Form it 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START UP NY Tax Year

Understanding the Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT for START UP NY Tax Year

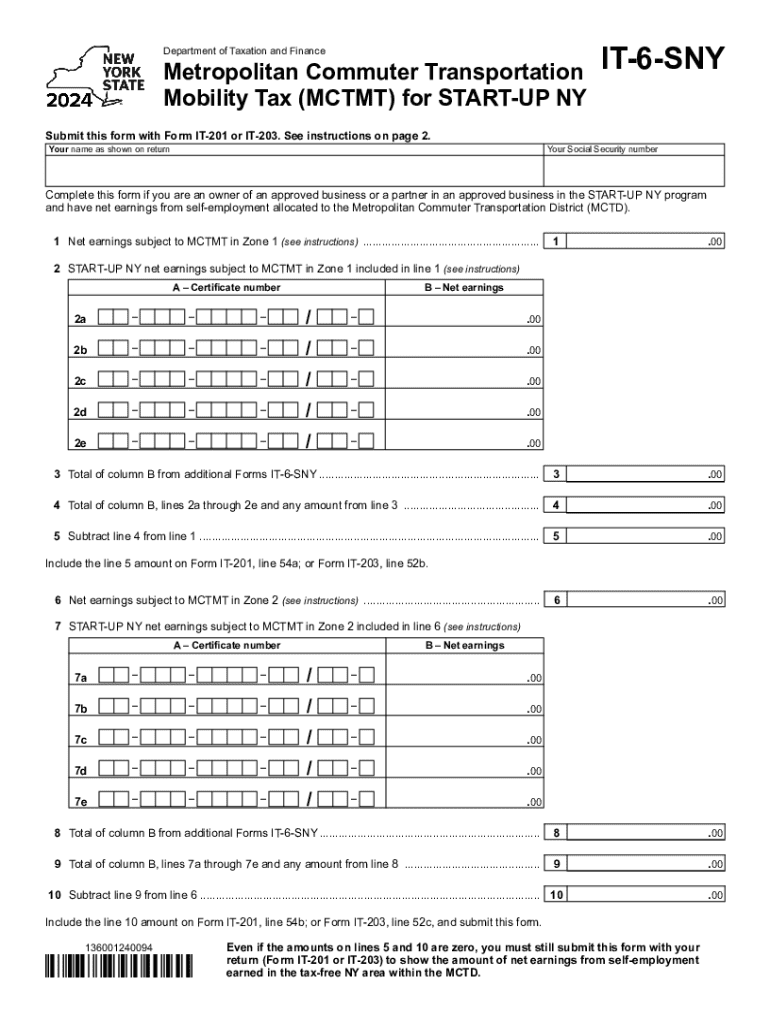

The Form IT 6 SNY is a crucial document for businesses participating in the START UP NY program, which aims to boost economic growth in designated areas. This form specifically addresses the Metropolitan Commuter Transportation Mobility Tax (MCTMT), which applies to employers and self-employed individuals operating within the Metropolitan Commuter Transportation District. The tax is levied to support public transportation services in New York, ensuring that the infrastructure can accommodate the growing population and workforce.

Steps to Complete the Form IT 6 SNY

Completing the Form IT 6 SNY requires careful attention to detail. Begin by gathering all necessary information, including your business identification details, income data, and any relevant deductions. Follow these steps:

- Provide your business name, address, and identification number.

- Report total income subject to the MCTMT.

- Calculate the tax owed based on the applicable rates.

- Include any credits or deductions that may apply to your situation.

- Review the completed form for accuracy before submission.

Ensure that you have all supporting documents ready, as they may be required for verification purposes.

Obtaining the Form IT 6 SNY

The Form IT 6 SNY can be obtained through the New York State Department of Taxation and Finance website. It is available for download in a PDF format, which allows for easy printing and completion. Additionally, you may contact the department directly for assistance or to request a physical copy if necessary.

Legal Use of the Form IT 6 SNY

Using the Form IT 6 SNY is essential for compliance with New York State tax regulations. It is legally required for businesses that meet certain criteria within the Metropolitan Commuter Transportation District. Failing to file this form can result in penalties, including fines and additional taxes owed. It is important to stay informed about the legal obligations associated with this form to avoid any compliance issues.

Filing Deadlines for the Form IT 6 SNY

Filing deadlines for the Form IT 6 SNY are critical to ensure timely compliance. Typically, the form must be submitted by the due date of your business tax return. It is advisable to keep track of any changes in deadlines announced by the New York State Department of Taxation and Finance, especially for businesses that may have unique filing requirements or extensions.

Required Documents for Form IT 6 SNY

When completing the Form IT 6 SNY, certain documents are necessary to support your claims and calculations. These may include:

- Proof of business registration and identification.

- Financial statements or income reports.

- Records of any previous MCTMT payments.

- Documentation for any deductions or credits claimed.

Having these documents ready will streamline the completion process and help ensure accuracy in your filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 6 sny metropolitan commuter transportation mobility tax mctmt for start up ny tax year 772081742

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year?

Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year is a tax form used by businesses in New York to report their Metropolitan Commuter Transportation Mobility Tax. This form is essential for startups operating in the metropolitan area to ensure compliance with local tax regulations.

-

How can airSlate SignNow help with Form IT 6 SNY MCTMT?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. Our user-friendly interface simplifies the document management process, ensuring that your tax forms are completed accurately and on time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a startup or an established company, you can choose a plan that fits your budget while ensuring you can easily manage Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. These features streamline the process, making it easier for businesses to manage their tax documentation efficiently.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with various tax regulations, including those related to Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year. Our platform ensures that all documents are handled securely and in accordance with legal requirements.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year alongside your existing tools. This integration capability enhances productivity and simplifies your workflow.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform helps businesses focus on growth while ensuring compliance with tax obligations.

Get more for Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

Find out other Form IT 6 SNY Metropolitan Commuter Transportation Mobility Tax MCTMT For START UP NY Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors