Vat Form 002

What is the value added tax return form 002?

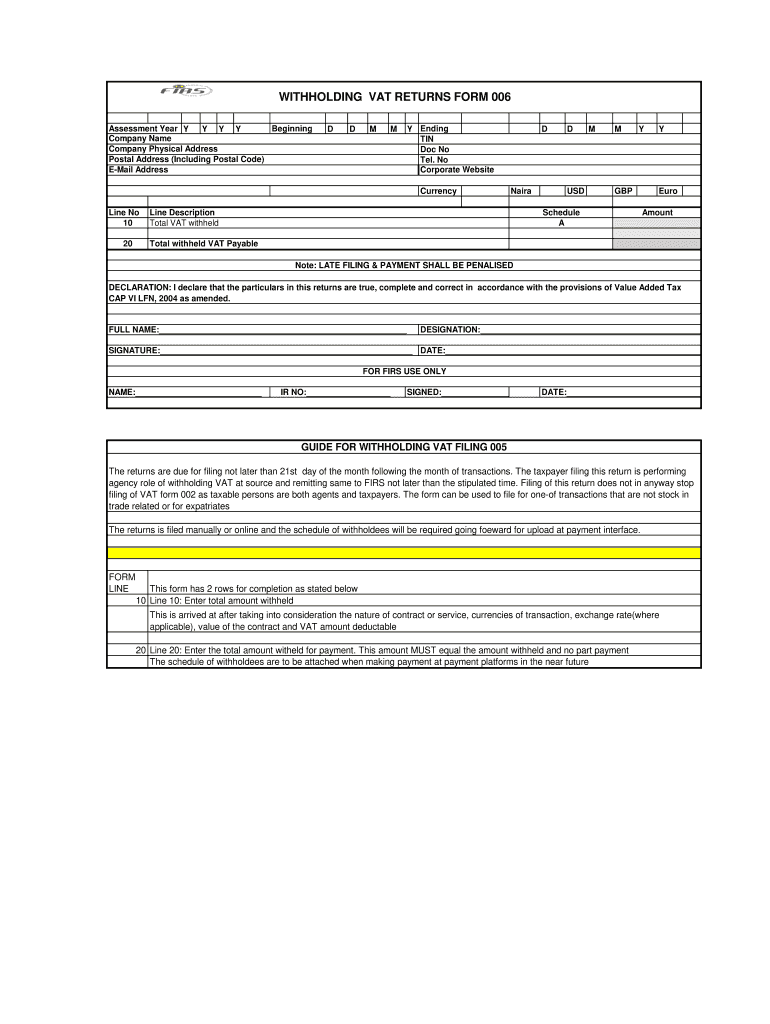

The value added tax return form 002 is a document used by businesses to report their value added tax (VAT) obligations to the relevant tax authority. This form is essential for ensuring compliance with tax regulations and accurately calculating the amount of VAT owed or refundable. It typically includes sections for reporting sales, purchases, and the applicable VAT rates. Understanding the purpose and structure of this form is crucial for businesses to maintain proper tax records and fulfill their legal obligations.

How to use the value added tax return form 002

Using the value added tax return form 002 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including sales invoices and purchase receipts. Next, fill out the form by entering the total sales and purchases along with the corresponding VAT amounts. It is important to double-check all entries for accuracy before submission. Finally, ensure that the form is signed and submitted to the appropriate tax authority by the specified deadline to avoid penalties.

Steps to complete the value added tax return form 002

Completing the value added tax return form 002 requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant sales and purchase documentation.

- Fill in the total sales and total purchases sections of the form.

- Calculate the VAT due or refundable based on the provided rates.

- Review the completed form for any errors or omissions.

- Sign the form to validate it.

- Submit the form electronically or via mail to the designated tax authority.

Legal use of the value added tax return form 002

The legal use of the value added tax return form 002 is governed by tax regulations that outline the requirements for accurate reporting. To ensure that the form is legally valid, it must be completed in accordance with the guidelines set by the tax authority. This includes providing accurate financial data, adhering to submission deadlines, and maintaining proper records of all transactions. Failure to comply with these regulations can result in penalties or audits.

Filing deadlines for the value added tax return form 002

Filing deadlines for the value added tax return form 002 are critical for compliance. Typically, businesses must submit their VAT returns quarterly or annually, depending on their tax obligations. It is essential to be aware of the specific deadlines set by the tax authority to avoid late fees or penalties. Keeping a calendar of important dates can help ensure timely submissions and maintain good standing with tax authorities.

Form submission methods for the value added tax return form 002

The value added tax return form 002 can be submitted through various methods, depending on the preferences of the tax authority. Common submission methods include:

- Online submission via the tax authority's official website.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, if available.

Choosing the right submission method can streamline the process and ensure that the form is received on time.

Quick guide on how to complete vat form 002

Complete Vat Form 002 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Vat Form 002 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to customize and electronically sign Vat Form 002 with ease

- Obtain Vat Form 002 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Vat Form 002 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat form 002

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the value added tax return form 002?

The value added tax return form 002 is a crucial document used for reporting VAT transactions to tax authorities. It captures your VAT liabilities and entitlements, ensuring compliance with tax regulations. Completing this form accurately is essential for businesses to manage their VAT obligations effectively.

-

How can airSlate SignNow help with the value added tax return form 002?

airSlate SignNow streamlines the process of completing the value added tax return form 002 by providing an intuitive eSigning platform. With automated workflows, you can collect electronic signatures and ensure all necessary documents are in order, making VAT submissions more efficient. This technology saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for VAT return forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including options for handling the value added tax return form 002. These plans are designed to be cost-effective, ensuring businesses of all sizes can access essential eSigning features without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for VAT returns?

Absolutely! airSlate SignNow supports integration with various accounting and ERP software, enhancing your workflow for managing the value added tax return form 002. Integrating allows for seamless data transfer, ensuring that all your financial details align with your VAT submissions.

-

What are the benefits of using airSlate SignNow for VAT form submissions?

Using airSlate SignNow for your value added tax return form 002 submissions streamlines document management, enhances compliance, and reduces turnaround time. The platform's user-friendly interface ensures that all involved parties can easily sign and approve documents, facilitating smoother operations. Overall, it promotes efficiency in handling VAT-related processes.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow employs robust security protocols, ensuring that your sensitive information, including the value added tax return form 002, is well-protected. With end-to-end encryption and compliant processes, you can trust that your data remains confidential and secure throughout the eSigning process.

-

How can I get support for completing the value added tax return form 002 with airSlate SignNow?

airSlate SignNow offers comprehensive customer support for users needing assistance with the value added tax return form 002. You can access resources like FAQs, tutorials, and direct customer service for any inquiries you may have. This ensures you can fully leverage the platform for your VAT needs.

Get more for Vat Form 002

- The gold business card supplementary application form

- American express charge card fee annual rs form

- X the platinum credit card from american express form

- Card application american express corporate card form

- Bank_gg_supp_bau 0409 22596 form

- Bank_ggp_am_bau 0609 22853 form

- Special inspection existing building form

- Rti handbook 20 21 form

Find out other Vat Form 002

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter