provider Contractor Intake in Gmail

How to make an electronic signature for the Hcs Aaa Dda Individual Provider Contractor Intake right from your smart phone

How to create an electronic signature for the Hcs Aaa Dda Individual Provider Contractor Intake on iOS

How to make an eSignature for the Hcs Aaa Dda Individual Provider Contractor Intake on Android devices

People also ask

-

What is the dshs individual provider application process?

The dshs individual provider application process involves submitting necessary documentation and information to the Department of Social and Health Services. This process ensures that you meet all the requirements needed to become an approved individual provider. airSlate SignNow simplifies document submission, making it easier to manage your application effectively.

-

How does airSlate SignNow facilitate the dshs individual provider application?

airSlate SignNow allows you to create, send, and eSign documents for the dshs individual provider application quickly. With an intuitive interface, you'll streamline your application process and ensure all required documents are correctly filled out and submitted on time. This not only saves you time but also reduces errors in your submission.

-

Are there any costs associated with the dshs individual provider application?

While the dshs individual provider application itself may not have associated fees, utilizing airSlate SignNow is a cost-effective solution for managing the application process. airSlate SignNow offers competitive pricing plans to fit different needs, allowing you to handle all document-related tasks without breaking the bank.

-

What features does airSlate SignNow offer for managing the dshs individual provider application?

airSlate SignNow offers essential features for the dshs individual provider application, including document templates, eSigning, and progress tracking. These features ensure that your application process is efficient and organized. Additionally, you can collaborate with multiple stakeholders seamlessly, ensuring all requirements are met.

-

Can I track the status of my dshs individual provider application using airSlate SignNow?

Yes, airSlate SignNow enables you to track the status of your dshs individual provider application in real-time. This feature allows you to see when documents are sent, viewed, or signed, keeping you informed throughout the process. It provides peace of mind knowing where your application stands at all times.

-

Does airSlate SignNow integrate with other systems for the dshs individual provider application?

Absolutely! airSlate SignNow seamlessly integrates with various systems and applications to enhance your dshs individual provider application experience. This allows you to sync important data and documents across platforms, ensuring that everything you need for your application is readily available and organized.

-

What benefits do I gain by using airSlate SignNow for my dshs individual provider application?

By using airSlate SignNow for your dshs individual provider application, you gain a multitude of benefits including increased speed, accuracy, and ease of use. This platform helps reduce paperwork clutter and simplifies the signing process. As a result, you can focus on providing quality care rather than getting bogged down in administrative tasks.

Get more for Dshs Individual Provider

- Vfw hall rental agreement form

- Rivermead head injury service follow up questionnaire rhfuq form

- Meals tax form louisa county

- Habitual traffic offender hearing request form

- Exclusive buyer brokerage agreement keller williams realty form

- Radioactive waste safety appraisal form

- Form it 6 sny metropolitan commuter transportation mobility tax mctmt for start up ny tax year 772081742

- Mean contract template form

Find out other Dshs Individual Provider

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online