Forms Georgia Tax Tribunal 2021-2026

What is the Georgia Tax Tribunal?

The Georgia Tax Tribunal is a specialized administrative body that handles disputes between taxpayers and the Georgia Department of Revenue. This tribunal provides a venue for individuals and businesses to challenge tax assessments, penalties, and other tax-related decisions made by the state. The tribunal aims to resolve these disputes in a fair and efficient manner, ensuring that taxpayers have access to a streamlined process for addressing their concerns.

Steps to Complete the Georgia Tax Tribunal Petition

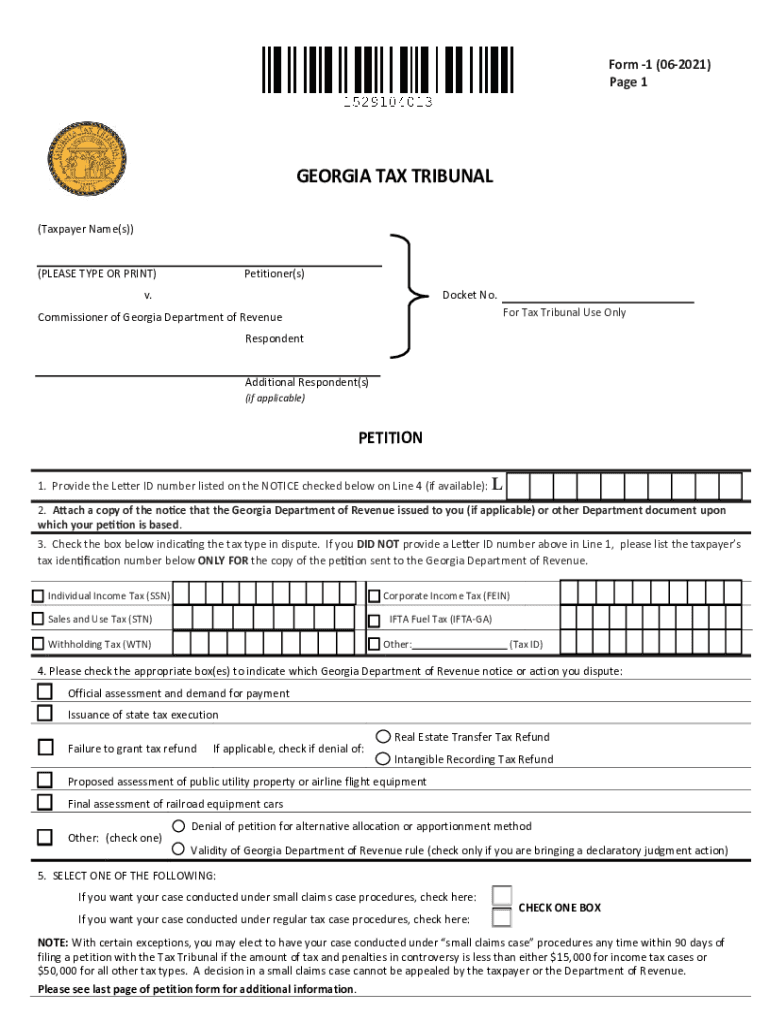

Completing a Georgia tax tribunal petition involves several key steps:

- Gather Documentation: Collect all relevant documents, including tax returns, assessment notices, and any correspondence with the Georgia Department of Revenue.

- Fill Out the Petition Form: Accurately complete the Georgia tax tribunal petition form, ensuring all required information is provided.

- Review for Accuracy: Double-check the petition for any errors or omissions that could delay the process.

- Submit the Petition: File the completed petition with the Georgia Tax Tribunal by the specified deadline, either online, by mail, or in person.

Required Documents for Filing

When filing a petition with the Georgia Tax Tribunal, certain documents are essential:

- Completed Georgia tax tribunal petition form.

- Copy of the tax assessment notice or determination being challenged.

- Supporting documentation that substantiates your claim, such as financial records or correspondence with the Department of Revenue.

Having these documents ready will facilitate a smoother filing process and help strengthen your case.

Form Submission Methods

There are multiple ways to submit your Georgia tax tribunal petition:

- Online: Use the official Georgia Tax Tribunal website to submit your petition electronically.

- By Mail: Send your completed petition and supporting documents to the address specified by the tribunal.

- In Person: Deliver your petition directly to the Georgia Tax Tribunal office during business hours.

Eligibility Criteria for Filing a Petition

To file a Georgia tax tribunal petition, you must meet certain eligibility criteria:

- You must be a taxpayer who has received an adverse decision from the Georgia Department of Revenue.

- The petition must be filed within the specified timeframe following the receipt of the tax assessment notice.

- All relevant documentation must be submitted to support your claim.

Legal Use of the Georgia Tax Tribunal

The Georgia Tax Tribunal serves as a legal forum for taxpayers to contest tax assessments and decisions. It operates under specific laws and regulations that govern tax disputes in the state. Utilizing this tribunal allows taxpayers to seek a resolution without necessarily engaging in lengthy court proceedings, making it a valuable resource for addressing tax-related issues.

Quick guide on how to complete forms georgia tax tribunal

Effortlessly Prepare Forms Georgia Tax Tribunal on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Forms Georgia Tax Tribunal on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Forms Georgia Tax Tribunal without hassle

- Locate Forms Georgia Tax Tribunal and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you select. Modify and eSign Forms Georgia Tax Tribunal and ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms georgia tax tribunal

Create this form in 5 minutes!

How to create an eSignature for the forms georgia tax tribunal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GA tax tribunal petition?

A GA tax tribunal petition is a formal request submitted to the Georgia tax tribunal to contest a tax assessment or decision made by the Georgia Department of Revenue. This process allows taxpayers to seek a fair resolution regarding their tax obligations. Understanding how to file a GA tax tribunal petition is crucial for anyone facing tax disputes.

-

How can airSlate SignNow help with my GA tax tribunal petition?

airSlate SignNow provides an efficient platform for preparing and eSigning documents related to your GA tax tribunal petition. With its user-friendly interface, you can easily create, send, and manage your petition documents securely. This streamlines the process, ensuring that your petition is submitted accurately and on time.

-

What are the costs associated with filing a GA tax tribunal petition?

The costs for filing a GA tax tribunal petition can vary depending on the complexity of your case and any associated legal fees. While airSlate SignNow offers a cost-effective solution for document management, it’s important to consider additional expenses related to legal representation if needed. Utilizing airSlate SignNow can help minimize costs by simplifying the documentation process.

-

Is airSlate SignNow compliant with legal standards for GA tax tribunal petitions?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures and document submissions, including those required for a GA tax tribunal petition. Our platform ensures that all documents are securely signed and stored, providing you with peace of mind that your petition meets legal requirements.

-

Can I track the status of my GA tax tribunal petition using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your GA tax tribunal petition in real-time. You will receive notifications when your documents are viewed or signed, ensuring you stay informed throughout the process. This feature enhances transparency and helps you manage your petition effectively.

-

What features does airSlate SignNow offer for managing GA tax tribunal petitions?

airSlate SignNow offers a variety of features tailored for managing GA tax tribunal petitions, including customizable templates, secure eSigning, and document sharing capabilities. These features simplify the preparation and submission of your petition, making the process more efficient. Additionally, you can collaborate with legal advisors directly within the platform.

-

Are there integrations available with airSlate SignNow for GA tax tribunal petitions?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in managing your GA tax tribunal petition. Whether you need to connect with cloud storage services or legal software, our integrations enhance your workflow. This flexibility allows you to streamline your document management process effectively.

Get more for Forms Georgia Tax Tribunal

Find out other Forms Georgia Tax Tribunal

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF